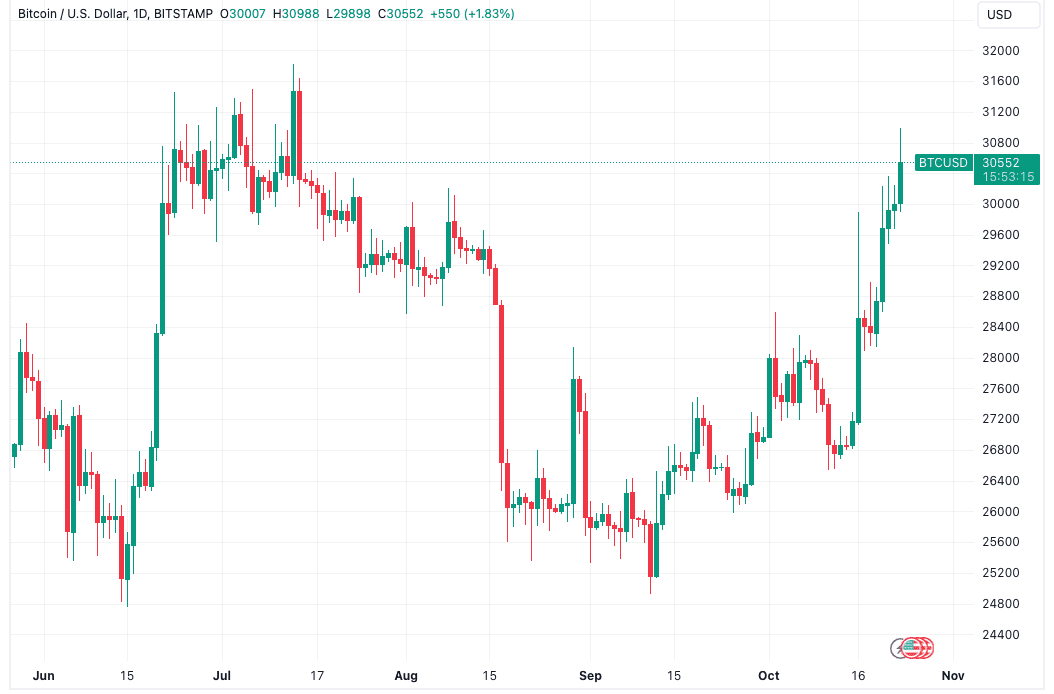

Bitcoin (BTC) starts the last week of October in classic style as 3% BTC price gains take cryptocurrency markets higher.

In what could yet turn out to be a classic “Uptober” for Bitcoin and altcoins, BTC/USD is back near 2023 highs as a resistance battle brews. Can bulls win?

That is the key question for traders and market observers going into the week’s first Wall Street open as Asia sets the tone for a crypto comeback.

Given the extent of resistance to overcome, however, traders are playing it safe — lofty BTC price predictions are less evident than might be expected, and few believe that the road beyond $32,000 will open up quickly or easily.

Bitcoin must also dodge potential headwinds in the form of macroeconomic data prints at a time when inflation continues to beat expectations.

Ahead of the United States Federal Reserve’s interest rate decision on Nov. 1, the month’s final prints will be all the more significant. Geopolitical events meanwhile add another element to market unpredictability.

With much at stake for crypto and risk assets, the week thus looks to be a rollercoaster in the making as Bitcoin bulls seek to effect a major trend change via a breakout from a multi-month trading range.

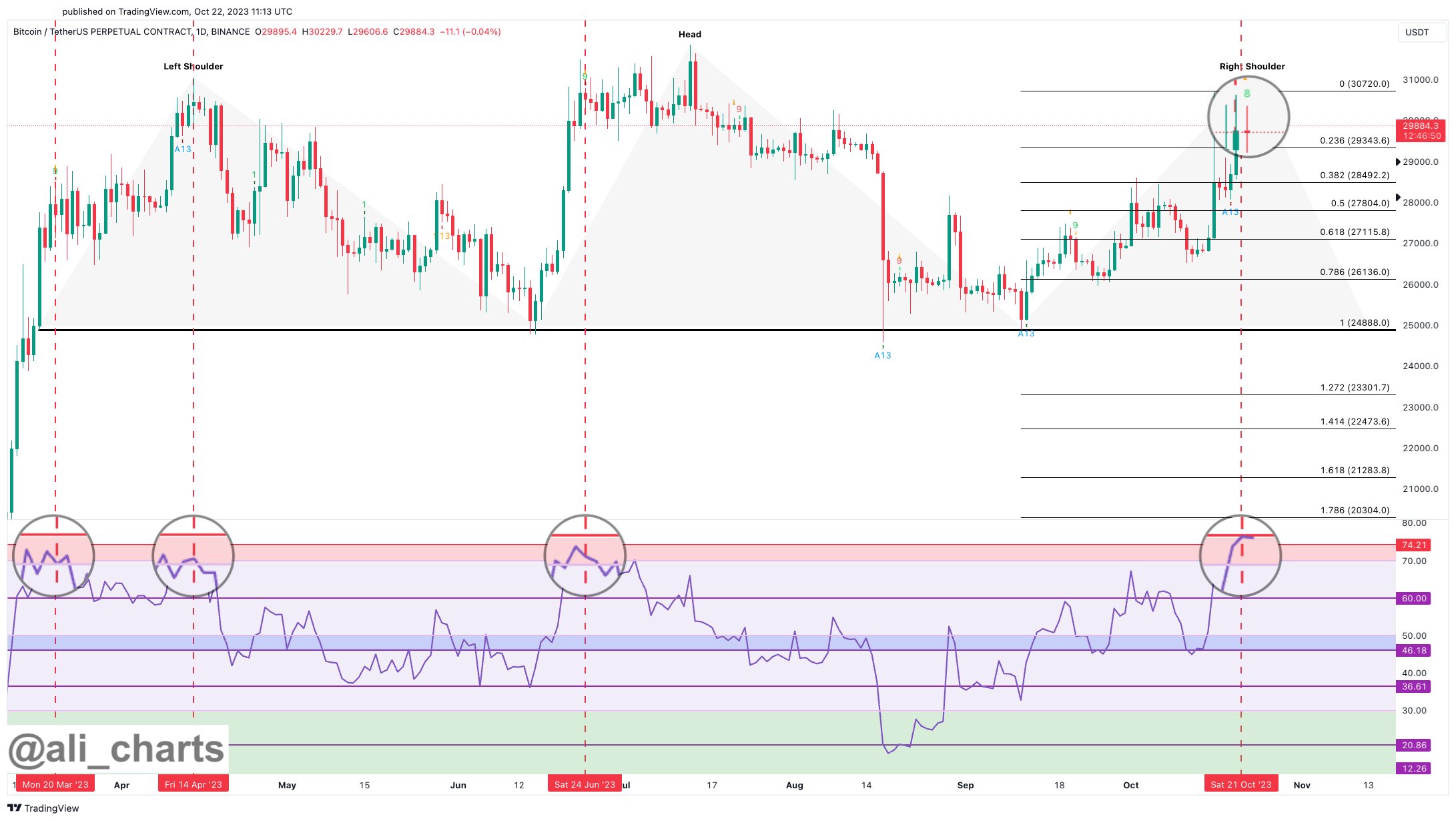

RSI gives Bitcoin traders cold feet over rally

As Cointelegraph reported, these three-month highs are being treated with suspicion by some traders, who see breaking through $32,000 as a difficult challenge.

“Well on it’s way towards the top of the 2023 range,” popular trader Daan Crypto Trades summarized on X on the day.

“$31K-32K won’t be easy to break through but upon doing so I would be targeting $38K next. Remains range-bound until then.”

With hours to go until the Wall Street open, BTC/USD is now retreating from the highs, on the way back toward the $30,000 mark.

Analyzing the odds of a deeper drawdown, popular trader Ali drew attention to relative strength index (RSI) readings.

“An impending price correction appears to be on the horizon unless BTC manages to clock a daily candlestick close above $31,560,” part of his comments warned.

At 77 on Oct. 23, RSI was already at levels which Ali noted had triggered “sharp corrections” since March this year. As a rule, anything above 70 is considered “overbought.”

Others were freely optimistic, among the Philip Swift, co-founder of trading suite DecenTrader and creator…

Click Here to Read the Full Original Article at Cointelegraph.com News…