Bitcoin (BTC) starts a new week with consolidation in the air amid some of the least volatile conditions ever.

Despite losing 5% in an hour last week, Bitcoin’s subsequent lack of volatility is on every trader’s mind.

The question is whether that will change in the coming days.

There are plenty of potential catalysts, from macroeconomic data to exchange setups and more, but which will win out — and in which direction it will send BTC price — remains to be seen.

Behind the scenes, it remains business as usual for Bitcoin network fundamentals, with miners preserving their newfound buoyancy and ready for new all-time highs in difficulty.

Cointelegraph takes a look at these major market-moving factors and summarizes opinions as to how they might shape BTC price action this week.

Bitcoin price stays paralyzed after weekly close

While anything can and does happen in Bitcoin, the weekend was marked by one word only when it comes to BTC price action — boring.

After flash volatility on March 3 due to a combination of Silvergate bank concerns and exchange margin calls, BTC/USD has remained eerily quiet.

Data from Cointelegraph Markets Pro and TradingView proves the point, with spot price moving within a barely perceptible range ever since.

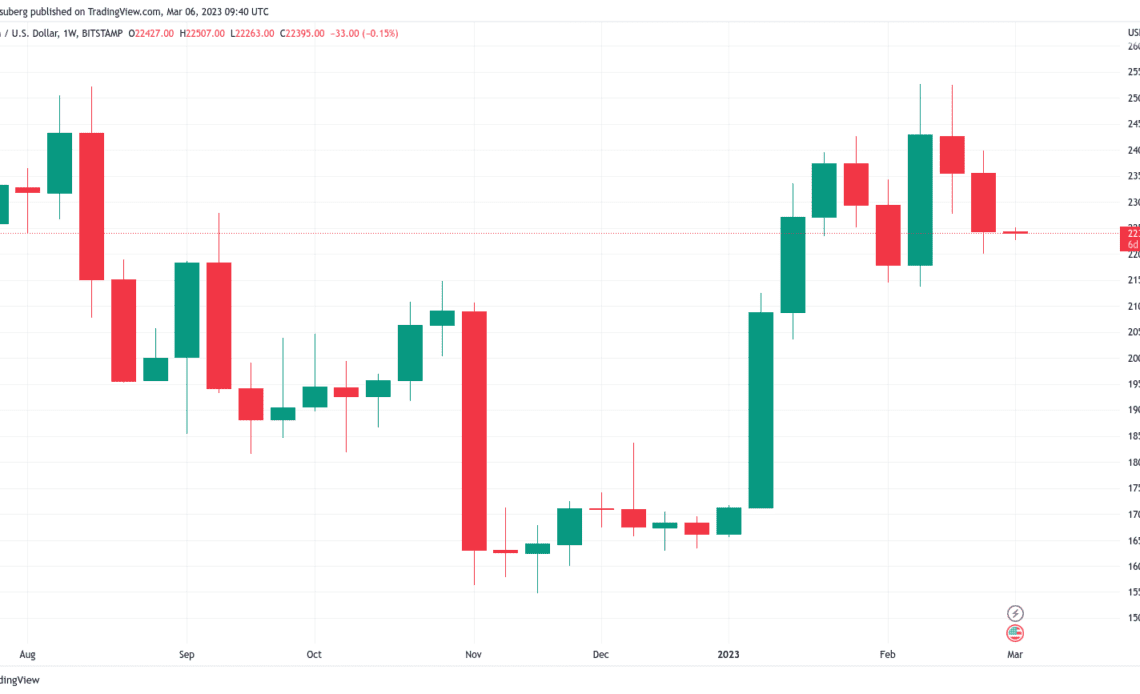

Bulls nonetheless failed to recover much of the lost ground, leading Bitcoin to finish the week down around 5.1% on Bitstamp.

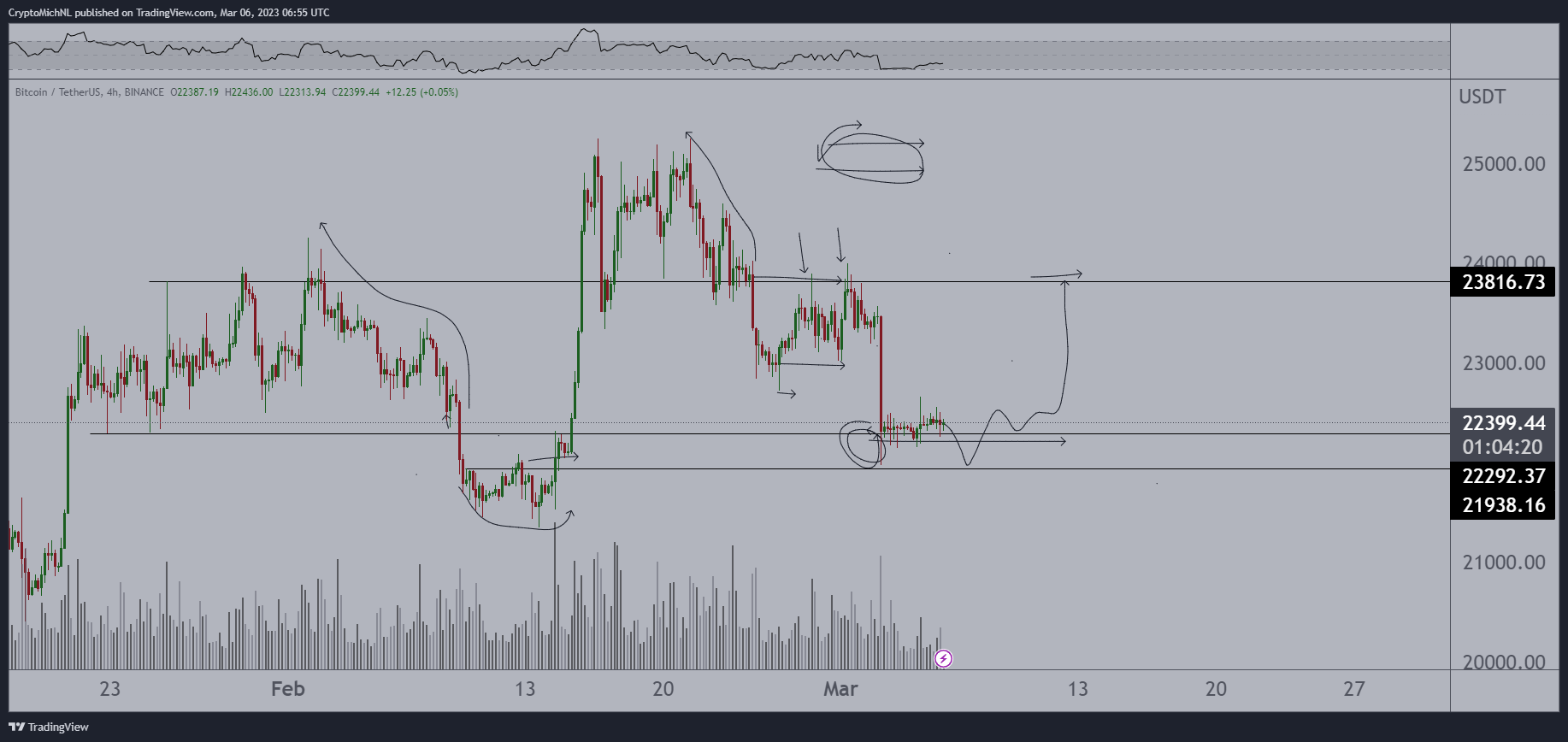

For Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, there is still reason to believe that the market will soon draw a line under the current short-term trend.

“Boring price action on Bitcoin since the correction, but still acting in support here,” he told Twitter followers on March 6.

“Indices bounced already and seem to continue to do so. Might have another sweep of the lows and then reverse up, losing $21.5K = trouble time.”

A further post eyed a potential bounce target for $23,000 should the bulls reclaim some form of strength.

“I just want to see some price movement today if I am honest,” popular trader Crypto Tony continued.

“I remain short as of few days ago with my stop loss at $23,200 to remain transparent. I would like to see a move up to $22,800 before any downside.”

Fellow trading account Daan Crypto Trades meanwhile noted that BTC/USD had already closed the…

Click Here to Read the Full Original Article at Cointelegraph.com News…