Bitcoin (BTC) starts a new week under $30,000 as analysts’ predictions of a short-term support retest come true.

The largest cryptocurrency saw a classic dive following its latest weekly close as its latest gains evaporated — will they return?

Ahead of a fairly innocuous week for macro data releases, catalysts are likely to come elsewhere as BTC price action makes a decision on a key support zone.

Much is at stake for traders, as the week prior offered the opportunity to reinvestigate altcoins as Bitcoin itself cooled its upside. With a retracement now in effect, attention will be on whether those altcoins can hold at their own higher levels.

Under the hood, it appears to be business as usual for Bitcoin — network fundamentals, already at or near all-time highs, show no definitive signs of a comedown of their own this week.

It may be too early to determine how price performance will impact hodlers, but the temptation to sell at ten-month highs must be clear — the percentage of the overall BTC supply now in profit is at an impressive 75%.

Cointelegraph takes a look at these factors and more in the weekly rundown of potential Bitcoin price triggers.

BTC price: $30,000 hangs in the balance

After a “boring” weekend for BTC price action, volatility returned in classic style at the April 16 weekly close.

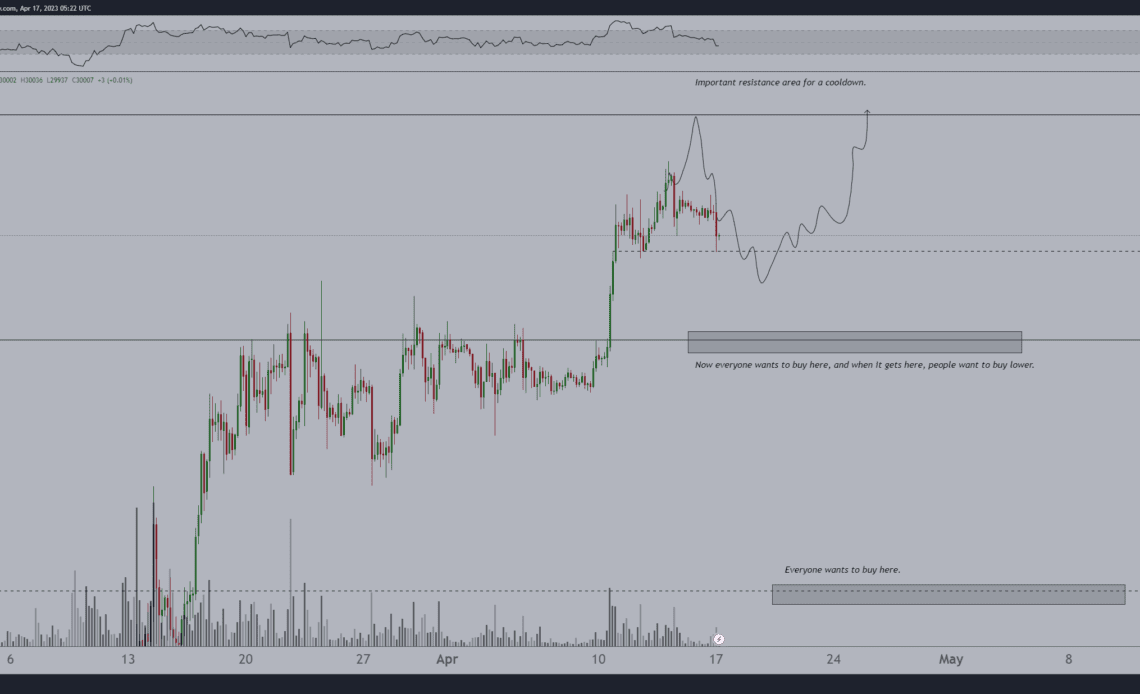

With it came a return to $30,000 for BTC/USD, this marking its first major support retest since hitting ten-month highs above $31,000 last week.

Traders and analysts had widely predicted the move, arguing that it would constitute a healthy retracement to prepare for continuation of the uptrend.

Re-bought everything that I took profit on.

I’ll reduce below $29.7K BTC and $2K on ETH.

Worst case scenario, I make a little less money on the overall positions. Best case scenario, I make a lot of money.

But generally speaking, risk is definable enough for me to re-enter. https://t.co/WH3vUVciY8

— Loma (@LomahCrypto) April 16, 2023

Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, was among those eyeing a buy-in just below $30,000, but kept his options open in the case of a deeper correction.

“Bitcoin is getting towards the long areas. Back towards the range low, through which a sweep can be granted as an entry point towards $32K,” he told Twitter followers.

“$28,600 could also be a long entry, but then I think we won’t be starting to make new highs, for now.”

Click Here to Read the Full Original Article at Cointelegraph.com News…