Bitcoin (BTC) has seen its highest monthly close since May 2022 after “Uptober” delivered near 30% BTC price gains.

Monthly close boosts Bitcoin bull market hopes

Data from Cointelegraph Markets Pro and TradingView confirms Bitcoin bulls successfully held on to upside into Nov. 1.

After navigating a choppy mid-month trading environment, hodlers were treated to a finale similar in character to October’s initial breakout.

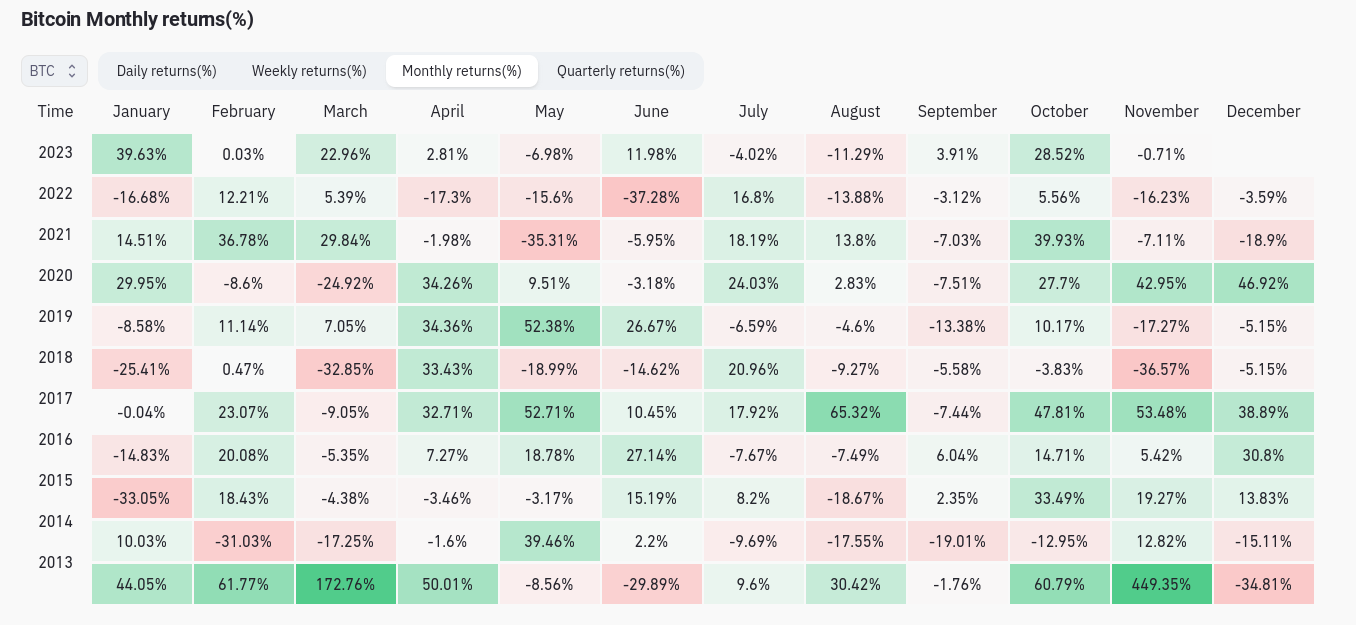

Monitoring resource CoinGlass thus put October as the second best-performing month of 2023. Bitcoin gained 28.5%, trailing only January’s 39.6%.

Reacting, popular trader Bluntz cautioned over discounting what amounts to a “high timeframe weekly range breakout.”

“I believe this current one will be akin to the oct 2020 ones and the april 2019 one,” he wrote in part of an X post around the monthly close.

In both scenarios, BTC/USD entered a new bullish phase, with straight upside lasting several months.

Striking a similar note, fellow social media trading personality Moustache eyed the TK Crossover indicator for a rare bull market trigger.

TK Crossover, which gets its name from a trading signal on the Ichimoku Cloud and involves two of its trendlines, Tenkan-sen and Kijun-sen, produced a once-in-a-cycle bull flag at the monthly close, he said.

The monthly close for October is only a few hours away.

-The last 3 times $BTC has closed above the Conversion Line () in the TK Cross-Indicator, we have seen a bull run in the following months (for at least ~300 days).

Send it higher. pic.twitter.com/pvWrwm0XG7

— ⓗ (@el_crypto_prof) October 31, 2023

On a slightly more conservative note, on-chain monitoring resource Material Indicators suggested that bullish momentum, while still present, is waning compared to last month.

“Still waiting for a retest of $33k, although we may not see it until after an attempt at $36k,” it told X subscribers alongside data from one of its proprietary trading tools.

Trader eyes $36,000 BTC price after FOMC “fakeout”

Volatility meanwhile remains on the menu for market participants, with the week’s main macroeconomic event due later in the day.

Related: There are now nearly 40M Bitcoin addresses in profit — A new record

This comes in the form of the United States Federal Reserve announcing interest rate policy amid a testing inflation environment. Fed Chair Jerome Powell…

Click Here to Read the Full Original Article at Cointelegraph.com News…