Bitcoin (BTC) starts a new week keeping traders guessing near its highest levels in 18 months — what’s next?

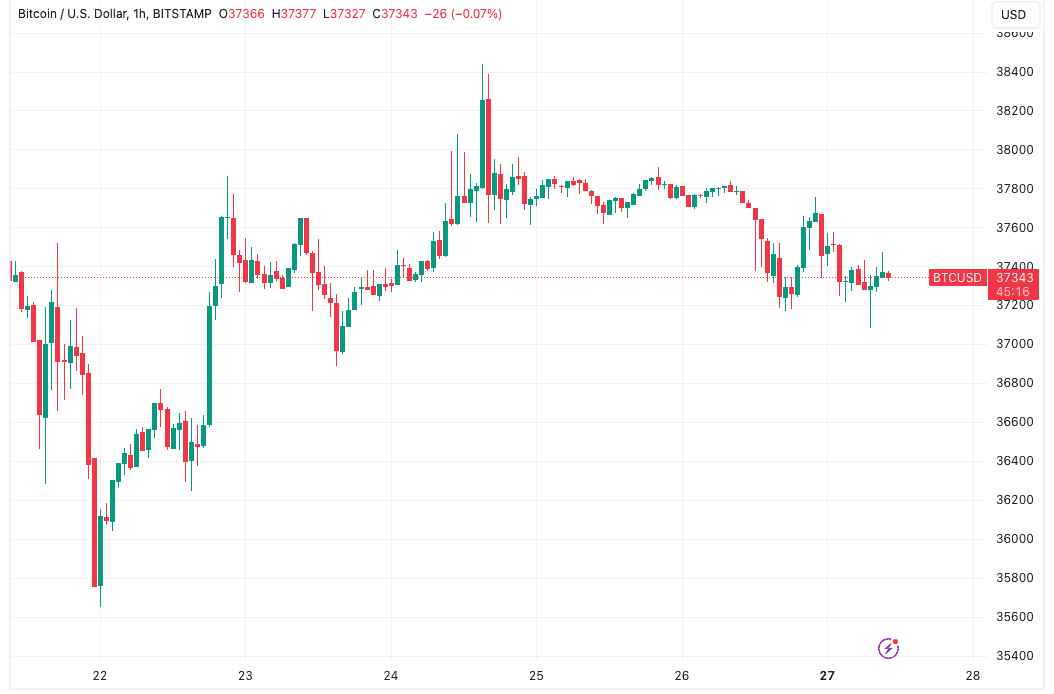

BTC price action has held higher after spiking above $38,000 last week, but since then, a testing “micro-range” has left bulls and bears locked in battle.

Whether a deeper retracement will come or a trip to $40,000 will leave naysayers behind is now the key short-term question for market participants.

Coming up over the next few days are various potential catalysts to help effect trend emergence for Bitcoin, while underneath, there are mounting signs that the market is due a boost.

Volatility is set to come at the hands of the monthly close later on, but before then, a host of macroeconomic events has the ability to inject some surprise price action.

Cointelegraph takes a look at these issues and more in the weekly rundown of Bitcoin price volatility triggers for the week ahead.

Monthly close looms with BTC price up less than 10%

The monthly close forms the key diary date for day traders this week, with Bitcoin at a crossroads.

As Cointelegraph reported, untested liquidity levels to the downside and the lure of $40,000 to the upside — this surrounded by resistance — makes for a stubborn daily trading range.

Neither bulls nor bears have been able to dislodge an increasingly narrow corridor for BTC/USD, and even new higher highs on daily teimframes have been few and short lived.

At the latest weekly close, a timely drop saw bids beginning to be filled, with Bitcoin dropping to lows of $37,100 before recovering, data from Cointelegraph Markets Pro and TradingView shows.

For popular trader Skew, it is now time for bid momentum to return.

“Spot takers led the bounce & eventually perp takers were the forced bid; mostly shorts forced out of the market,” he wrote in part of dedicated analysis on X (formerly Twitter.)

“Now as we go into EU session & US session important to see if spot bids or not.”

Skew likewise referenced blocks of liquidity both above and below spot price, with $37,000 and $38,000 the key levels to watch.

“Lots of bid liquidity below $37K so if spot takers continue to be net sellers this would be the momentum required to fill those limit bids below,” he wrote about the order book on largest global exchange Binance.

“As for ask liquidity aka supply, that remains between $38K – $40K area ~ important area for higher.”

With the monthly close…

Click Here to Read the Full Original Article at Cointelegraph.com News…