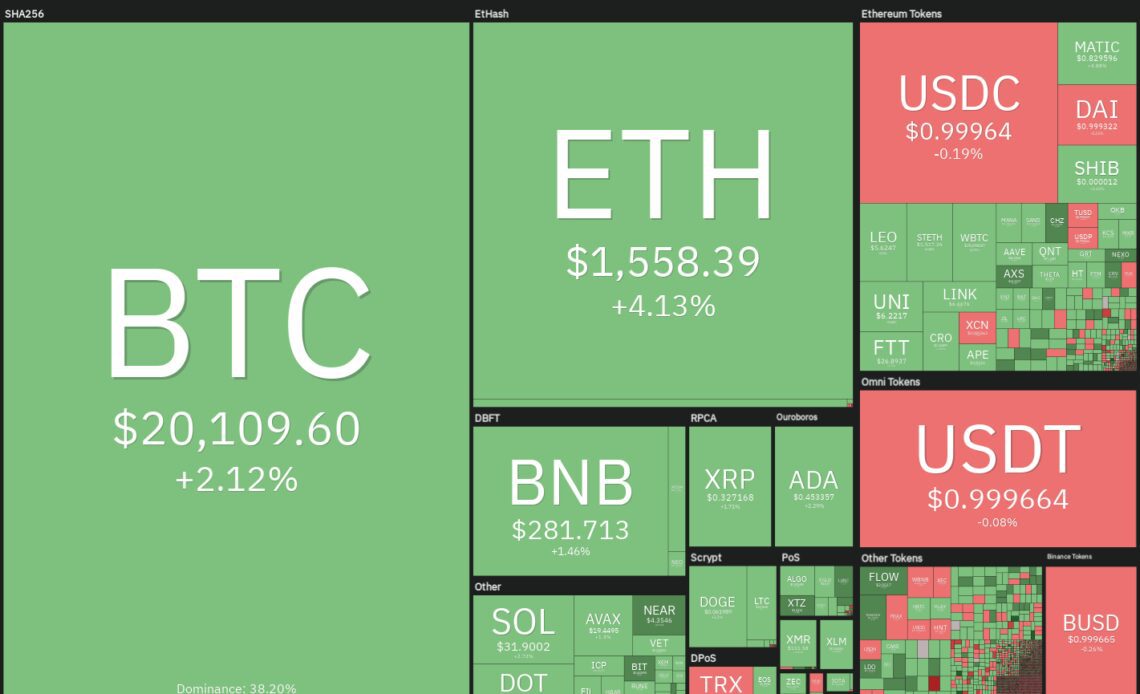

Bitcoin (BTC) price has been trying to change course while the S&P 500 is still giving up gains on a daily basis. Even though the United States equities markets have been grinding lower since Aug. 26, Bitcoin has managed to hold on to the $20,000 mark.

However, investor interest seems to be shifting away from Bitcoin. That has led to a reduction in assets under management (AUM) for Bitcoin investment products, which dropped 7.16% in August to $17.4 billion, according to a new report by CryptoCompare.

In comparison, the AUM for Ethereum (ETH) products increased 2.36% to $6.81 billion during the same period, indicating that investors are positioning themselves in Ethereum products ahead of the Merge.

Even though prices are down across the ecosystem, bear markets at least offer attractive opportunities to long-term investors. To capitalize on this opportunity, Reddit co-founder Alexis Ohanian’s venture capital firm Seven Seven Six is aiming to raise $177.6 million for a crypto investment fund. On similar lines, former executives from Galaxy Digital and Genesis are looking to raise a $500 million fund.

Although the near term looks uncertain, long-term investors may be looking for bottom fishing opportunities. Could Bitcoin and major altcoins stay above their immediate support levels? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin turned down from the downtrend line on Aug. 30 but a minor positive is that the bulls purchased the dip near $19,500. The bulls are again trying to push the price above the downtrend line on Aug. 31.

If they succeed, the BTC/USDT pair could rally to the 20-day exponential moving average ($21,325), which is an important level to keep an eye on. If the price turns down from this level, the bears will attempt to pull the pair to the strong support zone of $18,910 to $18,626. A break and close below this zone…

Click Here to Read the Full Original Article at Cointelegraph.com News…