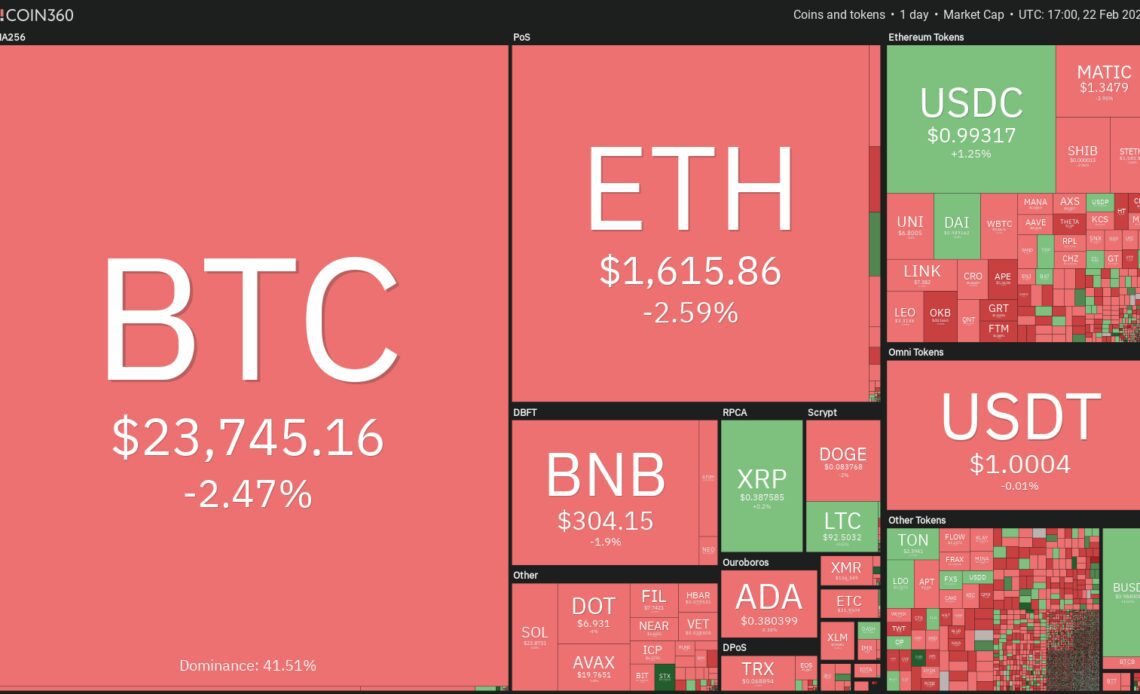

The United States equities markets saw their worst performance of 2023 as concerned investors dumped stocks on Feb. 21, fearing continued rate hikes by the U.S. Federal Reserve.

Although the cryptocurrency markets also gave back some of the gains, the fall was comparatively muted. UTXO Management senior analyst Dylan LeClair said that Bitcoin’s (BTC) correlation to the S&P 500 index has fallen to its lowest since late 2021.

After the sharp recovery from the lows, Glassnode data showed that only 21% of the coins sent by Long-Term Holders to exchanges at the start of this week moved at a loss. That is a huge improvement from mid-January, when 56% of LTH coins sent to exchanges were moved at a loss.

The decoupling of the crypto and the U.S. equities markets is a positive sign, but traders must remain cautious. If stocks turn sharply lower and a risk-off sentiment develops, then the crypto rally may find it difficult to continue its gains.

What are the important levels that could arrest the correction in Bitcoin and altcoins? Let’s study the charts of the top 10 cryptocurrencies to find out.

BTC/USDT

Bitcoin faced yet another rejection at $25,211 on Feb. 21, which may have tempted the short-term bulls to give up and book profits. That could pull the price to the first major support at the 20-day exponential moving average ($23,364).

In an uptrend, buyers try to protect the 20-day EMA and then the 50-day simple moving average ($21,772). If the price rebounds off the 20-day EMA, it will indicate that bulls are not waiting for a deeper correction to buy. That may enhance the prospects of a rally above $25,250.

On the contrary, if the price slips below the 20-day EMA, it will suggest that traders are rushing to the exit. That could result in a fall to the 50-day SMA. The BTC/USDT pair may again attempt a rebound off it but, on the way up, the 20-day EMA may pose a strong challenge.

The short-term trend could tilt in favor of the bears if the price closes below the crucial support at $21,480.

ETH/USDT

Although Ether (ETH) stayed above the $1,680 level since Feb. 17, the bulls could not clear the overhead hurdle at $1,743. That may have attracted selling from short-term traders.

The price turned down on Feb. 21 and dipped back below the breakout level of $1,680. Sellers will now try to build upon this advantage and yank the price…

Click Here to Read the Full Original Article at Cointelegraph.com News…