The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession.

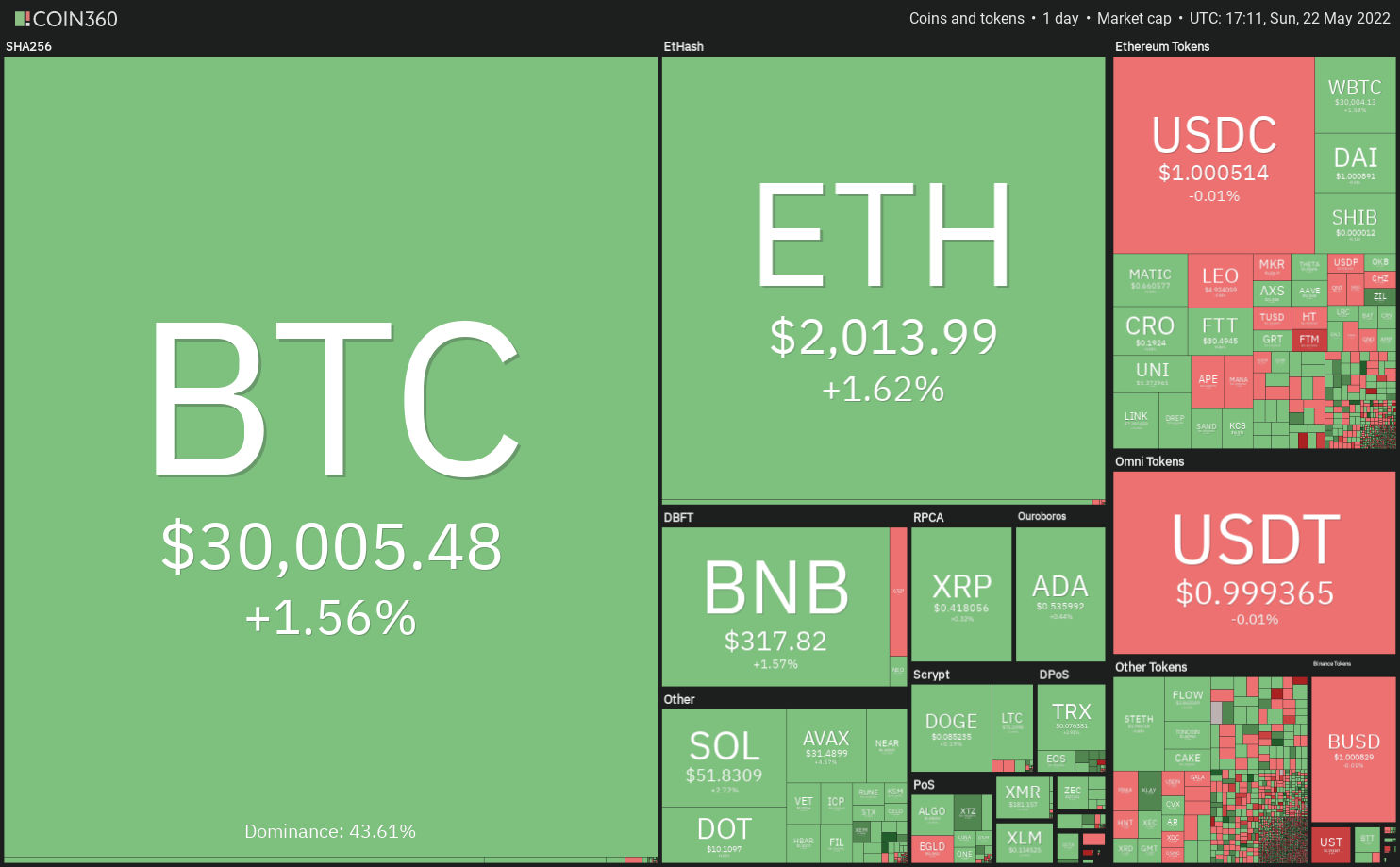

Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak.

Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally.

What are the critical levels that may signal the start of a sustained recovery? Let’s study the charts of the top-5 cryptocurrencies that may outperform in the near term.

BTC/USDT

Bitcoin rebounded off the crucial support at $28,630 on May 20, indicating strong buying near this level. The bulls are attempting to push the price above the downtrend line, which could be the first indication that the selling pressure may be reducing.

Above the downtrend line, the BTC/Tether (USDT) pair could rise to the 20-day exponential moving average (EMA) of $31,887. The bears are likely to defend this level with vigor. If the price turns down from the 20-day EMA, the bears will once again try to sink the pair below $28,630.

If they manage to do that, the pair could drop to $26,700. This is an important level to keep an eye on because a break and close below it could open the doors for a decline to $25,000 and then to $21,800.

Conversely, if buyers thrust the price above the 20-day EMA, the pair could attempt a rally to the 61.8% Fibonacci retracement level at $34,823. If this level is scaled, the pair could climb to the 50-day simple moving average (SMA) of $37,289.

Click Here to Read the Full Original Article at Cointelegraph.com News…