Bloomberg’s lead commodity strategist says that scaling solutions on Ethereum (ETH) may be threatening the rise of the alternative layer-1s like Solana (SOL) and Avalanche (AVAX).

In a new report on crypto assets, Mike McGlone says that Ethereum layer-2s are gaining rapid adoption, and are stopping the flow of new users from Ethereum into alternative layer-1s trying to rival the top smart contract platform.

“Even as activity declined on the Ethereum base chain, 2022 was a pivotal year for the asset, as the adoption of NFTs and Web3 applications on Layer-2 chains drove massive network effects. Layer-2s (L2s) is an umbrella term for blockchain-scaling solutions that attempt to address the constraints that Ethereum currently confronts…

Sharding in late 2023 is intended to alleviate scalability issues. In the meantime, L2s have stepped in to enhance the user experience and stop the flow of users to alternative layer-1 chains such as Solana, Avalanche.”

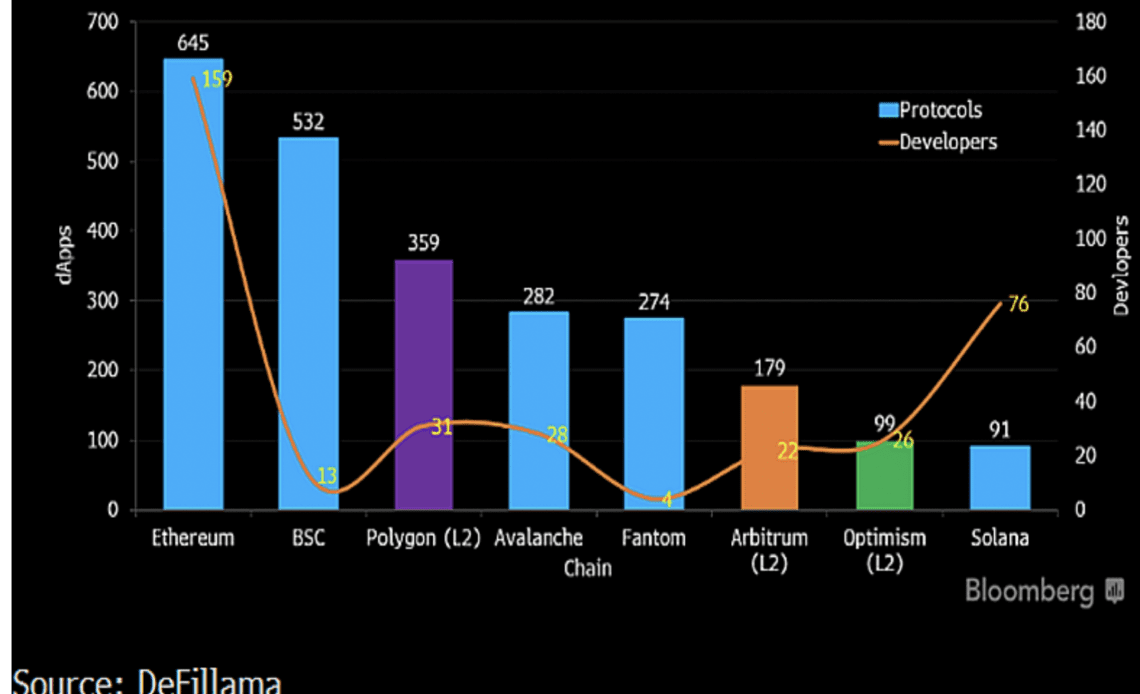

McGlone notes that activity on layer-2s has now eclipsed activity on the base layer. The analyst says Polygon (MATIC) in particular has outshined the rest of the layer-2 ecosystem, and has the stats to prove it.

“After averaging 250,000 daily active addresses in the prior months, L2s erupted in October 2022 and overtook the base chain. They now consistently maintain more than 400,000 daily active addresses. Daily active addresses on rollup or L2 chains rose 86% in 2022, versus a 33% decline on Ethereum. Polygon Becomes Beacon for Developers.

No L2 has created more network effects for Ethereum than Polygon. Polygon started as a sidechain but pivoted to an aggregator of technologies focusing on zero-knowledge (zk) rollups. A blockchain game-changer, Zk proofs, a method of proving the possession of certain information without revealing any of the data itself, enhance privacy and speed up transactions.”

The commodities strategist also says that some of the corporate partnerships that Polygon has attracted, including from CocaCola, Reddit and Meta, give Polygon an advantage when it comes to adoption and regulatory compliance.

“Putting aside the potential regulatory issues which may arise from a traditional company’s involvement in the issuance of its own token MATIC – see upcoming Ripple/SEC court case – the quality of the corporations it has brought on board bodes well for adoption potential. Companies like CocaCola, Starbucks, Reddit, and Meta have launched…

Click Here to Read the Full Original Article at The Daily Hodl…