An investor with nearly $2 million worth of funds frozen in bankrupt cryptocurrency lender BlockFi has filed a class-action complaint against its founders, two directors and crypto exchange Gemini.

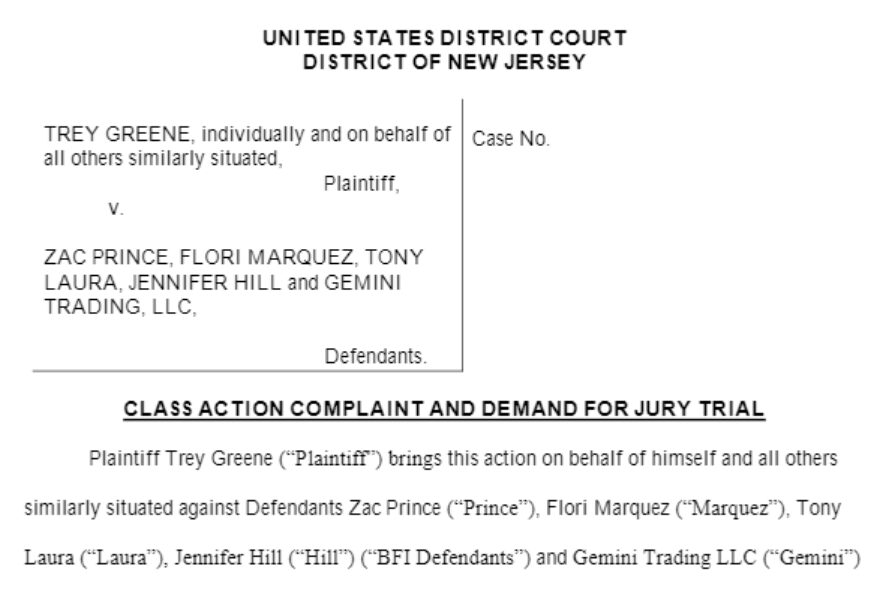

In a Feb. 28 complaint filed in the U.S. District Court for the District of New Jersey, investor Trey Greene accused the defendants of numerous wrongdoings, including violating the consumer fraud and exchange acts and breaching its fiduciary duties, as well as offering and selling unregistered securities.

“The unregistered securities sold by the BFI [BlockFi] Defendants on behalf of BlockFi were marketed and sold via a steady stream of misrepresentations and material omissions by Prince and Marquez over several years and through intermittent misrepresentations by Defendant Gemini.”

Greene claims he invested over $1.5 million in interest accounts that are alleged to be unregistered securities, accruing over $400,000 in capital gains and earned interest that was re-invested.

He is currently unable to withdraw the funds, however, after BlockFi froze all withdrawals on Nov. 10 — the same day that FTX filed for bankruptcy.

Greene further claims that he was induced into buying the “unregistered securities” by misrepresentations from BlockFi founders Zac Prince and Flori Marquez that the offerings were comparable to federally-insured bank products.

While the Securities and Exchange Commission charged BlockFi with “failing to register the offers and sales of its retail crypto lending product” on Feb. 14, the filing claims the exchange “admitted its [interest] accounts were unregistered securities” during the proceedings, which resulted in a $50 million settlement on Feb. 15.

Related: FTX ex-director Nishad Singh pleads guilty to fraud charges

Tyler Winkevoss’ Gemini previously held custody over BlockFi’s clients’ crypto holdings through its custodial services, and is alleged to have misrepresented how accessible these funds were to customers.

“Gemini knew of, and acquiesced in, the materially false and misleading statements about the status the safety and accessibility of Plaintiff’s and class members’ assets at Gemini and about the risks of loss. Gemini supplied materially false and misleading information to BlockFi for use in marketing the BIAs [BlockFi interest accounts].”

Gemini is alleged to have breached the exchange act but was not included in the other allegations.

Greene…

Click Here to Read the Full Original Article at Cointelegraph.com News…