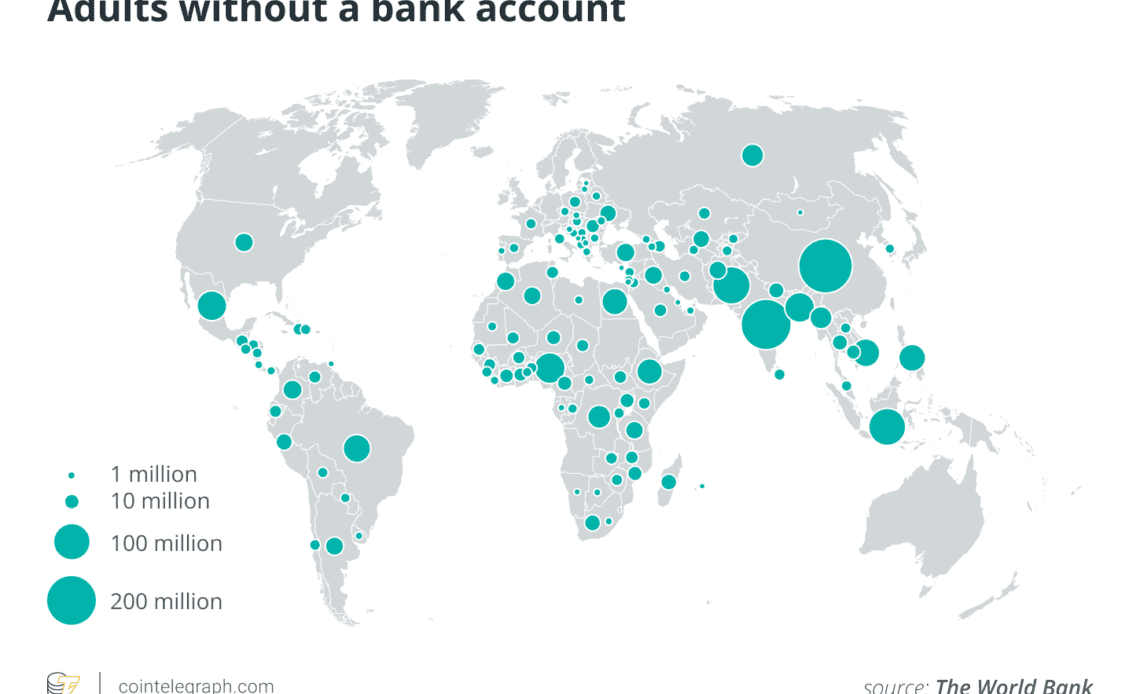

In modern times of rapid globalization and digitization, technological developments have now reached such proportions that the usage of cryptocurrencies is no new phenomenon. The technology behind blockchain opens the internet for financial services by replacing trust, a fundamental component of the financial system for centuries, with transparency integrated into a decentralized network. Thereby, blockchain bears the potential to help achieve the United Nations’ Sustainable Development Goals (SDG) by empowering the unbanked, predominantly women, reducing transaction fees as well as creating an alternative source of liquidity.

Only 57.7% of adults in Ghana in 2021 had a bank account. Unable to afford participation in the formal financial system, the poor find themselves paying the most for fundamental financial services. Moreover, there is a multiplier effect inherent with the economic participation of women that takes wide-ranging consequences respecting a number of SDGs.

Related: The UN’s ‘decade of delivery’ needs blockchain to succeed

Financial inclusion may alleviate poverty, improve health and well-being, gender equality, take a positive effect on children’s education, and more. Access to affordable financial services thus becomes a catalyst for economic growth and opportunity. Simply put, there is a lot at stake here. Let’s dig into it.

West Africa’s economic powerhouse: Ghana

Sharing borders with the Ivory Coast, Burkina Faso and Togo, Ghana lies in the heart of West Africa. The population is about 32 million, and besides various tribal languages, English is one of the recognized national languages. Frequently seen as West Africa’s economic powerhouse, in 2020, the country’s purchasing power parity (gross domestic product per capita) was around $5,744 United States dollars. Until it was hit by a severe banking crisis spanning from 2017 to 2020, Ghana’s economic growth had been astounding — the epitome of what many countries in the region ought to achieve. Shaken by just another crisis, going by the name COVID-19, the economy is in the process of recovery.

Ghana’s wealthy remain concentrated in the south’s urban areas and lower-income households dispersed across the countryside, home to most of the population. As a result, banking services are largely located in urban areas. Despite that, a 2010 research concluded that physical access to banks is not the central barrier to banking but rather Know Your Customer (KYC)…

Click Here to Read the Full Original Article at Cointelegraph.com News…