BlackRock, the world’s largest asset manager with more than $9 trillion in assets under management, has sent ripples through the cryptocurrency market with its recent filing for a Bitcoin Exchange-Traded Fund (ETF). Despite being home to some of the largest cryptocurrency exchanges, the United States does not have any ETFs tracking Bitcoin’s spot price due to regulatory constraints.

An ETF is a basket of securities—such as stocks—that tracks an underlying index. In the case of a Bitcoin ETF, it would be designed to track the spot price of Bitcoin. This provides a significant advantage to investors as it allows them to gain exposure to the price of Bitcoin without worrying about the challenges of buying and storing the cryptocurrency themselves. Like other ETFs, the Bitcoin ETF could be bought and sold on traditional stock exchanges.

The anticipation of an industry titan like BlackRock launching a Bitcoin ETF has sparked a renewed wave of Bitcoin accumulation within the U.S., as evidenced by on-chain data from Glassnode.

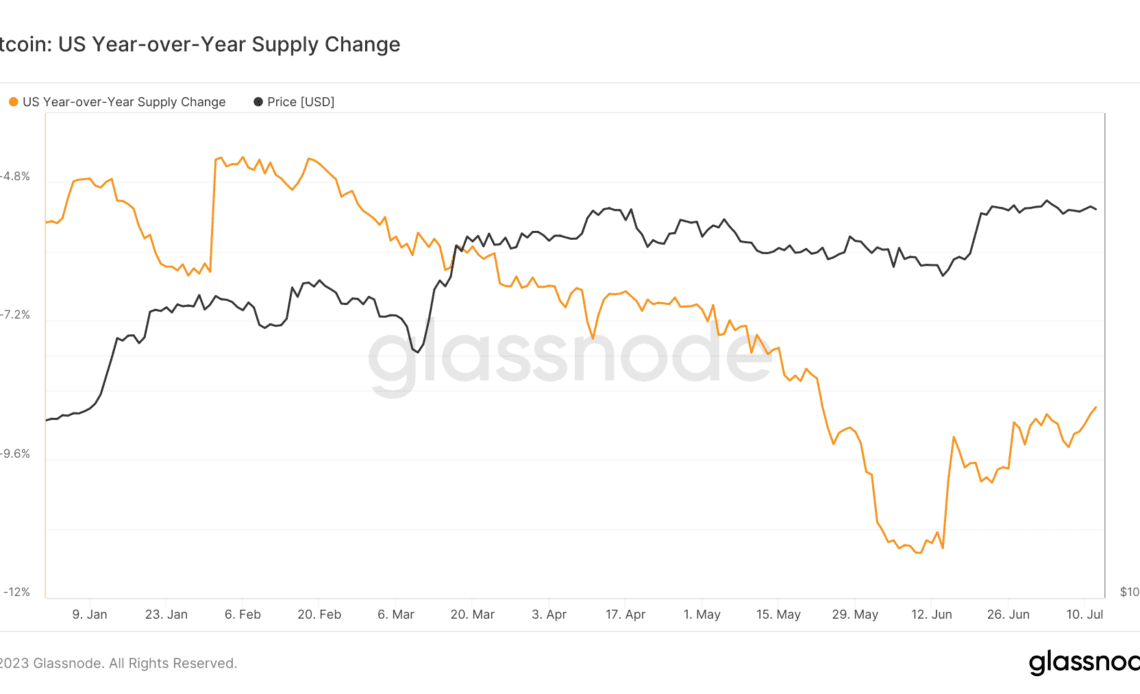

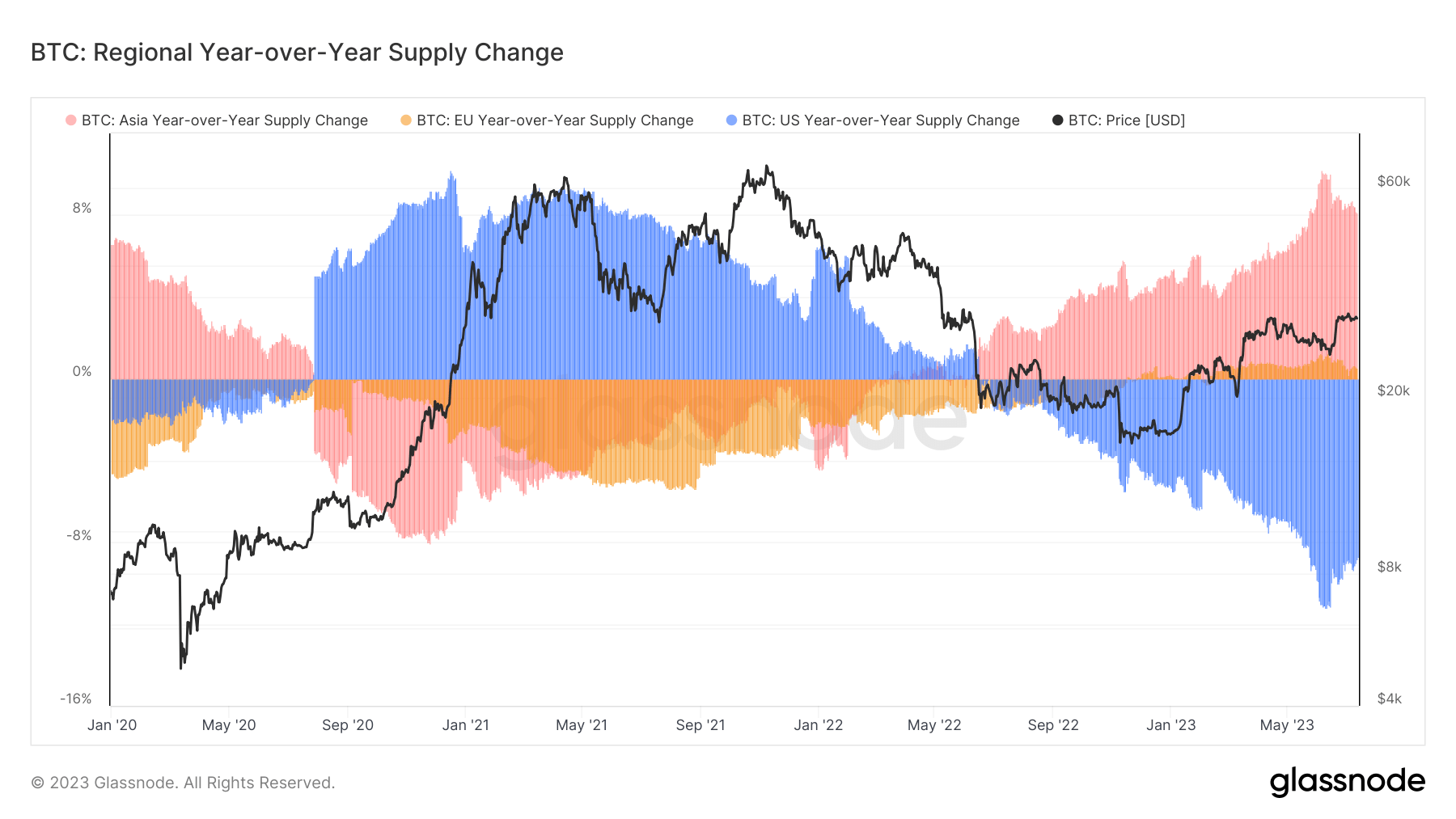

Glassnode’s data reveals an increase in the balance of Bitcoin held by U.S. entities since the start of this month, despite a downward trend observed year-on-year. Notably, the initiation of this surge appears to align with the announcement of BlackRock’s Bitcoin ETF filing.

To determine the geographical location of Bitcoin entities, Glassnode compares transaction timestamps with the working hours of different geographical regions. Through this method, they can determine the most likely location of an entity, which provides a broader understanding of regional Bitcoin supply dynamics.

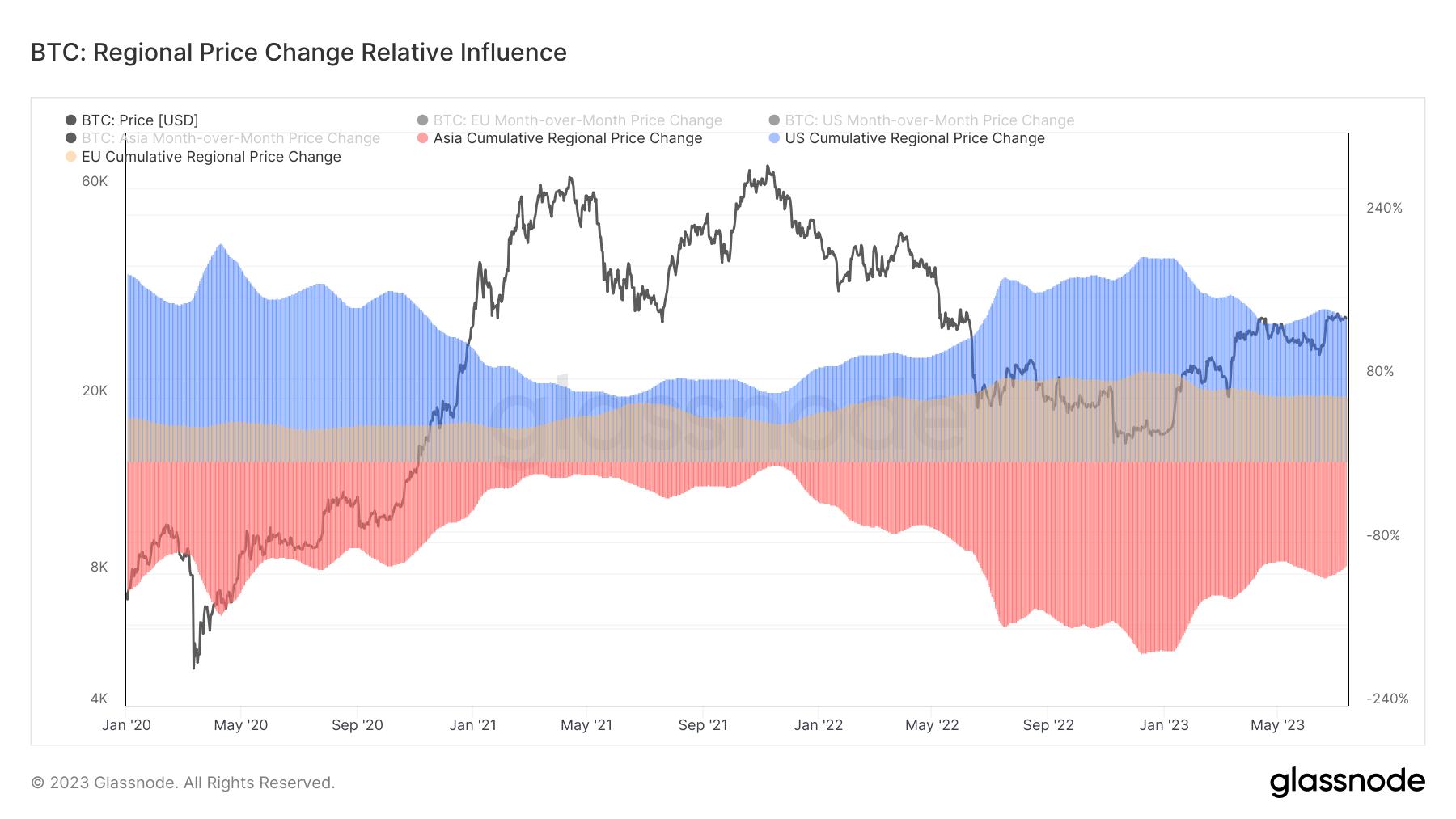

The revival of Bitcoin accumulation in the U.S. could signal a pivotal shift for the cryptocurrency market, considering the extensive influence of the U.S. market on Bitcoin’s price. Glassnode uses two models to calculate this influence: one examines cumulative price performance during trading hours in the EU, U.S., and Asia; the other compares cumulative performance by region against the aggregate total. According to these models, the U.S. exerts a regional market influence of 139.2%, a disproportionately high figure that underscores the prominent role of the U.S. in global Bitcoin trading.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…