Bitwise chief investment officer Matt Hougan attributed the recent decline in the crypto market to overinflated expectations regarding the potential impact of the newly launched Bitcoin exchange-traded funds (ETFs).

In a Jan. 23 post on X (formerly Twitter), Hougan explained that the current market sell-off is driven by what he terms an “ETF Expectations-led” phenomenon.

According to him, investors anticipating “larger net flows into (these) ETFs” front-ran the approval news by piling into both spot and derivatives positions on the flagship digital asset. However, with the expected inflows not materializing, these investors are now “unwinding that bet,” prompting the current market situation.

“Just as the market overestimated the short-term impact of ETFs, it is underestimating the long-term impact,” Hougan concluded.

Since the Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs in the U.S., the value of the top cryptocurrency has been on a downturn. The digital asset fell to as low as under $39,000 on Jan. 23 but has recovered to $40,389 as of press time, according to CryptoSlate’s data.

This downward trend raised concerns within the crypto community, with some attributing it to the outflows from Grayscale’s Bitcoin Trust ETF (GBTC).

Contrary to this sentiment, analysts, including CryptoQuant founder Ki Young Ju, share a perspective aligned with Hougan’s.

Young Ju recently emphasized that Bitcoin operates in a futures-driven market, making it less susceptible to spot-selling activities from GBTC-related issues.

“BTC falls due to derivative market selling, not GBTC. OTC (over the counter) markets are very active, but no price impact,” he added.

ETFs are BTC net buyers.

Meanwhile, the Bitwise investment chief also clarified that the recently launched ETFs are net buyers of Bitcoin despite the outflows emanating from GBTC.

Hougan pointed out that while GBTC functions as a net seller, the cumulative BTC acquisitions from the new ETFs surpass that being offloaded by Grayscale.

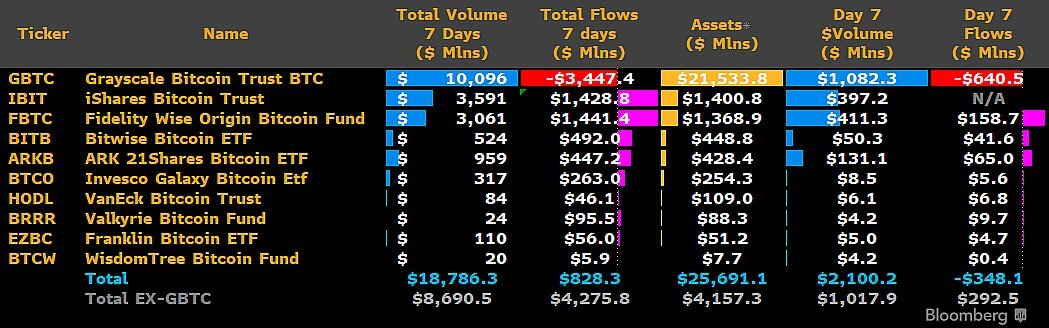

Bloomberg data corroborates Hougan’s view. As of Jan. 23, GBTC’s outflows stood at $3.45 billion, while the newly introduced nine ETFs had a combined inflow of more than $4 billion in assets under management.

This data stresses a compelling narrative—that the ETFs have seen substantial interest from the community, leading to a swift and significant accumulation…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…