CryptoSlate analysts examined the detailed proof-of-reserves of leading crypto exchanges outside of Coinbase and Binance. It revealed that Bitfinex holds the most significant Bitcoin (BTC) reserves, with $3.5 billion worth of BTC.

The data was obtained on Dec. 16 from OKX, KuCoin, Crypto.com, ByBit, Binance, BitMEX, and Bitfinex. OKX follows Bitfinex with the second largest BTC pool with more than $1.5 billion in BTC, while Binance comes as the third with just above $5 billion in BTC. BitMEX places fourth, with just over $1 billion in BTC. Crypto.com, ByBit, and KuCoin came as the fifth, sixth and seventh with $700 million, $370 million, and $300 million, respectively.

Reserves in billions

Bitfinex, OKX, Binance, and BitMEX calculate their reserves in billions. Amongst all exchanges included in this analysis, Bitfinex emerged as the exchange that held significantly more BTC than the other six that released their proof-of-reserves.

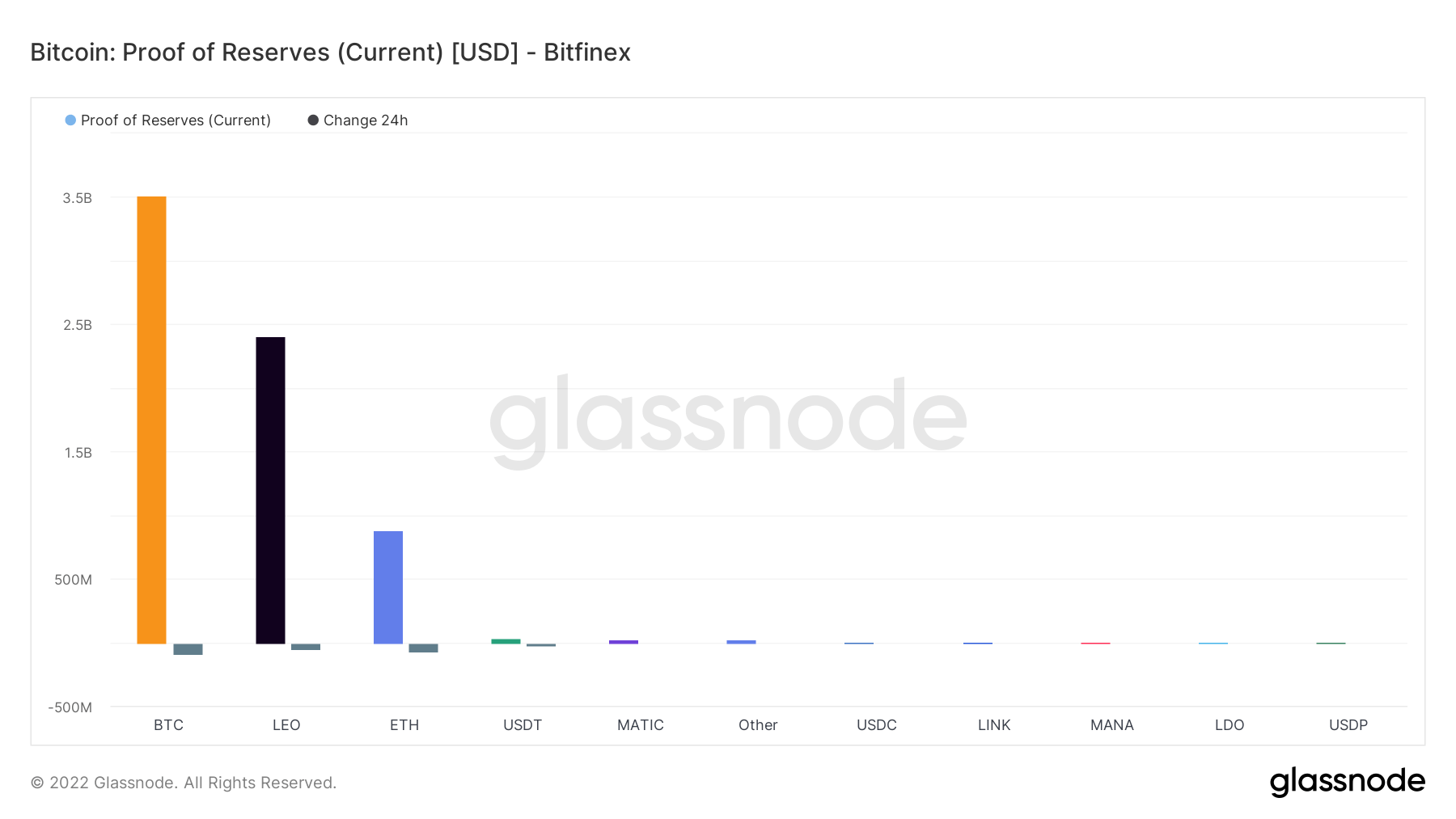

Bitfinex

According to the numbers, Bitfinex entered the weekend with $3.5 billion in BTC and around $2.37 billion in UNUS SED LEO (LEO). The exchange also holds just below $1 billion worth of Ethereum (ETH).

Besides BTC, LEO and ETH, the chart shows that Bitfinex holds eight more assets in millions each.

Data from Nov. 21 showed that 91% of Bitfinex’s reserves were made of BTC and ETH, which meant that Bitfinex held the most BTC. Even though its ETH reserves have shrunk, the exchange still holds the largest amount of BTC.

Another study at the end of November 2022 showed that Bitfinex held over $11 billion worth of Tether (USDT), equating to 60% of the whole USDT supply. However, the current data indicate that this amount retreated to millions within two weeks.

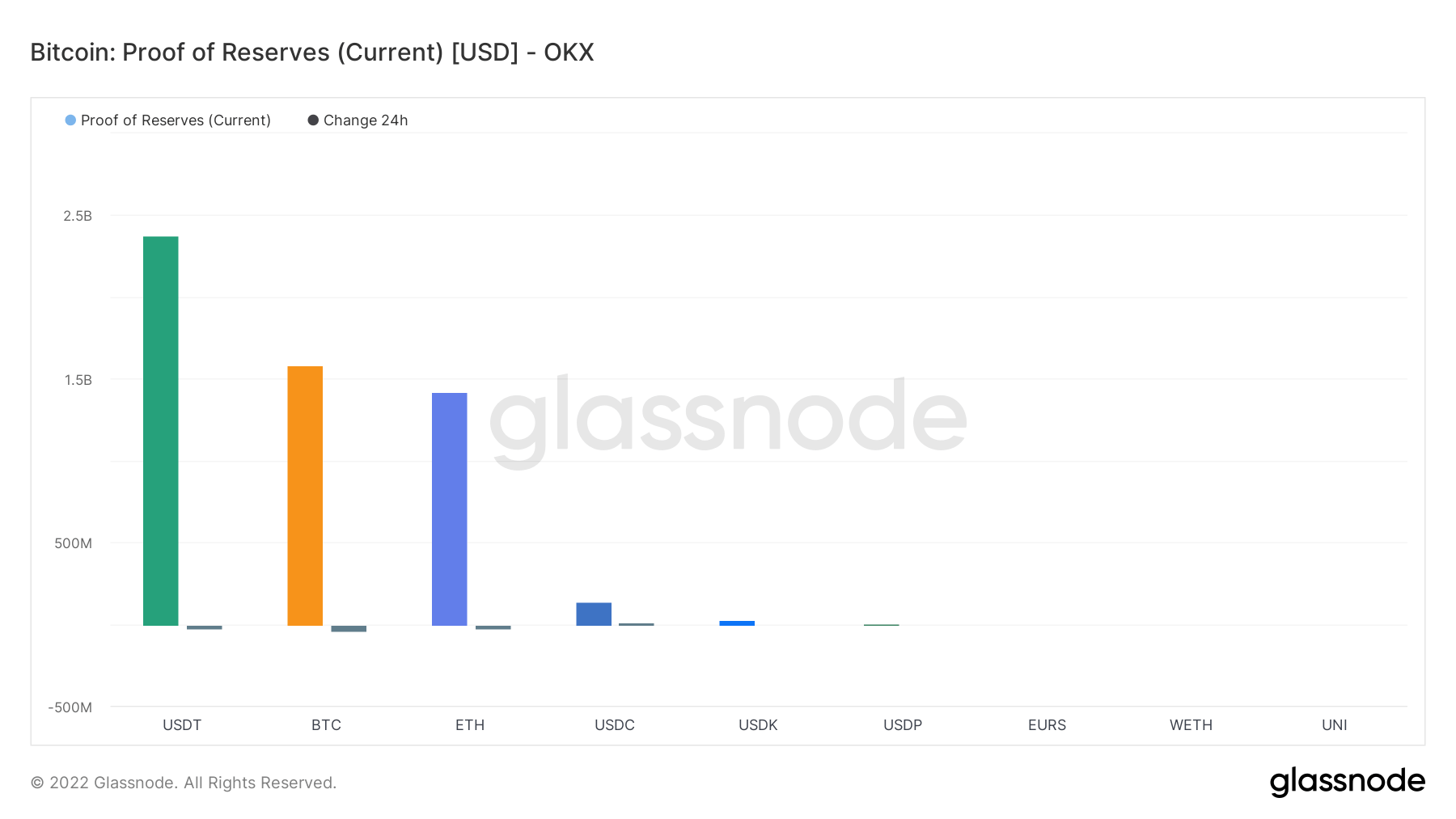

OKX

OKX is the only exchange included in this analysis that measures its BTC reserves in billions. The exchange’s BTC reserves amount to just above $1.5 billion.

In addition to the considerable amount of BTC,…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…