There are many different ways to quantify market sentiment. Looking at price action provides a very crude but effective gauge of the market’s feelings — if the price is going down, the market’s most likely bearish, and vice versa. However, feelings about the future are very complex to analyze, especially when it comes to Bitcoin, and on-chain data helps us see through the many layers of market sentiment.

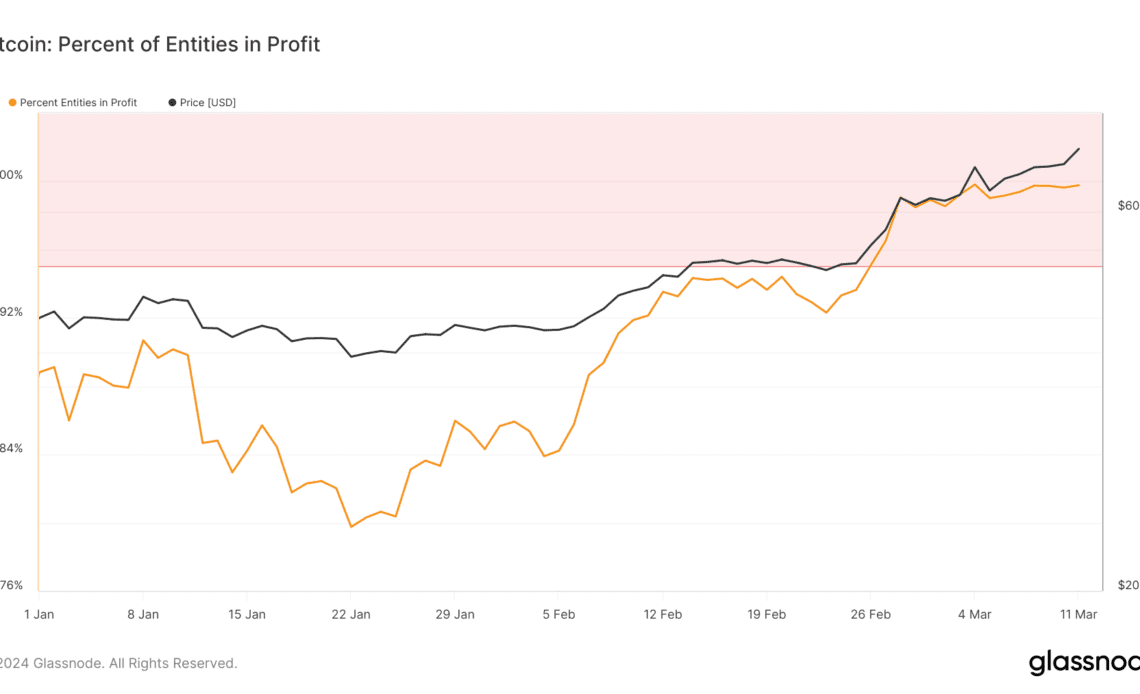

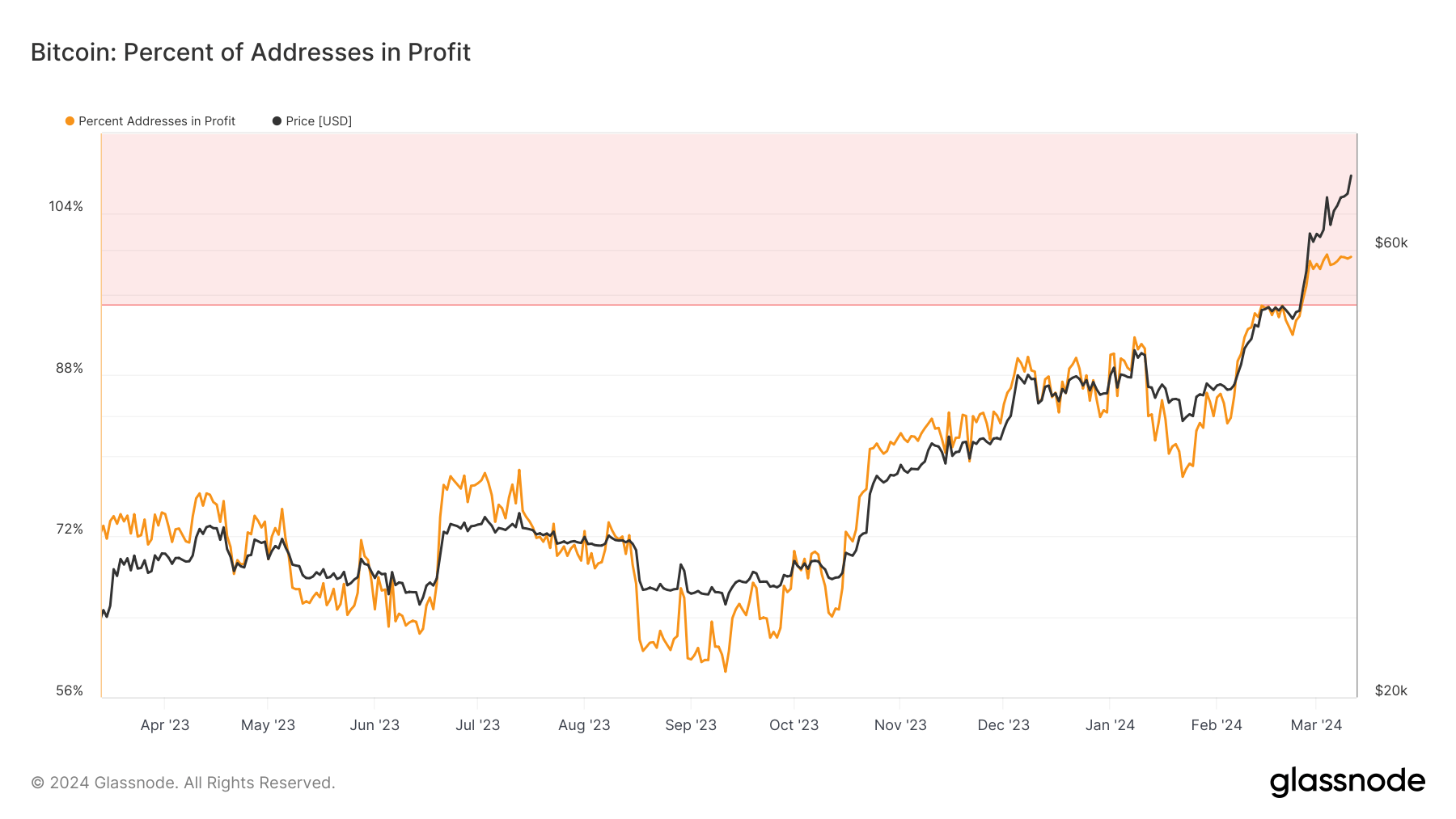

Few on-chain metrics measure market sentiment better than the percentage of addresses and entities in profit. These metrics look at the percentage of unique addresses and entities whose funds have an average buy price lower than Bitcoin’s current price. Glassnode defines ‘buy price’ as the price at the time the coins were transferred into an address or entity.

The distinction between entities and addresses here helps us provide a more nuanced market analysis. Entities, which may control multiple addresses, give a more accurate representation of investor sentiment and behavior, as focusing on individual addresses fails to provide a complete picture of the market’s profitability.

According to data from Glassnode, there have never been more addresses and entities in profit in the history of Bitcoin. This morning, with Bitcoin’s price standing at just above $72,000, 99.76% of entities and 99.74% of addresses were in profit. The US Market Open has again created some volatility, wiping out leverage and causing Bitcoin to trade between $72,920 and $70,145.

Historically, when the percentage of profitable entities and addresses surpassed 95%, it indicated the beginning of a mature phase of a bull cycle, where the overwhelming majority of market participants have accumulated gains. Historical data from Glassnode shows that this profitability threshold was usually maintained for around a month before experiencing a correction. It suggests a pattern where peak profitability precedes market retractions, which aligns with the usual bull market drawdowns. Corrections often follow periods of rapid price appreciation as they usually push a significant amount of investors to realize their gains, thereby increasing selling pressure.

However, zooming out and looking at the two previous bull cycles shows that the percentage of profitable addresses…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…