Bitcoin crossed the $57,000 mark on Feb. 27, reaching its highest level since November 2022. This surge, driving the price from $54,000 to $57,300 within 24 hours, led many to see it as the beginning of a bull rally, especially significant in a Bitcoin halving year.

Despite the blistering gains, the expected wave of liquidations did not follow suit.

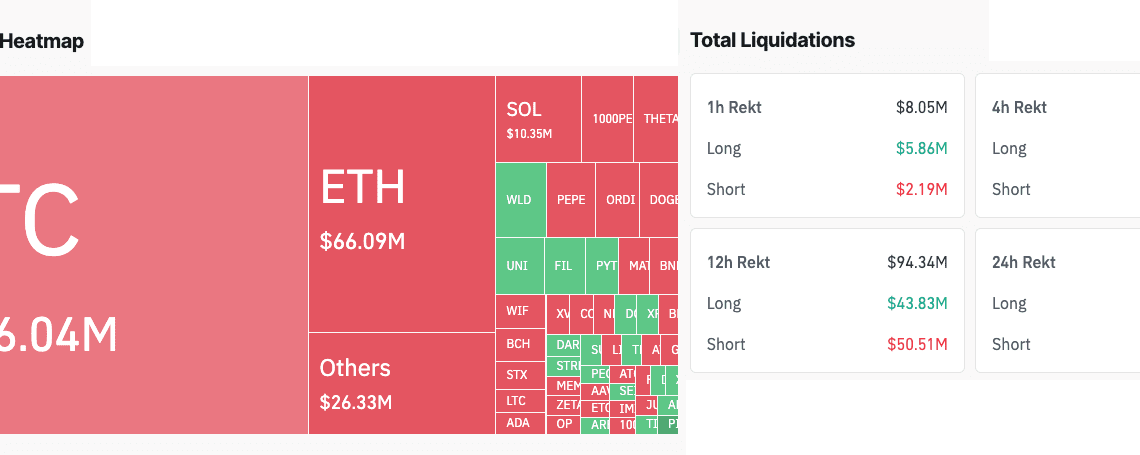

Between Feb. 26 and Feb. 27, 86,351 traders faced liquidation, cumulating to $387.15 million across the board. However, Bitcoin-specific liquidations stood at around $206 million. This figure, divided between $175 million in shorts and $30 million in longs, indicates a market thatremained resilient against massive liquidation triggers contrary to expectations.

The relatively muted response in terms of liquidations following Bitcoin’s sharp price increase can be attributed to several factors that cushion the impact of such volatile movements on the market’s derivative segment.

Firstly, the distribution of liquidations indicates that the market was not heavily leveraged. In scenarios where the market sentiment is overwhelmingly bullish or bearish, a sudden price movement against the majority position can trigger a cascade of liquidations.

However, the more balanced positioning in this case suggests that traders were not excessively leaning towards a bearish outlook, which would have been more vulnerable to being squeezed out by the price spike.

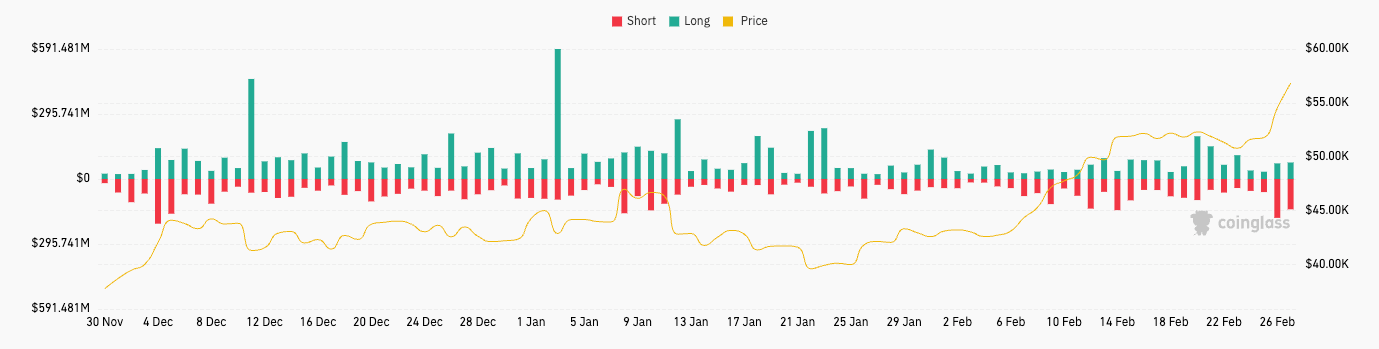

These balanced liquidations are not an outlier but rather part of a consistent pattern observed in recent weeks. The total amount of BTC liquidations on Feb. 27, although significant, did not deviate markedly from the daily averages seen over the previous weeks.

This steadiness suggests a shift among market participants towards more conservative leverage levels and a more even distribution across bullish and bearish positions. Such strategic positioning inherently buffers the market against the shock of sudden price movements, mitigating the risk of large-scale liquidations.

This is in line with CryptoSlate’s previous analysis of the derivatives market, which found an almost equal split between calls and puts in Bitcoin options. While the rise in open interest in February signaled a dominant bullish outlook in the market, the balanced call-to-put ratio showed caution among…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…