Bitcoin dropping below $60,000 at the beginning of May spooked the market and led to significant volatility across trading products. However, despite the massive volatility in derivatives, the spot market seems to have led most of this recovery, with volumes and inflows helping stabilize BTC at around $66,000 in mid-May. After a choppy few days where BTC struggled to break through $66,000, we saw a sharp spike on May 20 that sent it above $70,000, injecting much-needed optimism into the market. While BTC settled at around $70,100 on May 21, the important psychological level remained breached.

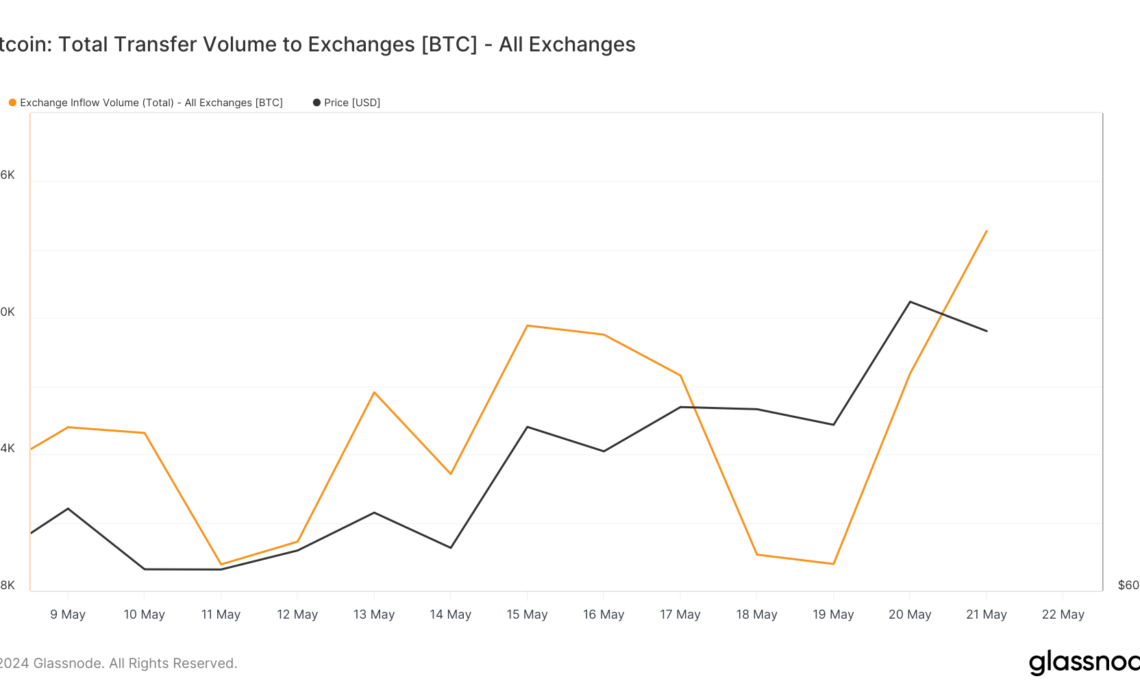

This optimism led to a notable increase in exchange activity, evident in the quick rise in inflows and volume.

Between May 15 and May 21, we saw quite a bit of volatility in transfer volumes into exchanges. On May 15, 39,095 BTC was transferred to exchanges, slightly decreasing to 38,031 BTC on May 16. The volume further dropped to 33,242 BTC on May 17, indicating a trend of declining transfer volumes. A dramatic drop occurred on May 18, with only 12,243 BTC transferred to exchanges, followed by an even lower 11,156 BTC on May 19. However, this trend reversed on May 20, with a substantial increase to 33,484 BTC, culminating in a peak of 50,186 BTC on May 2. These fluctuations show how small price changes lead to significant investor activity and sentiment fluctuations.

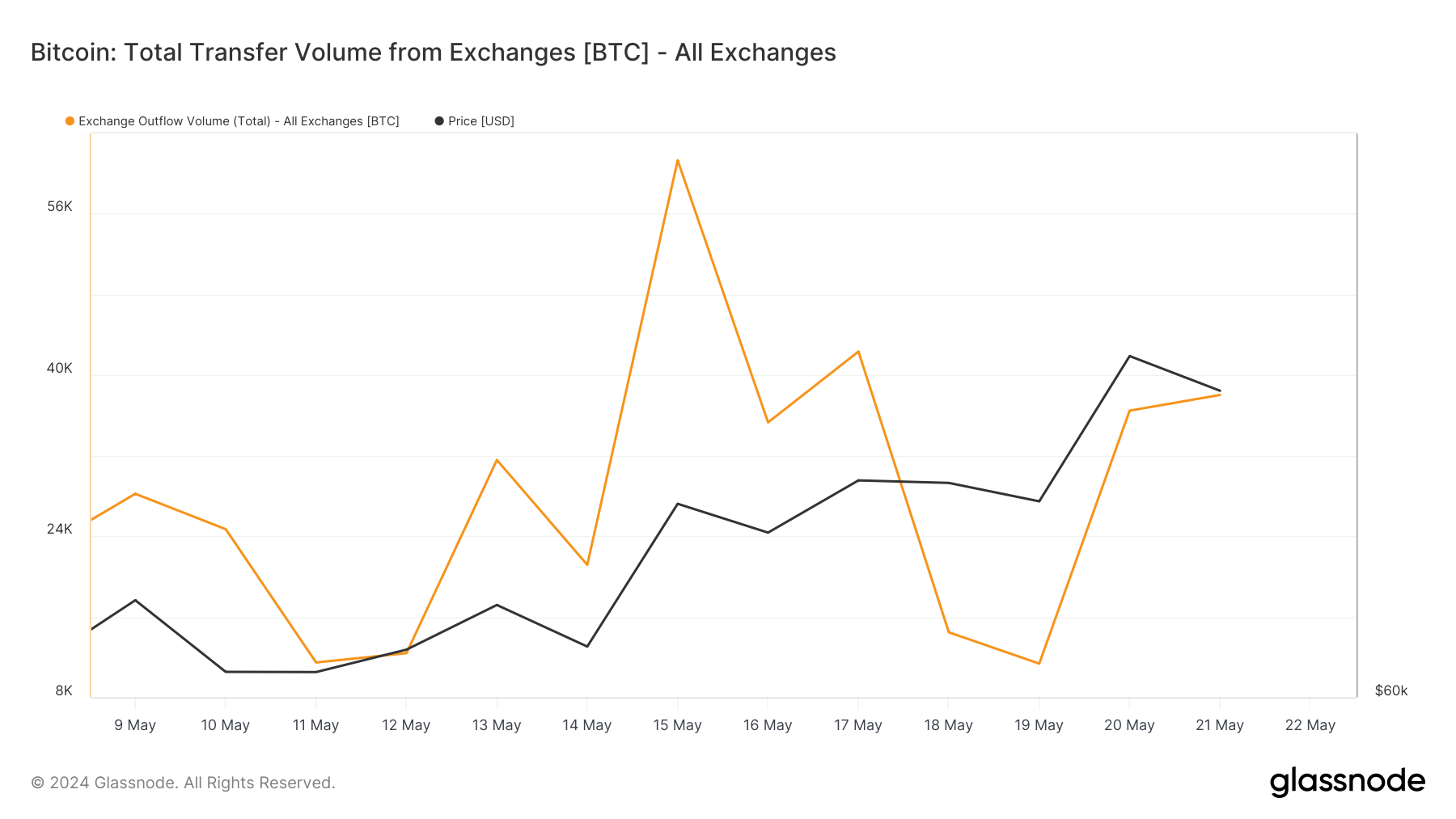

Transfer volumes from exchanges showed similar variations. Between May 15 and May 18, transfer volume out of exchanges dropped from 61,232 BTC to 14,454 BTC, followed by a further drop to 11,347 BTC on May 19. Similar to the inflow trend, the outflow volumes increased on May 20 to 36,468 BTC and slightly decreased to 38,027 BTC on May 21.

Before the price surge, from May 15 to May 19, Bitcoin’s price remained relatively stable with minor fluctuations. During this period, the net transfer volume generally leaned towards outflows, indicating holders’ reluctance to move assets into exchanges, possibly anticipating a price rise. The price surge and its aftermath on May 20 and 21 led to a notable change in investor behavior.

On May 20, Bitcoin’s price surged to $71,409, leading to the increased transfer volume to exchanges (33,484 BTC) and a high spot buying volume (72,971 BTC). However,…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…