Monitoring the percentage of Bitcoin’s supply in profit offers crucial insights into market trends and potential movements. This metric calculates the proportion of existing Bitcoins currently held at a value higher than their purchase price. Its significance lies in providing a snapshot of overall market profitability, revealing whether most holders are in a state of gain or loss. Spikes in this metric often correlate with market optimism, while drops can indicate increasing pressure to sell, often preceding market downturns.

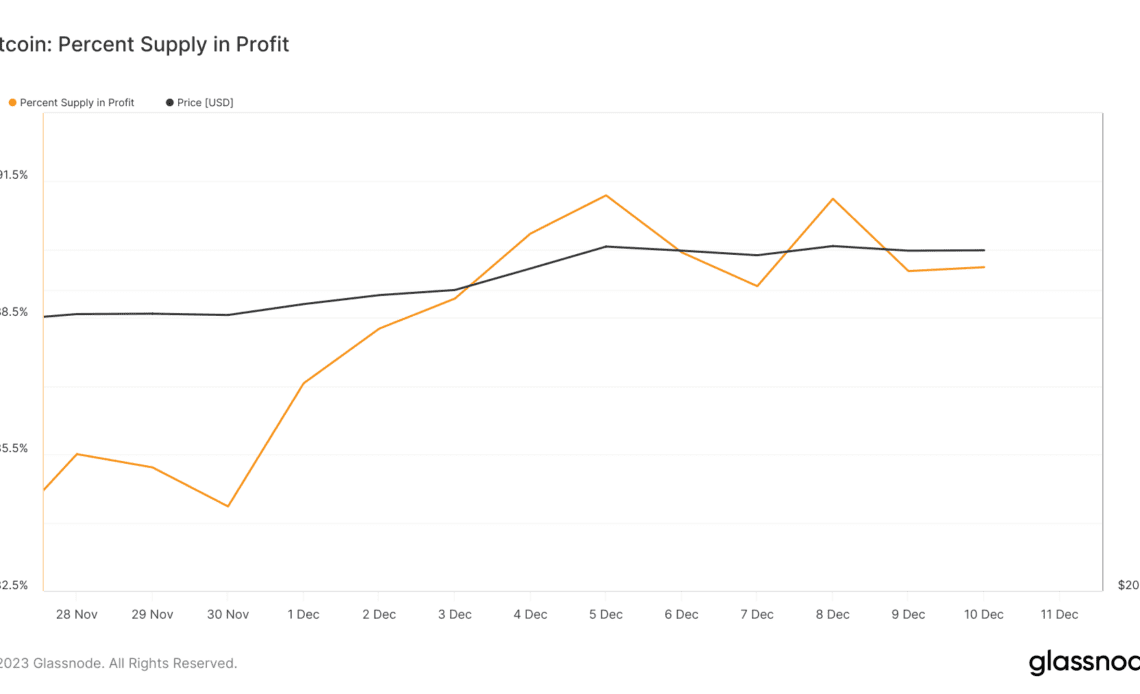

On Dec. 8, 2023, a crucial market milestone was achieved as Bitcoin’s supply in profit exceeded 91.1%, with its price surging over $44,000. This marked a momentous phase of market prosperity unseen since early November 2021. Such a high percentage of Bitcoin in profit typically signals a widespread bullish sentiment, as most investors hold assets at a value exceeding their initial investment.

However, this peak was followed by a swift correction over the weekend, with Bitcoin’s price retreating below $42,000. This shift resulted in the supply in profit dwindling to 89.6%, illustrating a substantial profit-taking event in the market. This reduction suggests that traders, possibly anticipating a more dramatic decline, were keen to secure their gains. Such behavior often indicates a market poised at a critical juncture, with investors wary of a potential fall below pivotal psychological levels like $40,000.

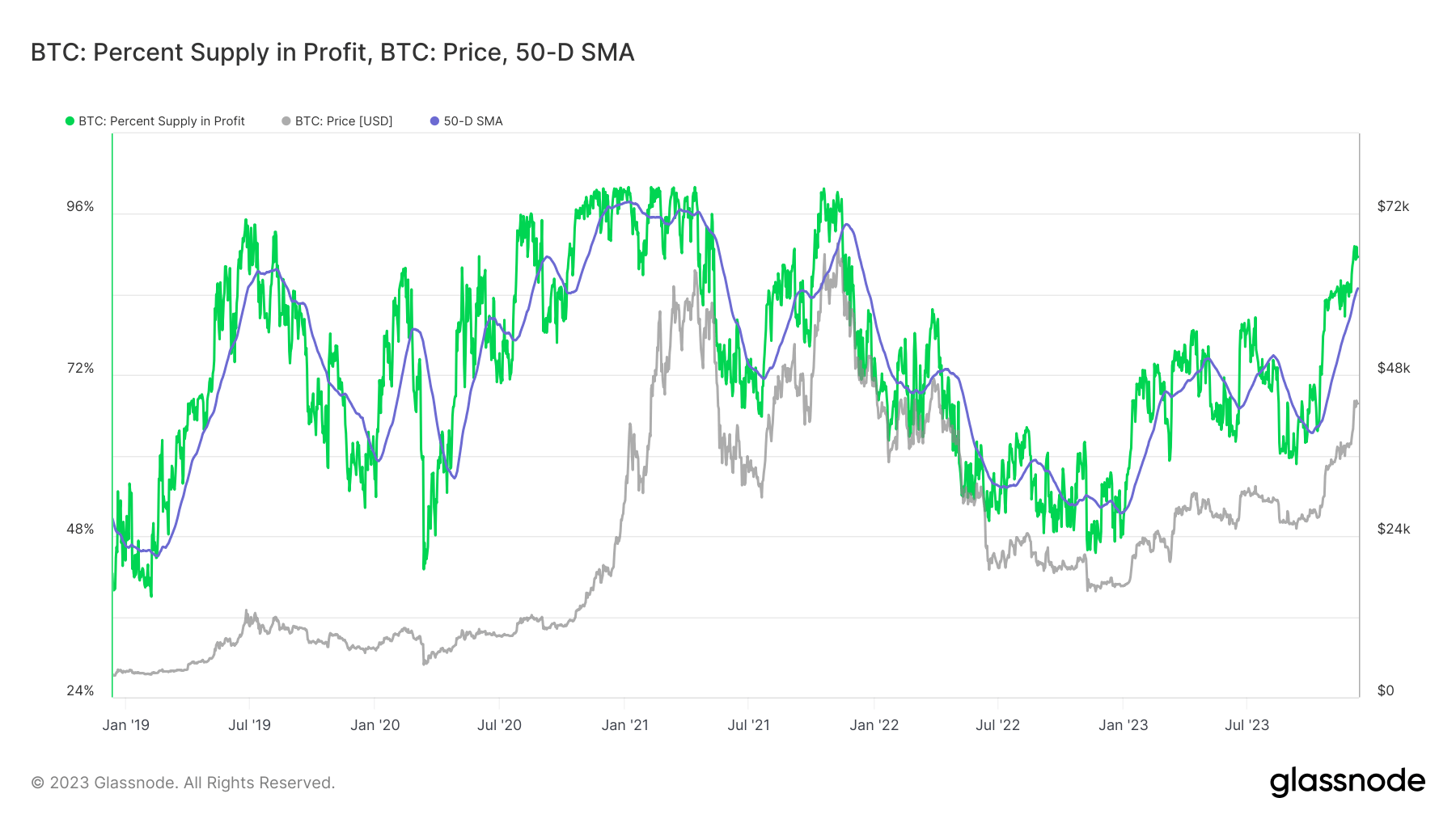

While raw data on Bitcoin’s supply in profit provides immediate insights, it can often be misleading due to its susceptibility to daily market fluctuations. To garner a more accurate and long-term perspective, analyzing the 50-day moving average (MA) of this metric is more instructive. The 50-day MA smooths out short-term volatility, offering a clearer picture of underlying market trends. When the percentage of Bitcoin’s supply in profit consistently hovers above this average, it generally reflects a bullish market sentiment. Conversely, persistently low figures below the MA can hint at bearish trends.

Since early October, the 50-day MA for Bitcoin’s supply in profit has witnessed a marked increase. It rebounded from a low of 63.3% in early October to 84.91% by Dec. 11, after a…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…