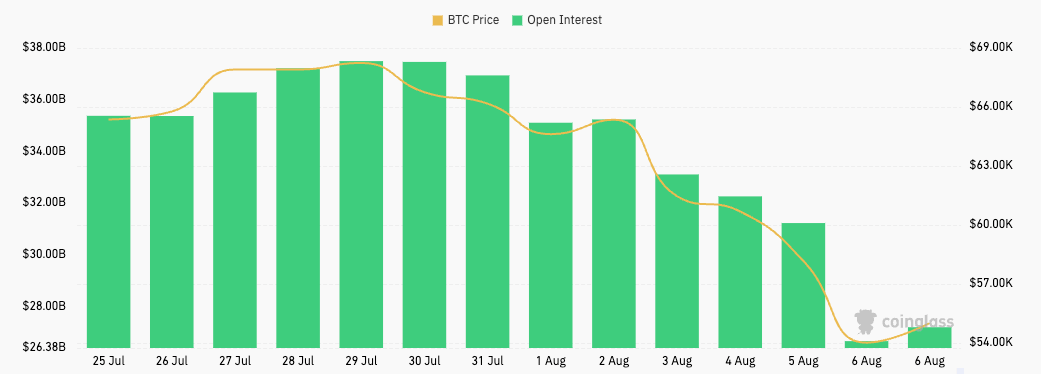

This week’s crash has led to some of the highest losses we’ve seen since the collapse of FTX, wiping out billions from the crypto market. Bitcoin’s drop to below $50,000 dramatically affected the futures market, with futures open interest plunging from $31.22 billion on Aug. 5 to $26.65 billion on Aug. 6.

Such a sharp drop in just 24 hours was most likely caused by forced liquidations of futures positions due to margin calls. When Bitcoin’s price drops below critical levels needed to maintain collateral, it usually triggers a cascade of liquidations, and over-leveraged traders have their positions forcibly closed.

The wipeout in futures open interest we’ve seen this week shows that a significant number of traders were betting on Bitcoin’s continued rise and were caught off guard by the sudden downturn, leading to a massive reduction in leveraged positions.

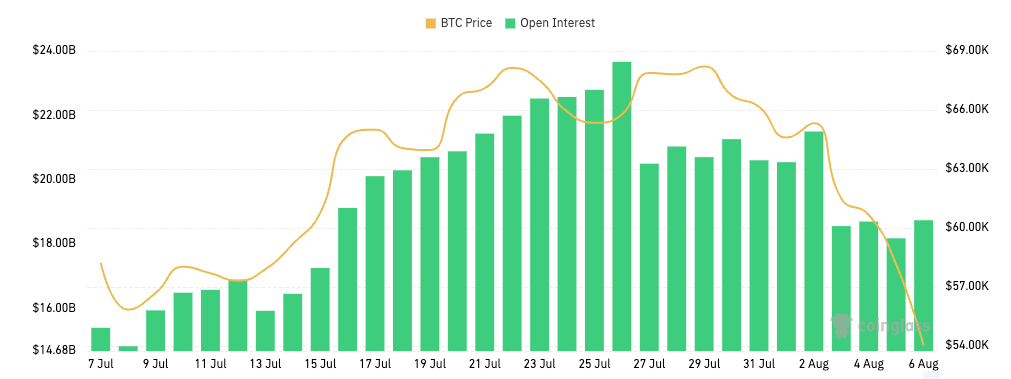

On the other hand, the options market remained relatively stable during the price downturn. Options open interest remained almost flat, fluctuating slightly around $18 billion during the weekend.

Unlike futures, options don’t involve margin calls that can force positions to close immediately. Instead, they give traders the right, but not the obligation, to buy or sell BTC at a predetermined price. This inherent characteristic enables options traders to hold onto their positions without the immediate risk of liquidation, even during periods of extreme price volatility.

However, it’s highly unlikely that the stability in options OI we’ve seen over the past few days was due to traders holding onto their positions.

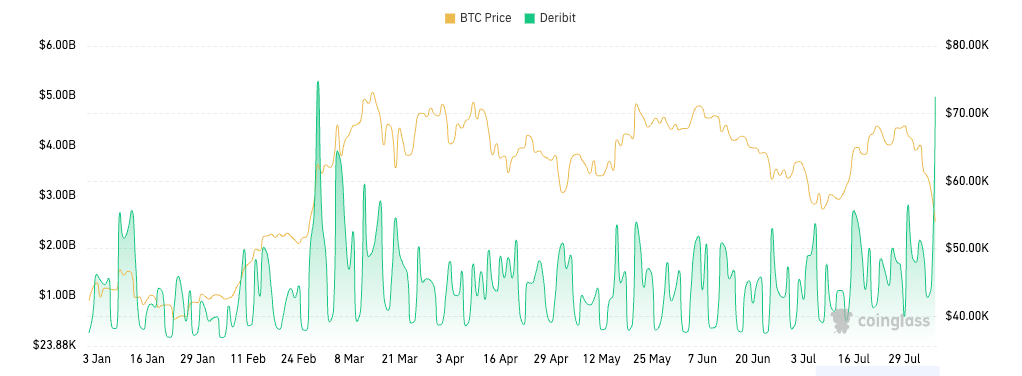

Options trading volume on Deribit surged from $1.22 billion on Aug. 5 to $4.98 billion on Aug. 6. This is the second-highest options volume ever recorded, topped only by the $5.30 billion in volume the market saw on Feb. 29 this year.

Such a high spike in volume indicates heightened trading activity, where traders are actively engaging in the market. Several factors could have contributed to this phenomenon where open interest remains stable while trading volume increases.

Firstly, during periods of high volatility, traders enter and exit positions more frequently, which means opening new contracts and closing…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…