Bitcoin (BTC) bears have been in control since Nov. 11, subduing BTC price below $17,000 on every 12-hour candle. On Nov. 28, a drop to $16,000 shattered bulls’ hope that the 7% gains between Nov. 21 and Nov. 24 were enough to mark a cycle low at $15,500.

The most likely culprit was an unexpected transfer of 127,000 BTC from a Binance cold wallet on Nov. 28. The huge Bitcoin transaction immediately triggered fear, uncertainty and doubt, but the Binance CEO, Changpeng Zhao, subsequently announced it was part of an auditing process.

Regulatory pressure has also been limiting BTC’s upside after reports on Nov. 25 showed that cryptocurrency lending firm Genesis Global Capital and other crypto firms were under investigation by securities regulators in the United States. Joseph Borg, director of the Alabama Securities Commission, confirmed that its state and several other states are investigating Genesis’ alleged ties to securities laws violation.

On Nov. 16, Genesis announced it had temporarily suspended withdrawals, citing “unprecedented market turmoil.” Genesis also hired restructuring advisers to explore all possible options, including but not limited to a potential bankruptcy, as reported by Cointelegraph on Nov. 23.

Let’s look at derivatives metrics to better understand how professional traders are positioned in the current market conditions.

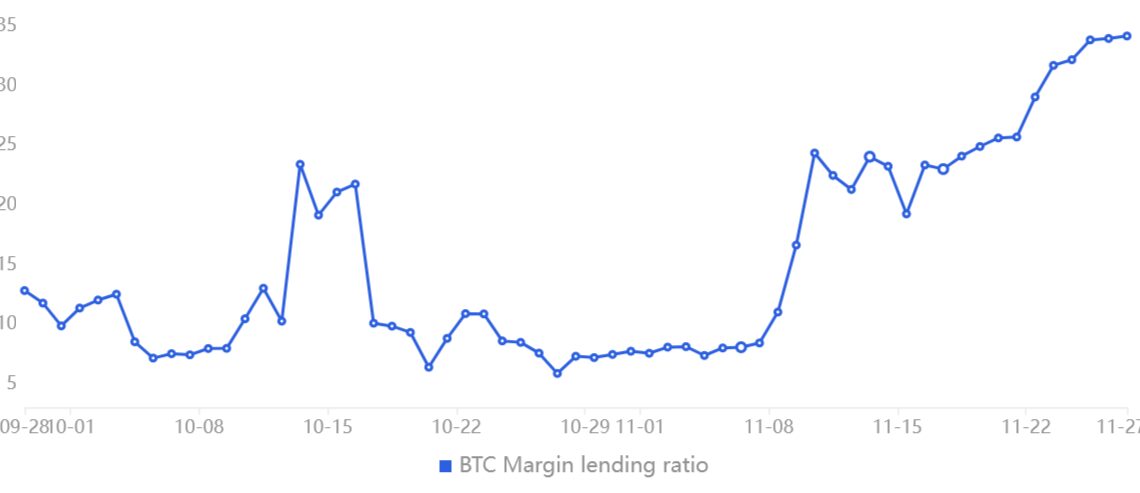

Margin markets show leverage longs at a 3-month high

Margin markets provide insight into how professional traders are positioned because it allows investors to borrow cryptocurrency to leverage their positions.

For instance, one can increase exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only short the cryptocurrency as they bet on its price declining. Unlike futures contracts, the balance between margin longs and shorts isn’t always matched.

The above chart shows that OKX traders’ margin lending ratio increased from Nov. 20 to Nov. 27, signaling that professional traders increased their leverage longs during the 6% dip toward $15,500. Presently at 34, the metric favors stablecoin borrowing by a wide margin — the highest in three months — indicating traders have kept their bullish positions.

Leverage buyers ignored the recent dip to $15,500

The long-to-short metric excludes externalities that might have solely impacted the margin markets. In addition, it gathers data from exchange clients’ positions on the spot, perpetual…

Click Here to Read the Full Original Article at Cointelegraph.com News…