2022 was a near-unprecedented year of extremes and black swan events for the crypto market, and now that the year is about to wrap up, analysts are reflecting on the lessons learned and attempting to identify the trends which may point to bullish price action in 2023.

The collapse of Terra Luna, Three Arrows Capital and FTX created a credit crunch, a severe reduction in capital inflows and an increased threat that additional major centralized exchanges could collapse.

Despite the severity of the market downturn, a few positives have emerged. Data shows long-term hodlers and smaller-sized wallets are actively accumulating during this period of low volatility.

While the market continues to see red, positives are emerging.

Let’s dive in on the positive and negative data points.

Low liquidity and losses abound

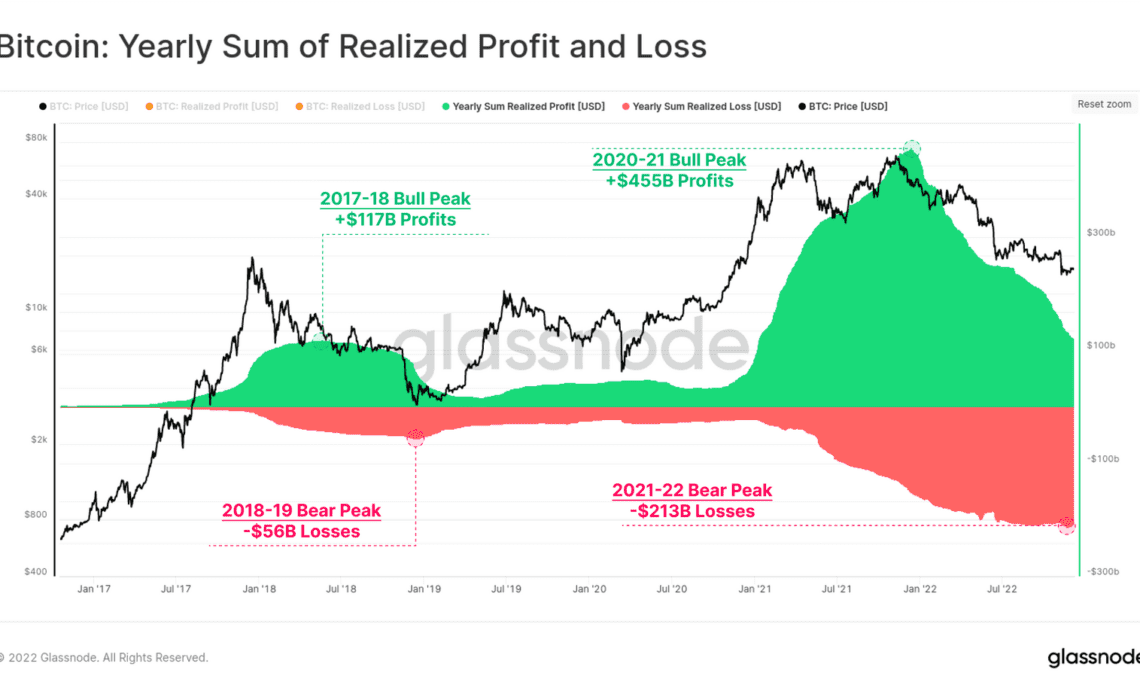

When liquidity was flooding into the market in November 2021, BTC price hit an all-time high and investors realized $455 billion in profits. Conversely, as liquidity tightened in what many investors hoped were the darkest days of the bear market, $213 billion in realized losses led to investors giving back 46.8% of the peak bull market profits. The magnitude of the profits versus realized losses is similar to the 2018 bear where the ratio retraction from gains hit 47.9%.

In the thread below, Cumberland, a major liquidity provider within the crypto sector, highlighted the liquidity challenges facing the market.

There are plenty of sources of concern for market participants – volumes and liquidity have dried up and are, by various metrics, on the lows of the year. While this could be a holiday phenomenon, sentiment is dark –

— Cumberland (@CumberlandSays) December 12, 2022

According to Cumberland, the limited liquidity is a result of large-scale capitulations, leaving bankrupt firms with no remaining coins to sell.

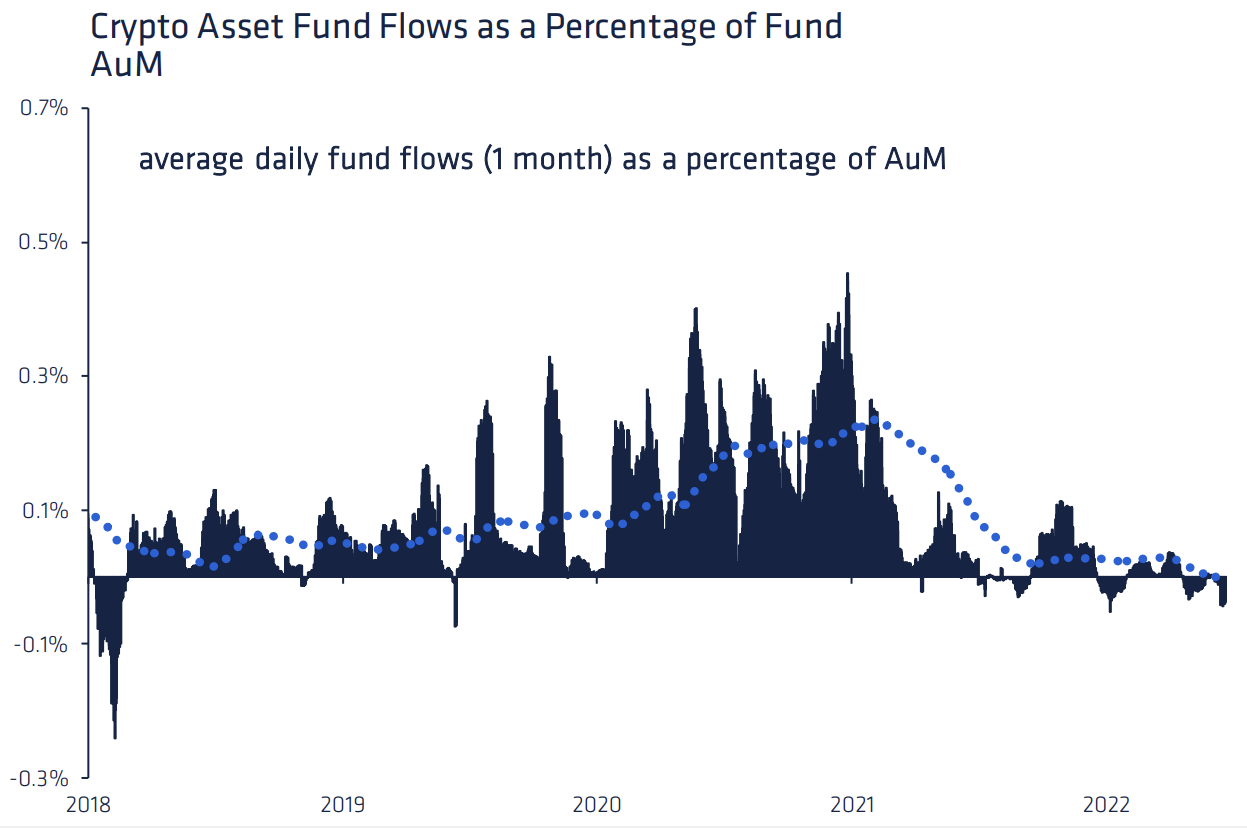

CoinShares analysis of weekly fund flows also showed CoinShares trading volumes reaching a new 2-year low of $677 million for the week. The low trading volumes are coupled with crypto funds flowing out of digital assets, further hampering potential upside.

Historically, centralized exchanges have been a source for fiat onboarding which helps bring more capital into the crypto asset space. Due to regulatory concerns and CEX fears, bringing in new funds has become challenging.

While the above data is very…

Click Here to Read the Full Original Article at Cointelegraph.com News…