Bitcoin (BTC) has been lingering above $20,000 for the past 9 days, but worsening conditions from traditional markets are causing traders to doubt if the resistance will hold.

On Nov. 3, the Bank of England raised interest rates by 75 basis points to 3%, its largest single hike since 1989. The risks of a prolonged recession also increased as the monetary policy committee struggled to contain inflationary pressure.

The U.K. monetary authority noted that its most recent growth and inflation projections present a “very challenging” outlook for the economy. The statement from the committee added that “high energy prices and tighter financial conditions weigh on spending,” thus negatively pressuring the employment data.

The U.S. Federal Reserve also hiked interest rates on Nov. 2, the fourth consecutive raise, which brings rates to the highest levels since January 2008. The confirmation of a conservative approach from central banks can partially explain why Bitcoin failed to break the $21,000 resistance on Oct. 29 and has since declined by 4.5%.

Let’s take a look at derivatives metrics to better understand how professional traders are positioned in the current market conditions.

Options traders are not particularly bullish

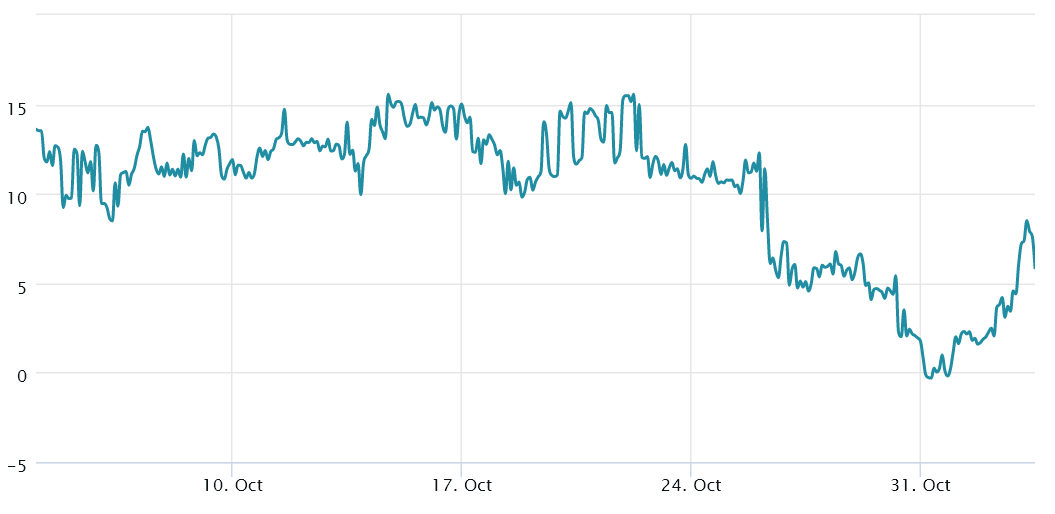

The 25% delta skew is a telling sign of when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 10%. On the other hand, bullish markets tend to drive the skew indicator below negative 10%, meaning the bearish put options are discounted.

The delta skew had been above the 10% threshold until Oct. 26, signaling that options traders were less inclined to offer downside protection. A more balanced situation emerged, but the $21,000 resistance test on Oct. 29 was not enough to instill confidence in option traders.

Currently, the 60-day delta skew stands at 6%, so whales and market makers are pricing similar odds of rallies and price dumps. However, other data is showing low confidence as BTC approaches the $20,000 support.

Leverage buyers ignored the recent rally

The long-to-short metric excludes externalities that might have solely impacted the options markets. It also gathers data from exchange clients’ positions on the spot, perpetual and quarterly futures contracts, thus better informing on how professional traders are positioned.

There are occasional…

Click Here to Read the Full Original Article at Cointelegraph.com News…