On-chain data suggests the Bitcoin whales have been showing different behavior regarding exchange inflows from the last cycle. Here’s why this may be so.

Bitcoin Whales Are Showing Different Behavior In Exchange Inflows This Time

As an analyst explained in a CryptoQuant Quicktake post, the BTC whales’ movements have been different this time compared to the previous cycle.

The indicator of interest here is the “exchange inflow,” which tracks the total amount of Bitcoin being transferred to wallets attached to all centralized exchanges. In the context of the current discussion, derivative platforms are specifically of interest.

When this metric’s value is high, it means that investors are depositing large amounts on these exchanges. Such a trend usually suggests a high demand for the services these derivative exchanges provide.

Generally, extraordinary spikes in the indicator are associated with whale movements, given that only these humongous holders can cause such large shifts.

On the other hand, when the metric has a low value, it suggests that the whales aren’t depositing anything significant to these platforms, a possible sign that they don’t want to take risks on the derivative side.

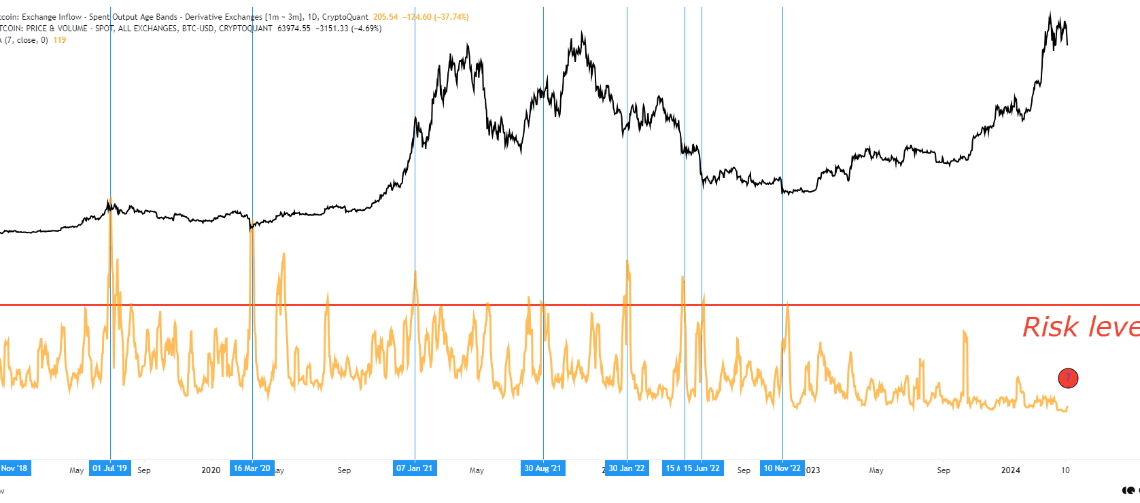

Now, here is the chart shared by the quant, which shows the data for the Bitcoin exchange inflow for derivative exchanges:

The value of the metric seems to have been relatively low in recent days | Source: CryptoQuant

The indicator in the above graph also has another condition attached: it only tracks the inflows coming from the whales that had been holding for at least 1 month and at most 3 months.

These would be the newbie whales in the market, but not quite so new that they have only bought (those with a holding time of less than 1 month). Restricting this time range also excludes the data of the traders who make a high amount of moves in short timeframes on average.

As the analyst has highlighted in the chart, the whales in this group have usually made large inflows to derivative platforms around notable cryptocurrency tops and bottoms, when speculation is at its height.

Interestingly, though, the cryptocurrency has witnessed no such large inflow spikes this year even though the asset has broken past the previous all-time high (ATH).

One explanation may be that the whales are not interested in making any real moves right now. However, a more likely reason may be that spot exchange-traded funds (ETFs) exist now.

The spot…

Click Here to Read the Full Original Article at NewsBTC…