On-chain data shows Bitcoin whales have sold $2.2 billion worth of BTC in the past week, but price has continued to hold strong so far.

Bitcoin Whales Have Distributed Around 50,000 BTC In Past Week

As pointed out by an analyst in a post on X, the BTC whales have been participating in some selling over the past week. The relevant indicator here is the “Supply Distribution” metric from the on-chain analytics firm Santiment, which tells us about the total amount of Bitcoin that the different investor groups are carrying in their combined wallets currently.

In the context of the current discussion, “whale” entities are of interest. These humongous investors are typically defined to be the addresses who carry between 1,000 to 10,000 BTC.

At the current exchange rate of the asset, this range converts to about $43.8 million at the lower end and $438 million at the upper limit. Due to the sheer scale of their holdings, the whales can carry some influence, and therefore, they can be entities worth tracking on the blockchain.

Now, here is a chart that shows the trend in the Bitcoin Supply Distribution specifically for these large holders over the past month:

The value of the indicator appears to have plunged in recent days | Source: @ali_charts on X

As displayed in the above graph, the supply held by the Bitcoin whales has been showing a decline in the past week, after remaining stagnant for the preceding few weeks.

Most of the selling had come while BTC was still trading at the recent lows, suggesting that these were whales who had been panicking after BTC had failed its recovery run towards $44,000.

In total, these humongous investors have shed about 50,000 BTC from their combined wallets during this latest selloff, which is worth almost $2.2 billion right now.

Despite this selling, Bitcoin has gone on to hit another local bottom and make a recovery push again, this time actually making a retest of the $44,000 level (although the asset has slumped again since then, as it’s now trading below the mark once more).

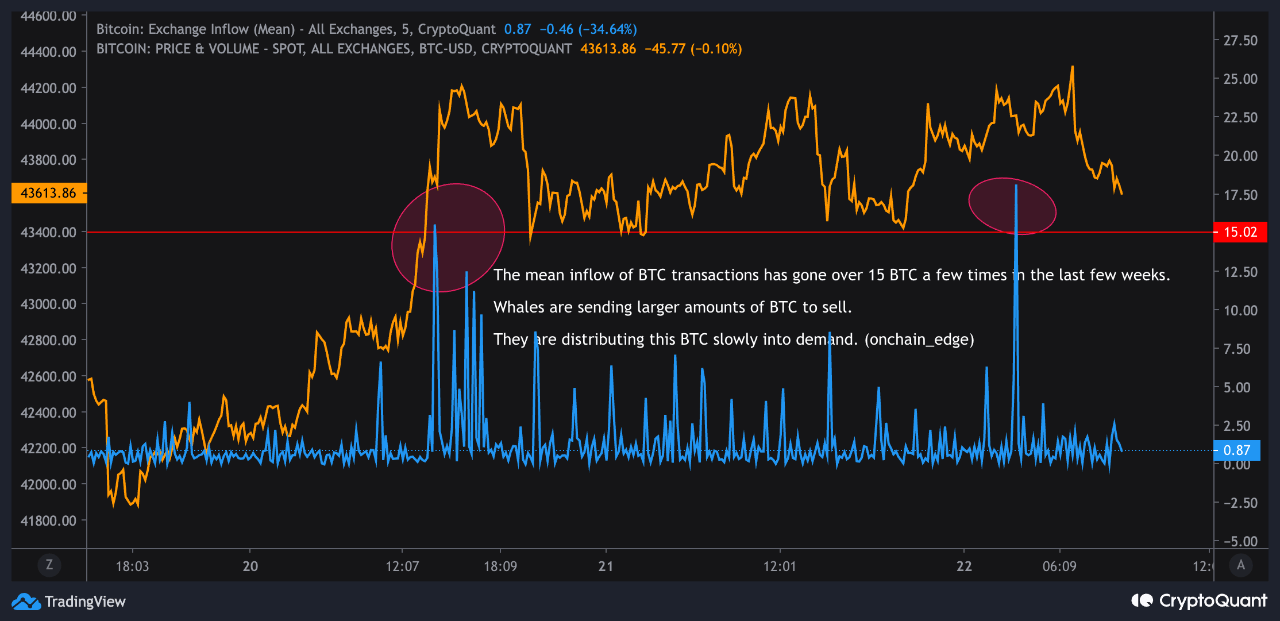

Another analyst has also given a whale selling alert in a CryptoQuant Quicktake post, citing the data for the “exchange inflow mean,” which is an indicator that measures the mean amount of Bitcoin that’s being transferred to centralized exchanges.

Looks like the value of the metric has been quite high recently | Source: CryptoQuant

Exchange inflows can be a sign of selling as investors generally use these…

Click Here to Read the Full Original Article at NewsBTC…