Bitcoin’s stint at its new all-time high of $108,200 was short-lived. In less than a week, its price dropped by over 12%, reaching $95,000 on Dec. 23.

While pullbacks ranging from 20% to as high as 30% are commonplace dulling bull rallies, this price reversal was accompanied by a cascade of long liquidations, which further amplified the downward price pressure over the weekend.

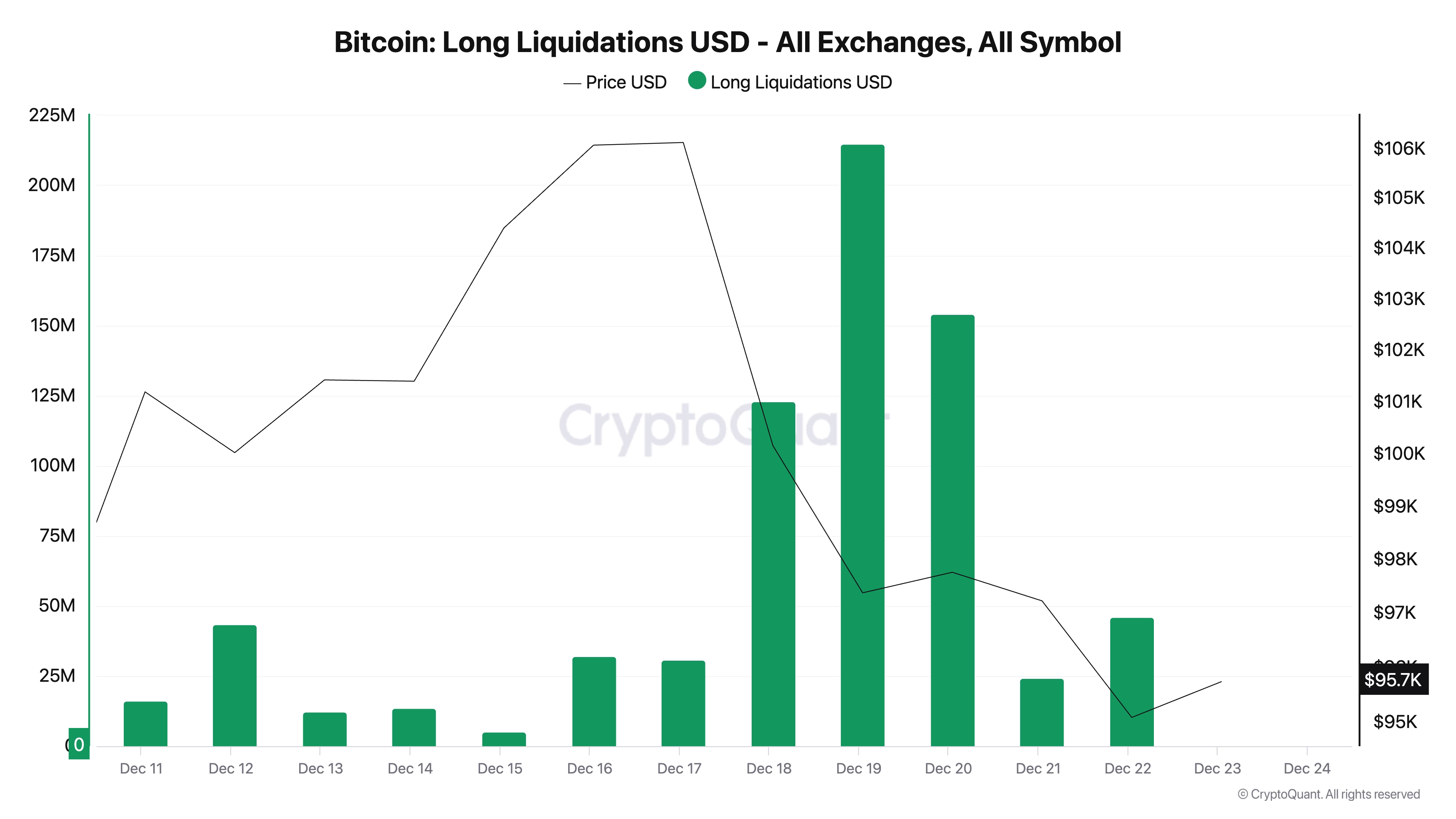

Between Dec. 17 and Dec. 22, over $540 million in long positions were liquidated across exchanges. The largest single day for liquidations was Dec. 19, when approximately $214 million in longs were wiped out.

The number of liquidations we’ve seen in the past week shows the risks of overleveraged trading. As soon as BTC began to retrace from its ATH, traders with high-leverage long positions were forced to close their positions as their margin levels were quickly breached. These forced liquidations added to the selling pressure, accelerating Bitcoin’s decline below the key psychological support of $100,000.

Long liquidations occur when the price of an asset drops below a trader’s liquidation threshold, often set by the level of leverage they use. The more leverage, the smaller the price movement needed to trigger a liquidation.

In this case, Bitcoin’s steep drop triggered a wave of liquidations as the market deleveraged. The Federal Reserve’s tighter monetary policy likely contributed to the sell-off by dampening investor sentiment and increasing market volatility. Once Bitcoin failed to maintain its price above $100,000, the subsequent liquidation cascade turned what might have been a controlled pullback into a sharper decline.

While long liquidations dominated during the price drop, it’s also important to analyze the earlier spike in short liquidations that occurred on Dec. 16, just as Bitcoin was approaching its all-time high. That day, approximately $120 million in short positions were liquidated as Bitcoin surged toward $108,200.

This move invalidated bearish bets made by traders who expected the rally to falter. The rapid price increase triggered a short squeeze, forcing traders to close their positions by buying Bitcoin, which in turn added upward pressure on the price.

The contrast between longs and shorts shows the role leverage plays in shaping price…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…