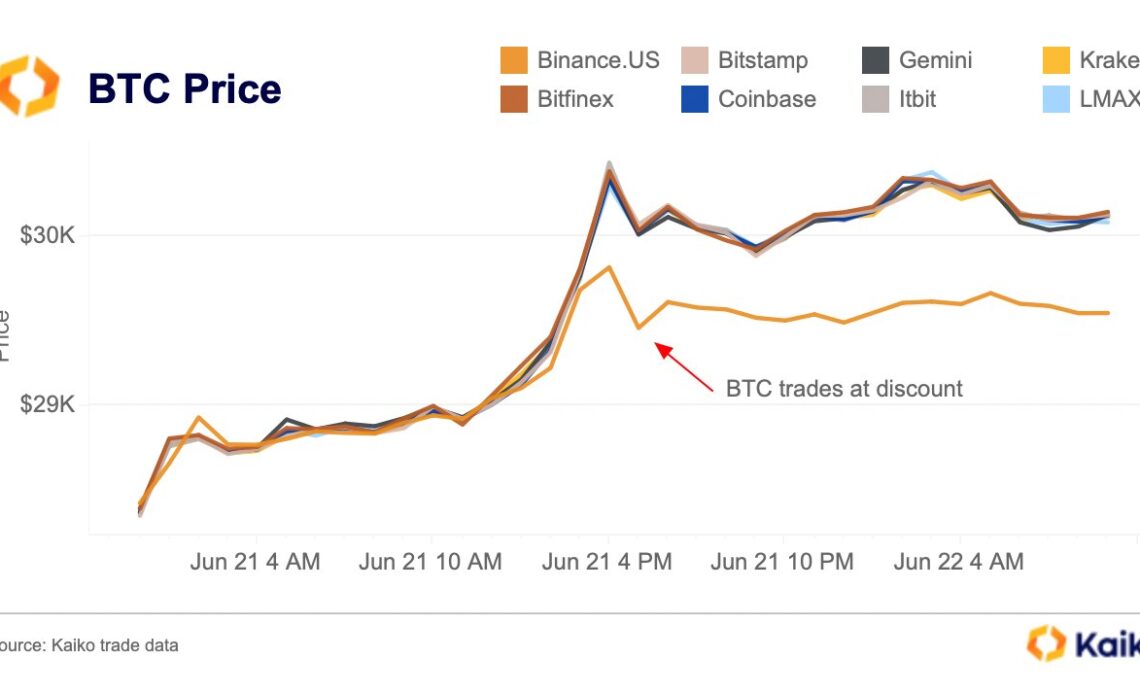

Bitcoin is trading at a “heavy discount” on Binance.US, presenting a significant arbitrage opportunity for traders, according to Kaiko data.

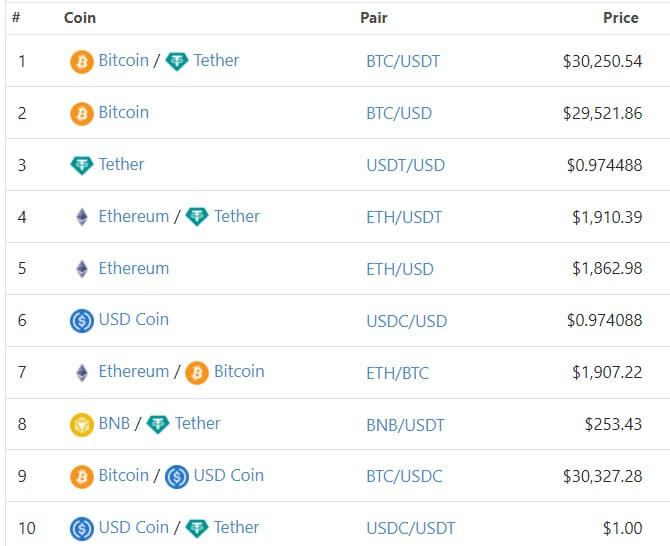

Data from Cryptocompare corroborates the above. The flagship digital asset is trading for $29,523 on Binance.US, or $500 lower than on major rivals like Coinbase, Kraken, BitStamp, and others.

Meanwhile, it should be noted that this discount is only present on assets paired with the USD as those paired with stablecoins like USDT and USDC are trading at regular prices, according to data from Coingecko.

Binance.US has experienced serious USD liquidity issues since its banking partners decided to halt their payment channels. This has led to an outflow of fiat currency from the platform amid its transition to a “crypto-only” exchange.

Bitcoin price fluctuates on Binance.US

Since the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the exchange on June 5, Binance US has experienced price swings for BTC trades on its platform.

Between June 6 and 8, Kaiko reported that BTC traded at a 2.5% premium on the exchange because of an illiquid market.

On June 12, BTC traded at a 1% premium on Binance.US after the exchange’s market depth dropped by 78% within a week of the U.S. SEC’s lawsuit.

Data from the exchange further shows that the BTC flash pumped to over $138,000 during the early trading hours of June 21.

Binance regulatory woes

Binance.US’s issues are linked to the troubles of its parent company, Binance, which is facing lawsuits from both the SEC and CFTC in the U.S.

Meanwhile, these challenges are not confined to the U.S. alone, as it has exited three European markets, including the United Kingdom, Netherlands, and Cyprus, within the past week.

Additionally, the exchange was forced to issue a cease-and-desist letter to an unaffiliated scam entity, “Binance Nigeria Limited,” declared illegal by the Nigerian Securities and Exchange Commission.

The post Bitcoin trades at $500 discount on Binance.US amid liquidity crisis appeared first on CryptoSlate.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…