Key points:

-

Failure to reclaim $120,00 could spell trouble for Bitcoin bulls.

-

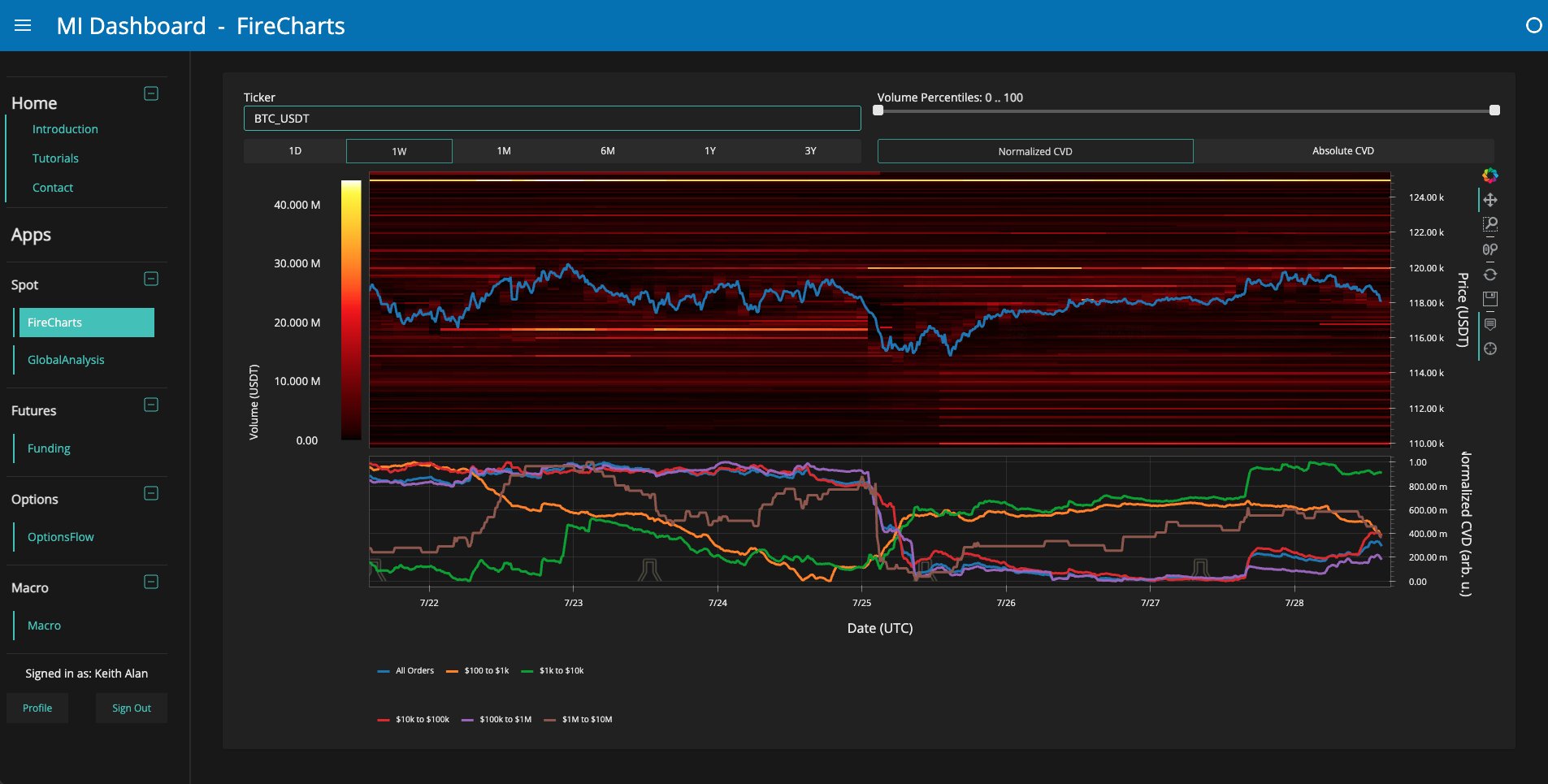

Whales appear to be offloading at local highs, creating further hurdles to price upside.

-

Short-term holder cost bases feature as local support lines of interest.

Bitcoin (BTC) gave up attempts to crack $120,000 at Tuesday’s Wall Street open as traders stayed split on market strength.

Bitcoin price weakness sparks sub-$110,000 targets

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD returning below $117,500, now under its daily open.

The pair had managed to reach $119,000 earlier in the day, despite signs of fresh BTC sales by asset manager Galaxy Digital.

US sellers subsequently stepped in, and commenting on the current market setup, many traders warned that any downside could snowball quickly.

$BTC thinking we about to start the C wave here to $111,000 https://t.co/2NoeP8dKCh pic.twitter.com/Mef2wsKqFD

— BigMike7335 (@Michael_EWpro) July 29, 2025

“We’ve got bear divs, everyone expects up, would make more sense to push down before a potential move higher,” popular trader Roman wrote in part of his latest analysis on X, having earlier given a downside target of $108,000.

Trading resource Material Indicators likewise saw the potential for new lows, warning that whales were distributing.

“If $116,750 doesn’t hold, the $110k range may come into focus quickly,” it told X followers Monday.

“Looks to be a clean triple tap developing on $BTC here,” trader Credible Crypto added, describing the area around $15,700 as being key to hold.

Profit-taking still offers “very positive signs”

Tuesday’s US job openings helped shore up the bull case for risk assets and crypto.

Related: ‘Biggest trade deal ever’ — 5 things to know in Bitcoin this week

In one of its “Quicktake” blog posts, analytics platform CryptoQuant also flagged improving consumer confidence data as a reason for optimism.

“Today’s JOLTS data, coming in slightly below expectations, provided a ‘not too hot, not too cold’ signal for the markets. This creates a positive environment for risk assets,” it summarized.

“Additionally, the better than expected Consumer Confidence data signals a reversal after a 6 month decline, showing growing investor optimism about the future.”

CryptoQuant argued that…

Click Here to Read the Full Original Article at Cointelegraph.com News…