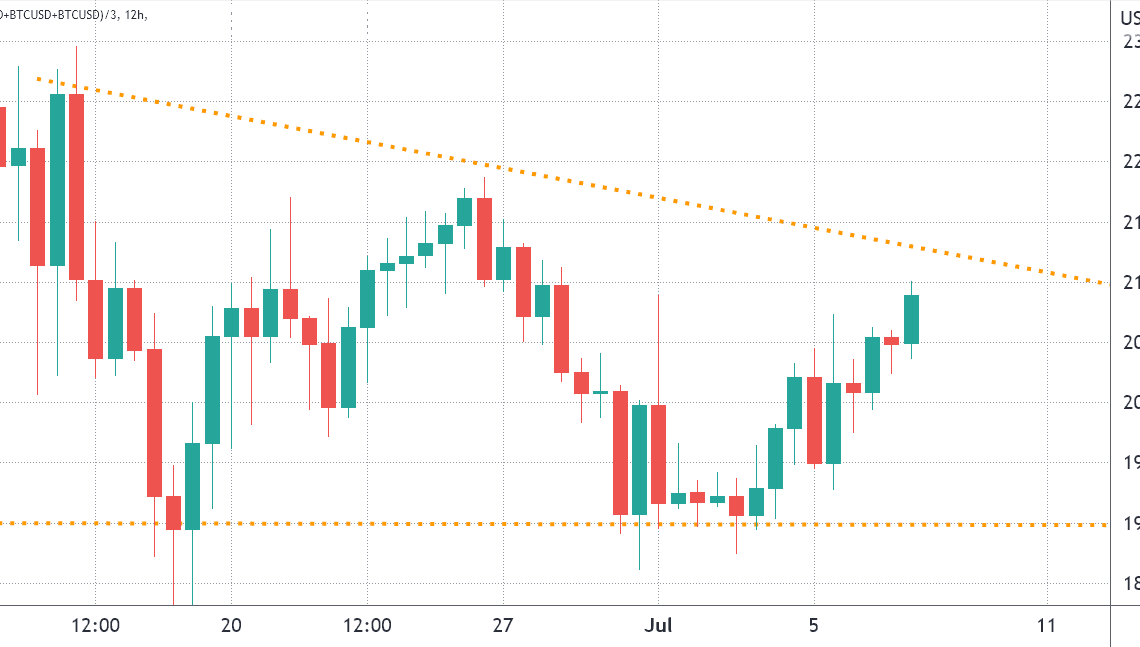

A descending triangle pattern has been pressuring Bitcoin (BTC) for the past three weeks and while some traders cite this as a bullish reversal pattern, the $19,000 support remains a crucial level to determine the bulls’ fate.

Despite the apparent lack of a clear price bottom, Bitcoin derivatives metrics have significantly improved since June 30 and positive news from global asset manager VanEck may have eased traders’ sentiment.

On July 5, two retirement funds in the U.S. state of Virginia announced a $35 million commitment to VanEck’s cryptocurrency-focused investment fund.

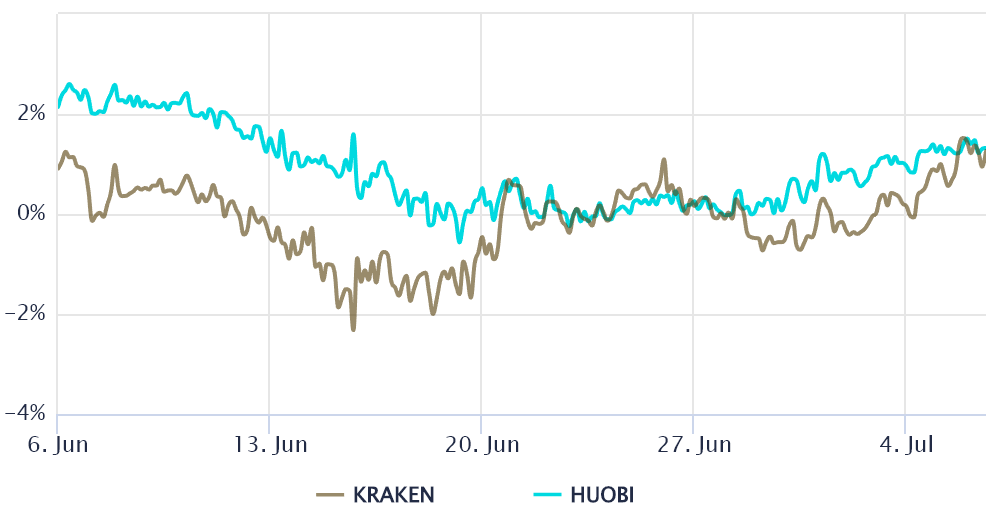

On the same day a Huobi exchange subsidiary received its money services business (MSB) license from the United States Financial Crimes Enforcement Network (FinCEN). The Seychelles-based company stated that the license creates a foundation for expanding crypto-related business in the U.S.

A bit of positive news came out on July 7 as decentralized finance staking and lending platform Celsius Network announced that it had fully repaid its outstanding debt to Maker (MKR) protocol.

Celsius is among several crypto yield platforms on the brink of insolvency after historic losses across multiple positions. Forced sales on leveraged positions by exchanges and decentralized finance (DeFi) applications accelerated the recent cryptocurrency price crash.

Currently, traders face mixed sentiment between possible contagion impacts and their optimism that the $19,000 support is gaining strength. For this reason, analyzing derivatives data is essential to understand whether investors are pricing higher odds of a market downturn.

Bitcoin futures premium flips slightly positive

Retail traders usually avoid quarterly futures due to their fixed settlement date and price difference from spot markets. However, the contracts’ biggest advantage is the lack of a fluctuating funding rate; hence, the prevalence of arbitrage desks and professional traders.

These fixed-month contracts tend to trade at a slight premium to spot markets as sellers request more money to withhold settlement longer. This situation is technically known as “contango” and is not exclusive to crypto markets. Thus, futures should trade at a 5% to 10% annualized premium in healthy markets.

Bitcoin annualized futures’ premium went negative on June 28, indicating low demand from leverage buyers. Yet, the bearish structure did not hold for long…

Click Here to Read the Full Original Article at Cointelegraph.com News…