Bitcoin (BTC) briefly reached $38,000 on Nov. 24 but faced formidable resistance at the price level. On Nov. 27, Bitcoin price traded below $37,000, which is unchanged from a week ago.

What is eye catching is the unwavering strength of BTC derivatives, which signals that bulls remain steadfast with their intentions.

An intriguing development is unfolding in China as Tether (USDT) trades below its fair value in the local currency, the Yuan. This discrepancy often arises due to differing expectations between professional traders engaged in derivatives and retail clients involved in the spot market.

How have regulations impacted Bitcoin derivatives?

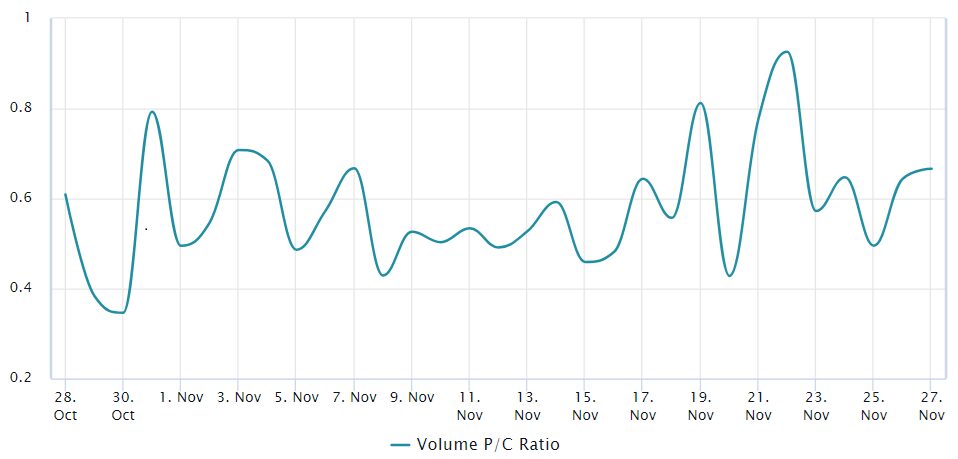

To gauge the exposure of whales and arbitrage desks using Bitcoin derivatives, one must assess BTC options volume. By examining the put (sell) and call (buy) options, we can estimate the prevailing bullish or bearish sentiment.

Since Nov. 22, put options have consistently lagged behind call options in volume, by an average of 40%. This suggests a diminished demand for protective measures—a surprising development given the intensified regulatory scrutiny following Binance’s plewith the U.S. Department of Justice (DoJ) and the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Kraken exchange.

While investors may not foresee disruptions to Binance’s services, the likelihood of further regulatory actions against exchanges serving U.S. clients has surged. Additionally, individuals who previously relied on obscuring their activity might now think twice, as the DoJ gains access to historical transactions.

Furthermore, it’s uncertain whether the arrangement struck by Changpeng “CZ” Zhao with authorities will extend to other unregulated exchanges and payment gateways. In summary, the repercussions of recent regulatory actions remain uncertain, and the prevailing sentiment is pessimistic, with investors fearing additional constraints and potential actions targeting market makers and stablecoin issuers.

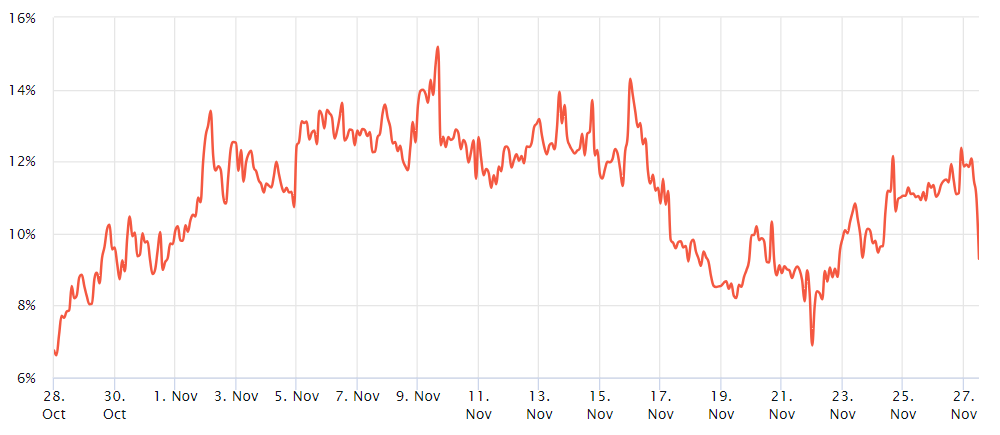

To determine if the Bitcoin options market is an anomaly, let’s examine BTC futures contracts, specifically the monthly ones—preferred by professional traders due to their fixed funding rate in neutral markets. Typically, these instruments trade at a 5% to 10% premium to account for the extended settlement period.

Between Nov. 24 and Nov. 26, the BTC futures premium flirted with…

Click Here to Read the Full Original Article at Cointelegraph.com News…