A popular crypto analyst says that Bitcoin (BTC) remains on track for a massive bull cycle despite last week’s sudden price decline.

Pseudonymous analyst Dave the Wave tells his 139,700 followers on the social media platform X that short-term indicators are not the most reliable predictors for BTC price given the current crypto market conditions.

He says indicators with a broader view of Bitcoin’s price patterns indicate the bull market cycle is continuing to take shape, despite breaking through key support levels on a plunge to the $25,000 range.

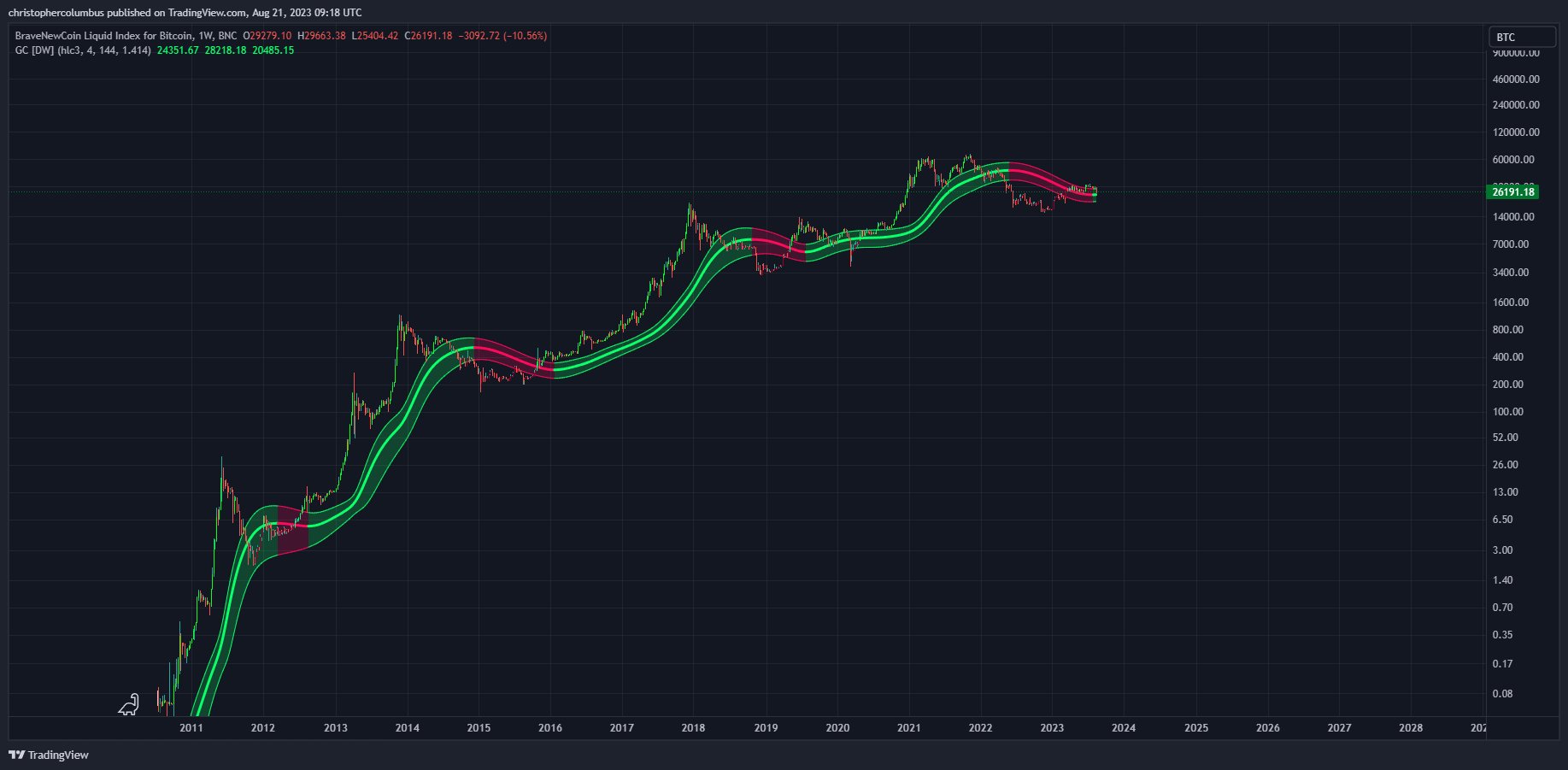

Dave the Wave uses his own version of logarithmic growth curves (LGC), which attempt to forecast Bitcoin’s macro highs and lows while filtering out medium-term volatility and noise, and the Gaussian channels, momentum indicators that can be used to identify price tops and bottoms.

“Beware the shorter-term indicators that might suggest that support for a BTC ‘bull market’ has been lost. Price is right where it should be in terms of the LGC, the Gaussian channel, and in terms of a normal consolidation after a solid run up.”

The analyst continues to believe that the 200-week moving average (MA) is no longer an indicator of a key price support level for Bitcoin.

“As outlined at an earlier date, a BTC metric such as the [200-week MA] becomes less significant as technical support as the market matures.”

He previously said,

“Why would the Bitcoin [200-week MA] remain a support of price?

If the macro trend is one of reducing volatility and diminishing returns, then it would eventually become a *mean* of price… with price oscillating around it.”

The trader also says he is looking for an entry point for the smart contract platform Ethereum (ETH).

Based on the weekly Gaussian, he predicts ETH is on the verge of making a move to the upside.

“Waiting and watching. Weekly Gaussian about to turn up on ETH/ USD. My last position trade turned out…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…