Bitcoin has shown some impressive strength above the $34,000 mark despite a high amount of profit-taking from short-term holders.

Bitcoin Short-Term Holders Are Selling, While Long-Term Holders Are Still Quiet

As explained by analyst James V. Straten in a new post on X, the short-term holders are currently participating in one of the strongest profit-taking events of the past couple of years.

The “short-term holders” (STHs) here refer to all those Bitcoin investors who have been holding onto their coins since less than 155 days ago. This group comprises one of the two main divisions of the BTC market, with the other being called the “long-term holders” (LTHs).

Statistically, the longer an investor keeps their coins dormant, the less likely they become to sell them at any point. Because of this reason, the STHs are generally the weak-minded hands of the sector, while the LTHs are the strong, persistent holders.

Whenever the sector goes through any significant FUD or FOMO, the STHs budge and participate in at least some amount of selling. The LTHs, on the other hand, usually show little reaction.

Since the Bitcoin price has enjoyed a sharp rally recently that has taken its price above the $34,000 level, the STHs would naturally be selling now. One way to track whether this Bitcoin group is selling their coins can be by tracking the volume that they are transferring to exchanges.

In the context of the current discussion, Straten has decided to choose the version of this indicator that specifically tracks the transactions from investors who are in profit, as profit-taking is generally the behavior of focus during rallies. In contrast, loss transactions play a greater role in price slumps.

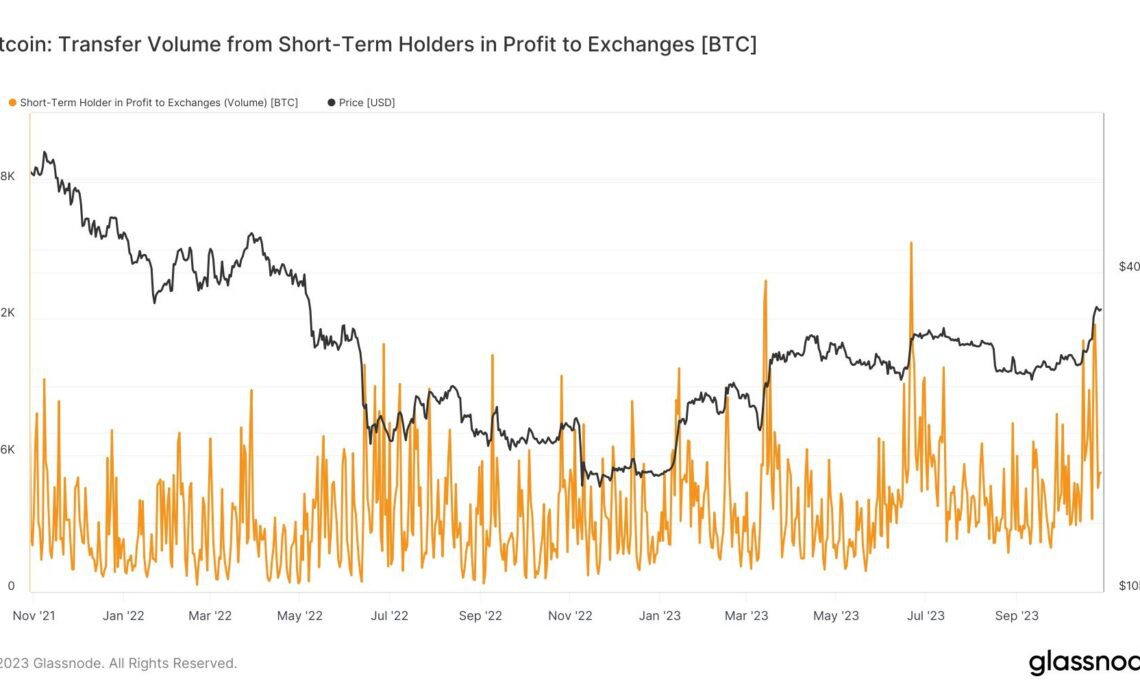

Now, here is a chart that shows the trend in the metric for the Bitcoin STHs over the past two years:

Looks like the value of the metric has been quite high in recent days | Source: @jimmyvs24 on X

As shown in the above graph, the Bitcoin STHs in profit have sent large amounts to these centralized platforms since the latest rally in the asset.

This confirms that these weak hands have been selling recently. As mentioned before, it’s not unusual for such a thing to happen, but the scale of the profit-taking this time around is particularly significant.

From the chart, it’s visible that there have only been a few times in the past couple of years where the STHs in profit have transferred comparable or higher volumes to exchanges….

Click Here to Read the Full Original Article at NewsBTC…