Bitcoin (BTC) has been battered by a relentless bear market over the past month, with its price tumbling 20% from its record highs. However, amidst the carnage, glimmers of hope emerge as prominent analysts predict a potential bottom forming around the current $57,000 mark.

Tough Opening Month For Bitcoin

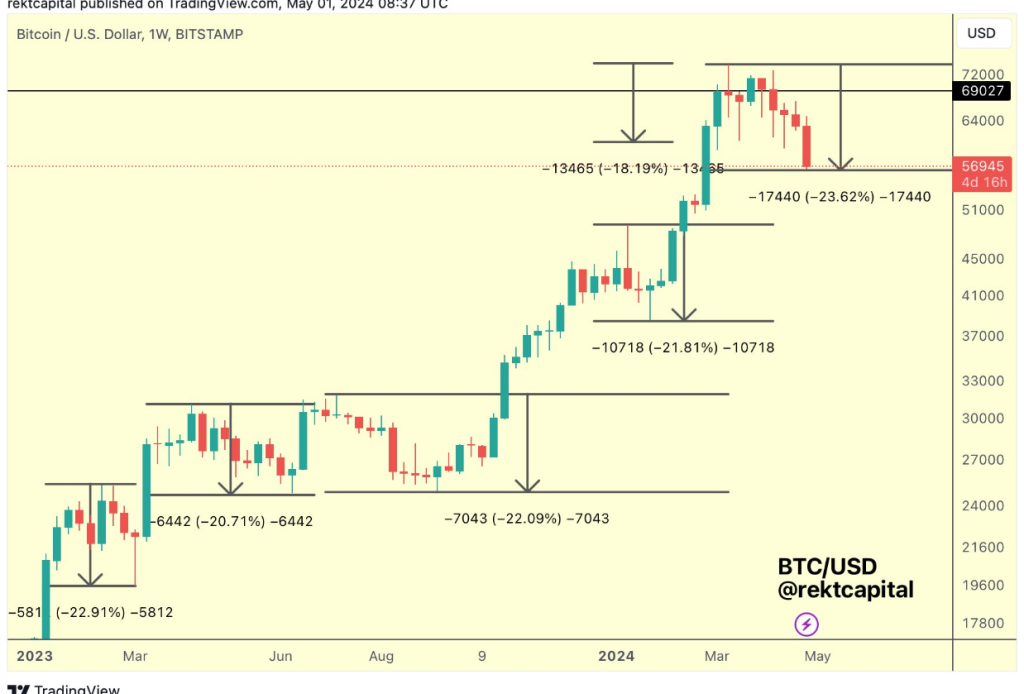

The start of May has not been kind to Bitcoin. The once-dominant cryptocurrency has seen a steady decline, plunging back to levels last witnessed in March before its monumental surge to $73,700. This recent price drop represents the most significant decline of this cycle, raising concerns about a prolonged bear market.

The pain extends beyond Bitcoin, with the broader altcoin market feeling the tremors. Litecoin (LTC), the silver to Bitcoin’s gold, has mirrored the downward trend, shedding a staggering 25% of its value in the past month. While historically seen as a more stable alternative to Bitcoin, Litecoin seems to be tethered to its big brother’s fate in this current downturn.

Finding The Bottom: Bullish Predictions Surface

Despite the prevailing gloom, a chorus of optimism is rising from the crypto analysis community. Several heavyweight analysts believe Bitcoin may have found its footing around the current price range of $56,000 to $58,000.

Rekt Capital, a popular crypto analyst, emphasizes a historical pattern where similar 20% dips have been followed by significant rebounds. Michaël van de Poppe, another well-respected voice, echoes this sentiment, suggesting Bitcoin may be nearing the end of its price consolidation phase. He cautions of potential short-term fluctuations but highlights the $56,000 to $58,000 zone as a crucial support level.

This is officially the deepest retrace in the cycle (-23.6%)$BTC #BitcoinHalving #Bitcoin pic.twitter.com/Gcapbl0Nu6

— Rekt Capital (@rektcapital) May 1, 2024

Uncertainty Looms As Market Awaits Fed Decision

While analyst optimism is a welcome sign, a cloud of uncertainty hangs over the crypto market. The upcoming Federal Reserve decision on interest rates could significantly impact investor sentiment and, consequently, Bitcoin’s price trajectory. A more hawkish stance from the Fed could trigger further selling, while a dovish approach might provide the tailwind needed for a Bitcoin rebound.

Related Reading: Ethereum Fees Dive: Will This Spark A Surge In Network Activity?

Buckle Up For A Bumpy Ride

The next few weeks will be crucial for Bitcoin and the broader…

Click Here to Read the Full Original Article at NewsBTC…