Bitcoin (BTC) held crucial $16,000 support into Nov. 29 as bulls weathered ongoing FTX fallout and macro triggers.

Trader teases BTC long as $16,500 reappears

Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD leaving lower levels untouched overnight.

The pair had seen a flash downturn after the Nov. 27 weekly close thanks to uncertainty from China over Coronavirus measures.

A recovery nonetheless took the market higher, with $16,500 coming into play at the time of writing.

As Cointelegraph reported, traders and analysts had warned that it was all but essential to preserve current support, with a violation opening up the road to $14,000 or lower.

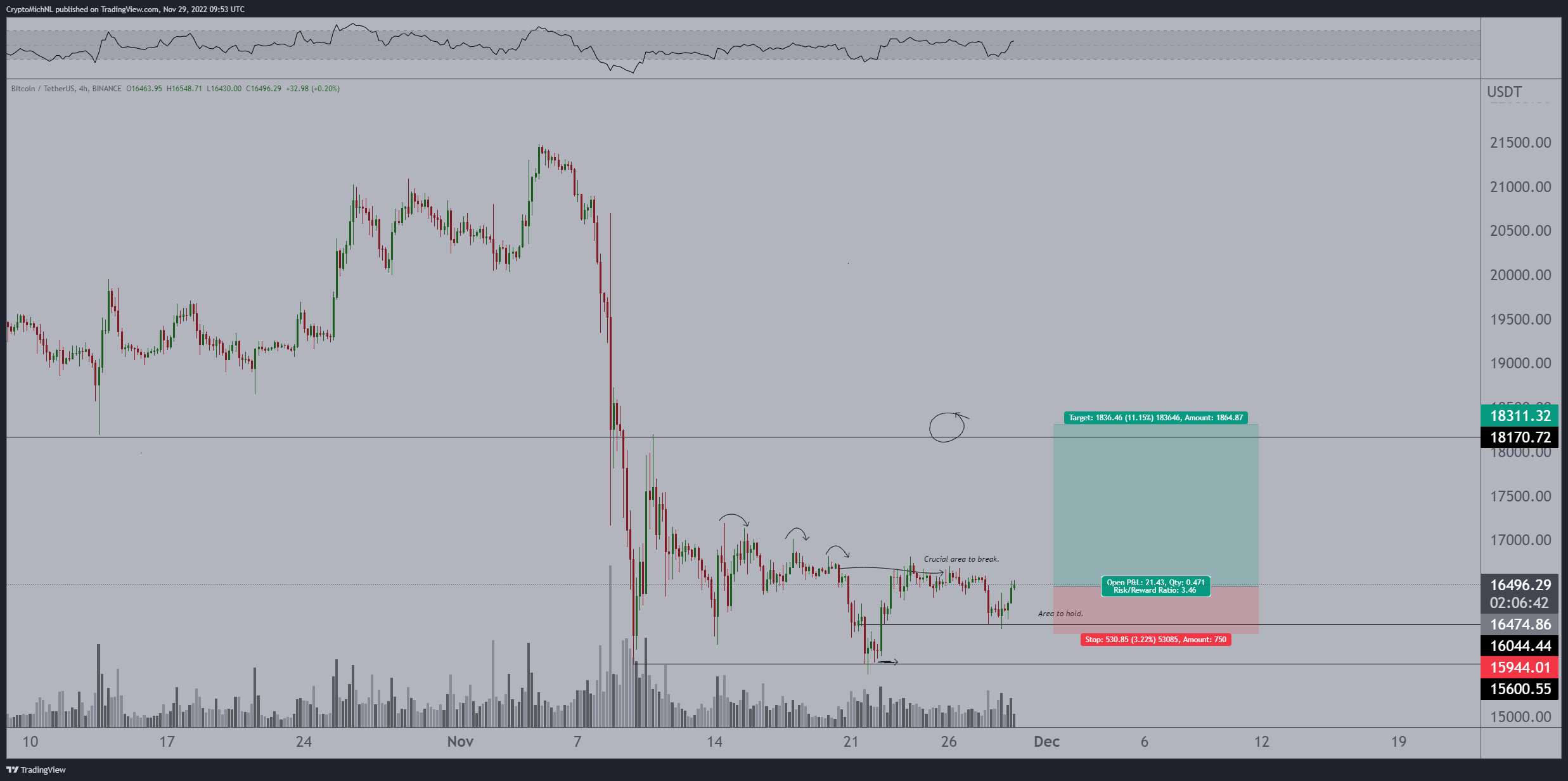

Popular trader Crypto Tony even felt comfortable going long BTC on the day.

“Flipping the EQ would be a safer long entry, but keeping this open with a tight stop loss is the best way for me,” he revealed to Twitter followers.

An accompanying chart identified support and resistance zones in play on midrange timeframes.

Even fresh repercussions over the FTX debacle failed to dent Bitcoin’s performance, meanwhile, these coming in the form of a bankruptcy filing and lawsuit from crypto lender BlockFi.

The latest in a chain reaction sparked by FTX going under, the news came alongside a surprise resumption of salary payments by the defunct exchange.

“Makes sense after this bounce, as we’ve created a HL on Bitcoin and aiming at resistance again,” Michaël van de Poppe, founder and CEO of trading firm Eight, continued about a higher low (HL) on the 4-hour chart.

“Taking out the range between $16.5-16.8K would trigger continuation towards $18K.”

China woes cool ahead of Fed Powell speech

China meanwhile formed the main macro focus on the day, with anti-lockdown protests’ impact on market sentiment nonetheless seeming to ease.

Related: New BTC miner capitulation? 5 things to know in Bitcoin this week

Asian markets bounced back strongly, with Hong Kong’s Hang Seng up 5.2% at the time of writing and the Shanghai Composite Index gaining 2.3%.

“We do not expect China policy to publicly shift away from the Zero Covid stance, however, we could see some easing of the policy privately and in localized areas,” Mohit Kumar, an analyst at investment banking firm…

Click Here to Read the Full Original Article at Cointelegraph.com News…