Throughout Bitcoin’s history, it’s been the long-term holders and those with substantial BTC balances who’ve traditionally played the role of market stabilizers—accumulating during downturns and distributing when the market peaks. Their actions, often driven by experience and unwavering conviction in the cryptocurrency’s potential, have been a consistent feature in the market.

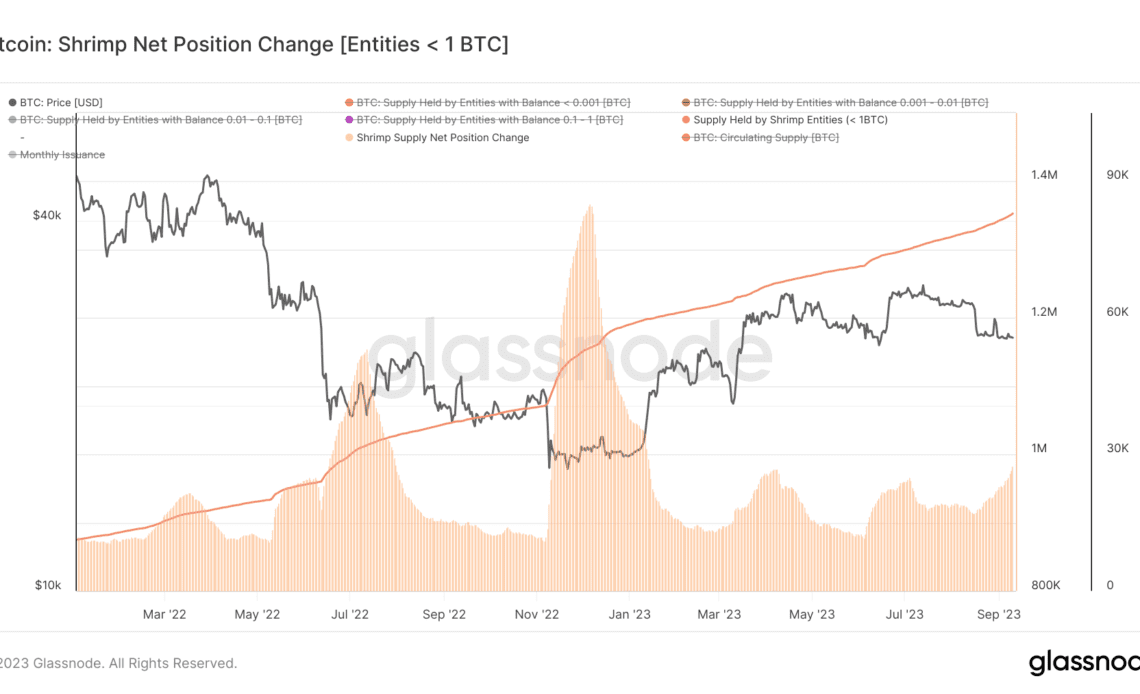

However, a shift in the winds of the Bitcoin market has been observed over the past couple of years. Since the collapse of FTX, a new player has emerged on the scene with an increased appetite for accumulation: the Bitcoin shrimp. In this context, the term “shrimp” refers to addresses with balances of less than 1 BTC.

The collapse of FTX marked a significant milestone for these shrimp. After the exchange’s crash, they added 85,000 BTC to their balances within a month. The previous high for shrimp accumulation was 53,000 BTC in 30 days, recorded in July 2022.

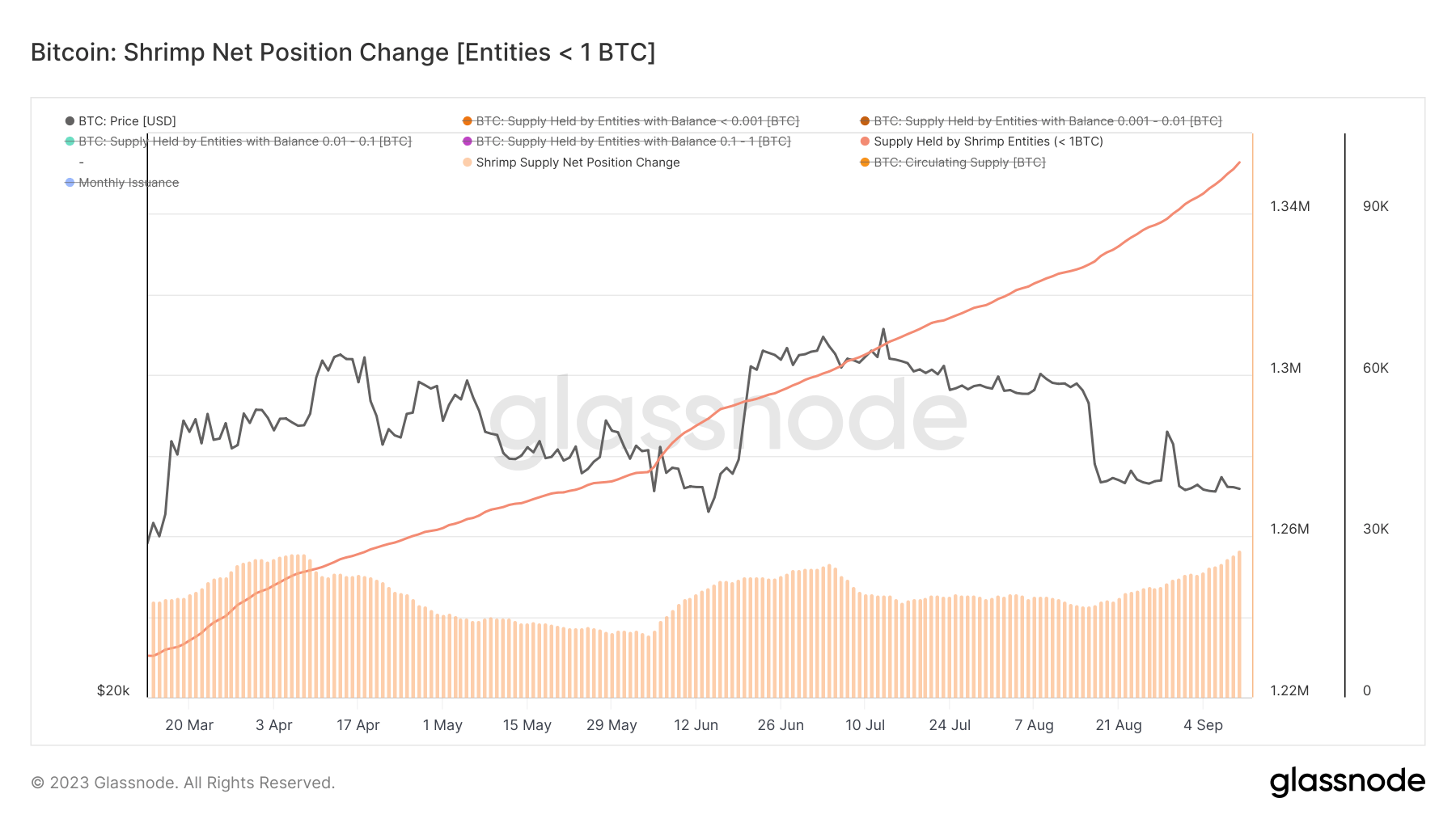

Between June and August, Bitcoin’s price oscillated in a constricted trading range of around $29,000. Their steady accumulation from shrimps continued, with an average monthly addition of 20,000 BTC to their balances. When Bitcoin’s price dropped to $25,000, the shrimp only intensified their accumulation activities.

As of September 10, shrimp balances witnessed an addition of over 27,000 BTC in the preceding 30 days.

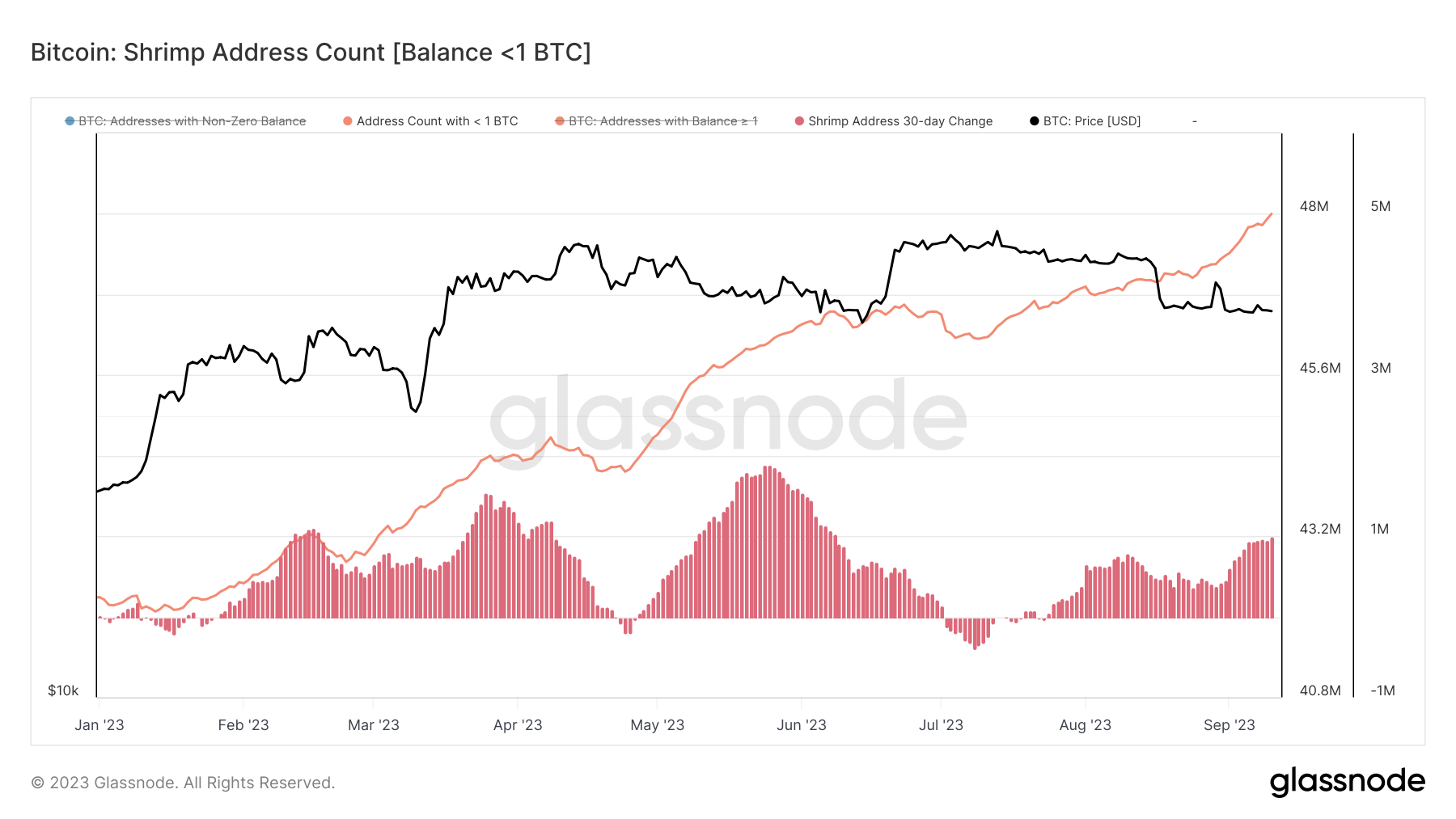

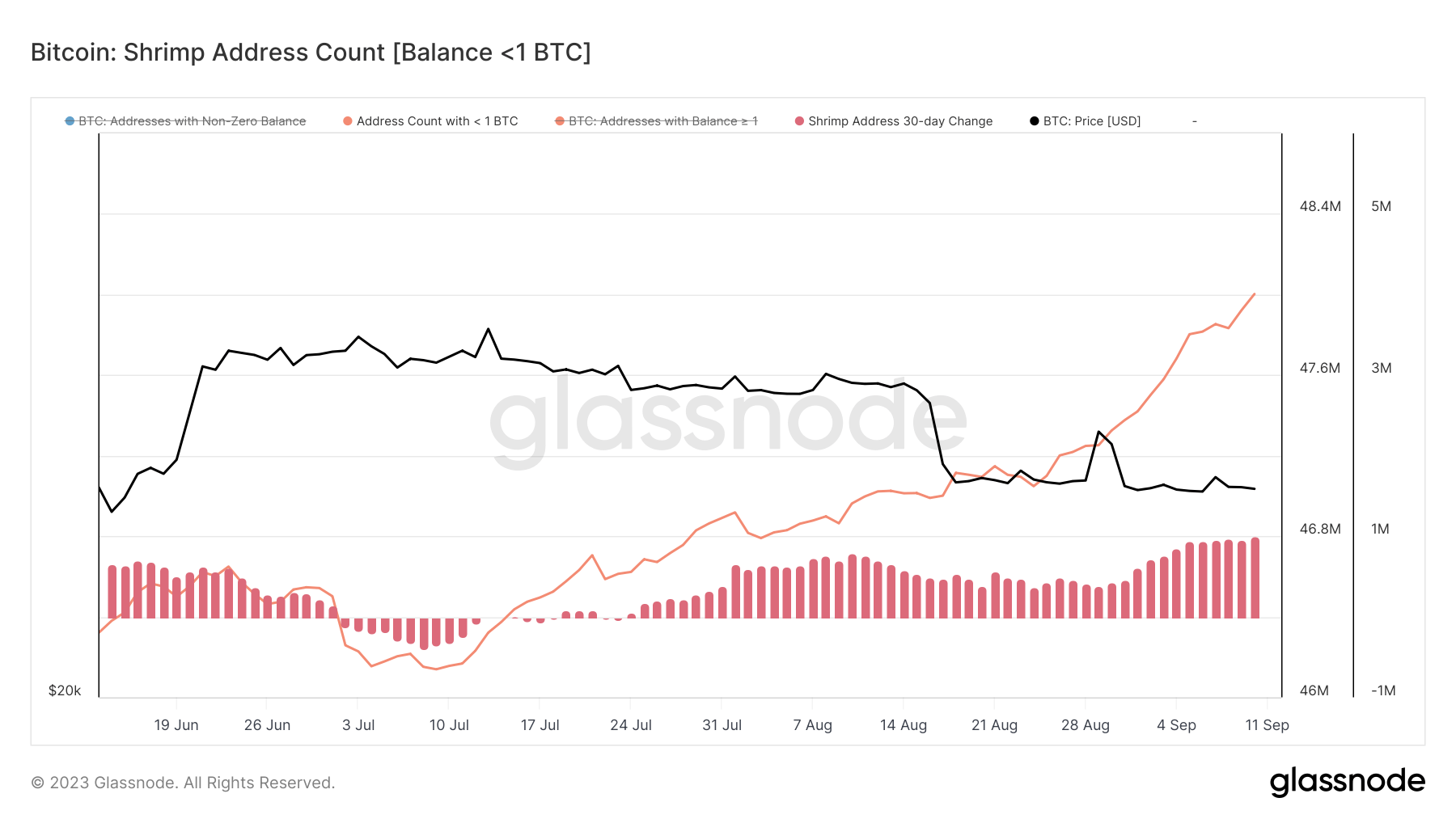

But it’s not just the accumulation of Bitcoin that’s noteworthy. The adoption rate, as evidenced by the creation of new shrimp addresses, has also seen a notable uptick. The number of addresses holding less than 1 BTC has surged this year. A record was set on May 25, with the creation of 1.89 million new shrimp addresses in 30 days.

And even as Bitcoin’s price dipped to $25,000, the momentum remained unchanged. The 30-day period leading up to September 10 saw the creation of over 1 million new shrimp addresses.

The shrimp’s aggressive accumulation patterns and rapid adoption rate signal a democratization of Bitcoin holdings. No longer is the market solely influenced by the…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…