Bitcoin (BTC) sellers may not have capitulated enough, but current trends are “typical” of the end of bear markets.

According to data from on-chain analytics firm Glassnode, seller behavior suggests that a macro price bottom is forming.

Analyst: Seller exhaustion “near” bear market lows

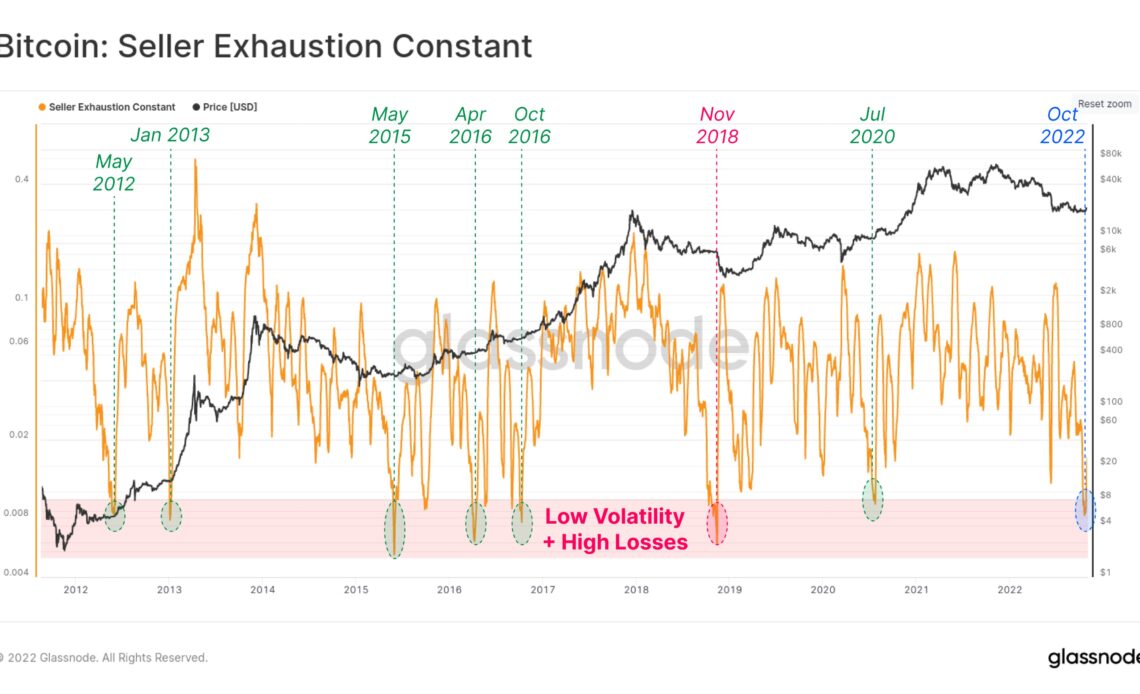

In the latest hint that Bitcoin’s latest bear market is nearing its end, Glassnode has revealed that the network is currently weathering a “perfect storm” of low volatility and high on-chain losses.

The Seller Exhaustion Constant, calculated from one-month rolling volatility and on-chain transaction profitability, is thus at long-term lows of its own.

As a Twitter post explains, such lows are rare, having only appeared seven times before. Six of those times, upside volatility resulted, implying that Bitcoin could soon put an end to its bearish trend.

“The Bitcoin seller exhaustion constant has recorded the lowest value since November 2018,” Glassnode commented.

In a subsequent discussion, lead on-chain analyst Checkmate described the data as “typical” of bear markets, adding that such levels occur “near the lows.”

The Seller Exhaustion Constant was originally created by ARK Invest and David Puell, responsible for the popular Puell Multiple indicator.

“The seller exhaustion constant shown below is the percentage of bitcoin total circulating supply in profit multiplied by its volatility over the last 30 days,” ARK analyst Yassine Elmandjra explained in an article last year.

“This metric measures whether the two factors align. Specifically, the combination of low volatility and high losses is associated with capitulation, complacency, and a bottoming out of the bitcoin price.”

Not quite there yet

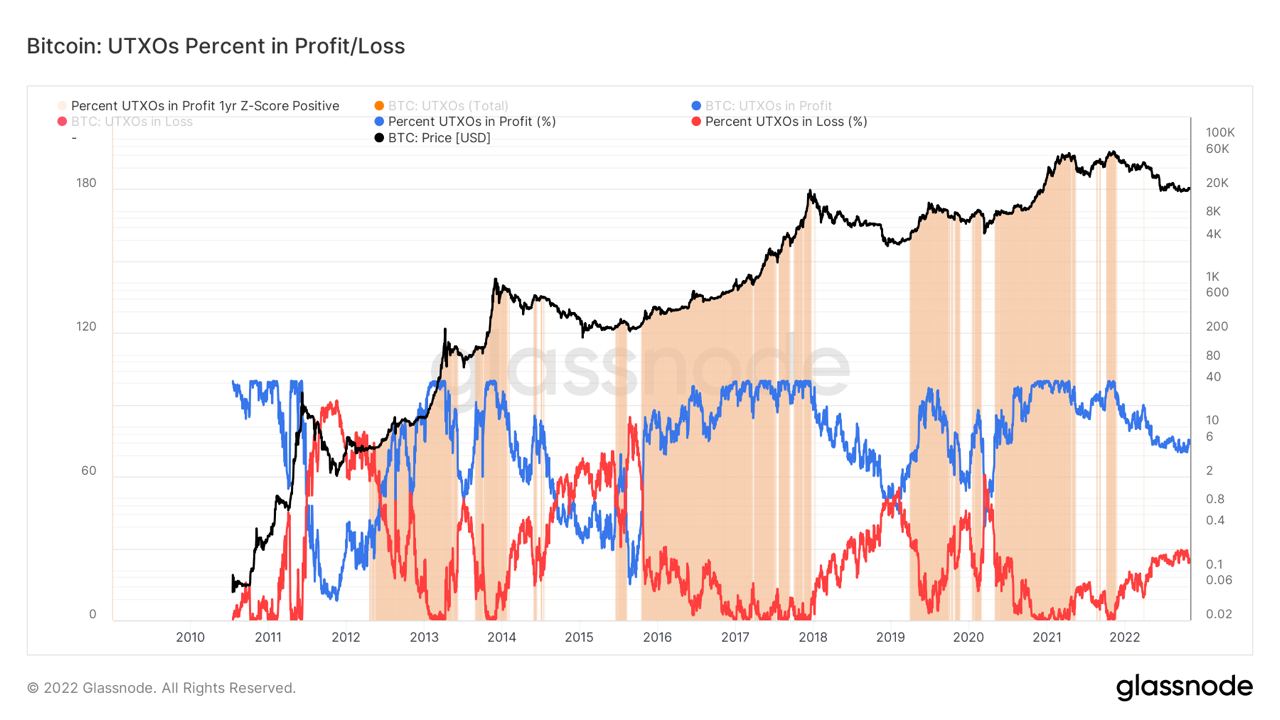

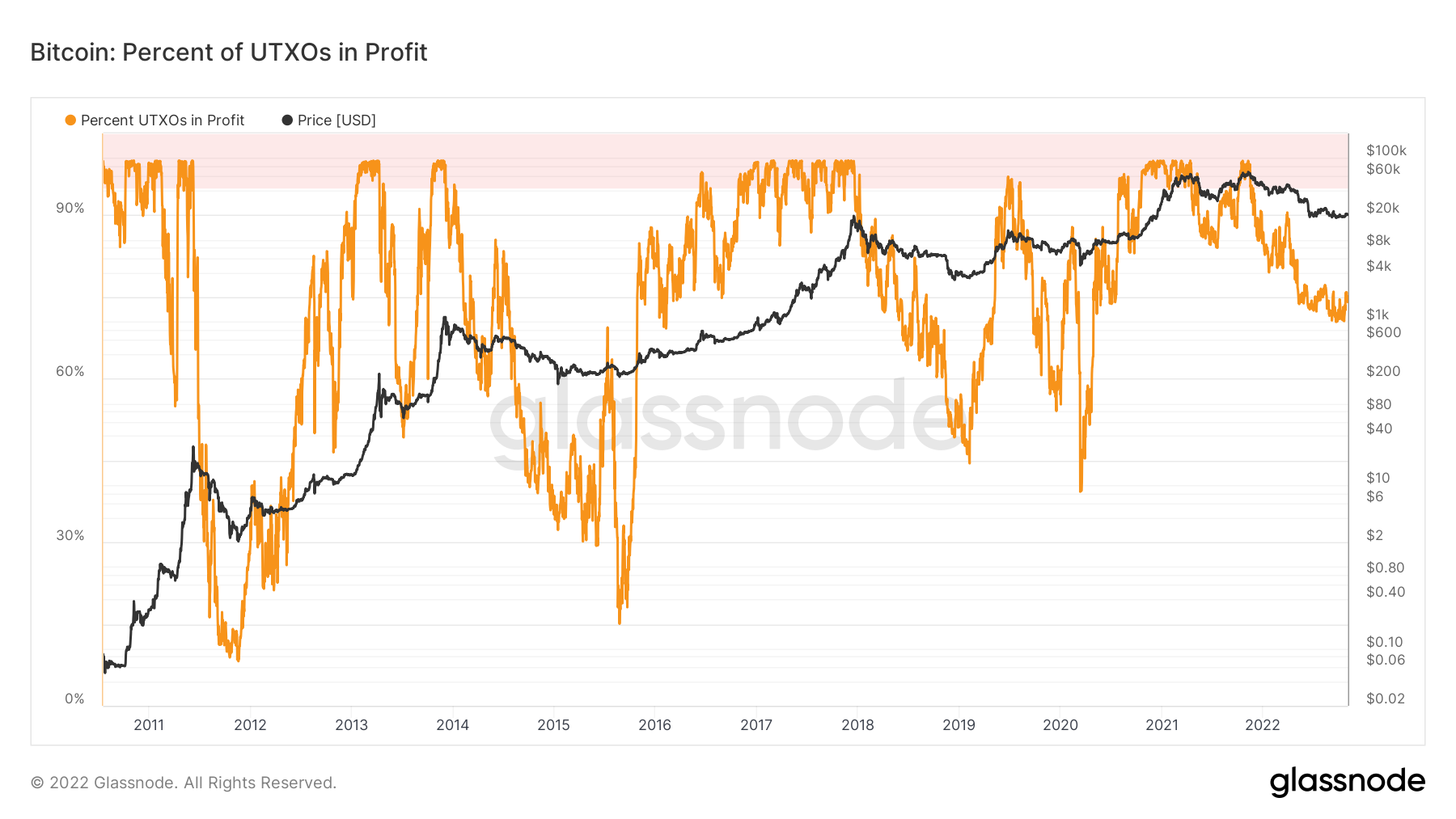

Additional data on unspent transaction outputs (UTXOs) nonetheless shows that current levels of BTC moved on-chain at a loss do not match historical bear market bottoms.

Related: New Bitcoin Yardstick metric says $20K BTC now ‘extraordinarily cheap’

As of Oct. 29, the latest date for which statistics are available, 75% of UTXOs were in profit — a stark contrast to late 2018, when the tally dipped well below 50%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move…

Click Here to Read the Full Original Article at Cointelegraph.com News…