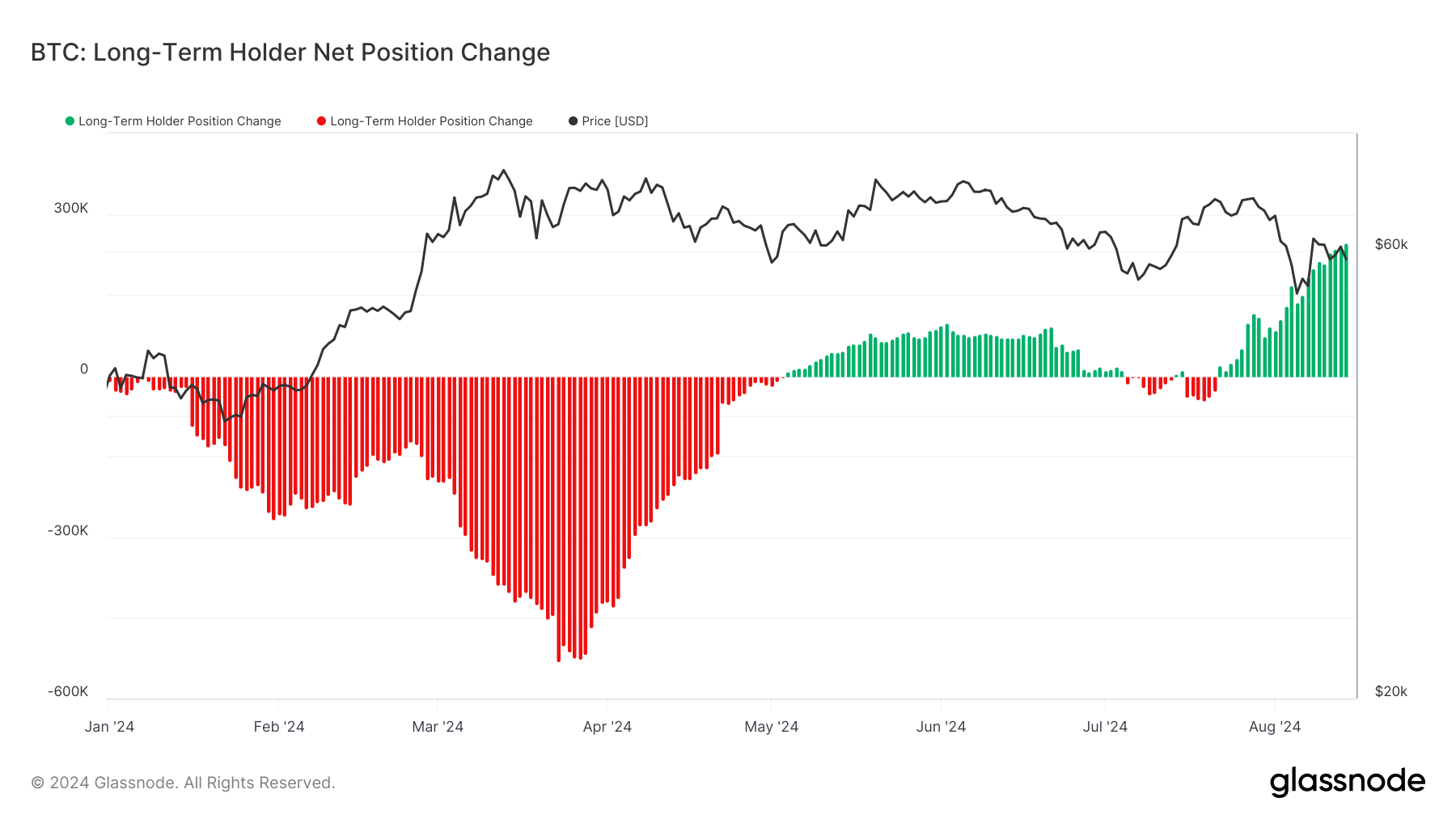

The supply of Bitcoin held by long-term holders has increased significantly in the past month, now undoubtedly reversing the declining trend that’s been dominant since the beginning of the year. Long-term holder supply is a very useful metric for understanding the sentiment of a more sophisticated part of the market, as it reflects the behavior of investors who are less likely to sell their holdings in response to short-term price fluctuations.

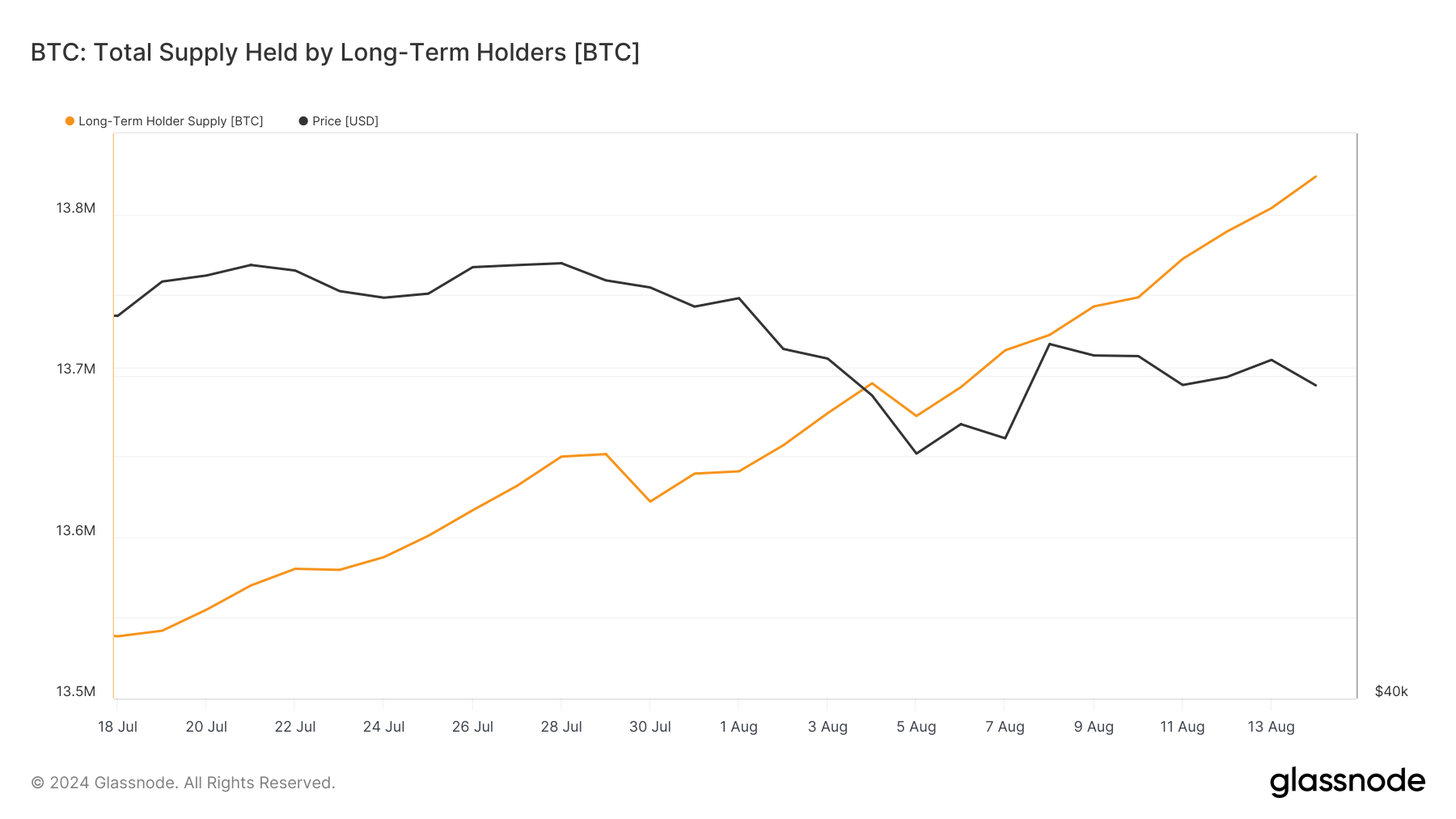

Between Jul. 18 and Aug. 14, the long-term holder supply grew from 13,538,543 to 13,823,283 million BTC, representing a substantial increase of 284,740 BTC. While this growth is noteworthy in itself, it becomes even more significant as it comes after a period of considerable decline in LTH supply earlier in the year.

The trend reversal began on May 4 and continued for two months, after which a brief two-week decrease in LTH supply correlated with Bitcoin’s price increase.

Tracking LTH supply is important because it provides valuable insights into potential future price movements. Long-term holders are typically considered more committed investors who are less likely to sell their Bitcoin in response to short-term price fluctuations. As a result, an increase in LTH supply generally indicates a reduction in the amount of Bitcoin available for trading, potentially leading to decreased market volatility and increased price stability.

The recent surge in LTH supply, particularly the largest 30-day change recorded on Aug. 14 with 246,196 BTC added, is a significant development that warrants further analysis. This increase shows growing confidence among investors, who choose to hold onto their Bitcoin for longer periods despite price volatility.

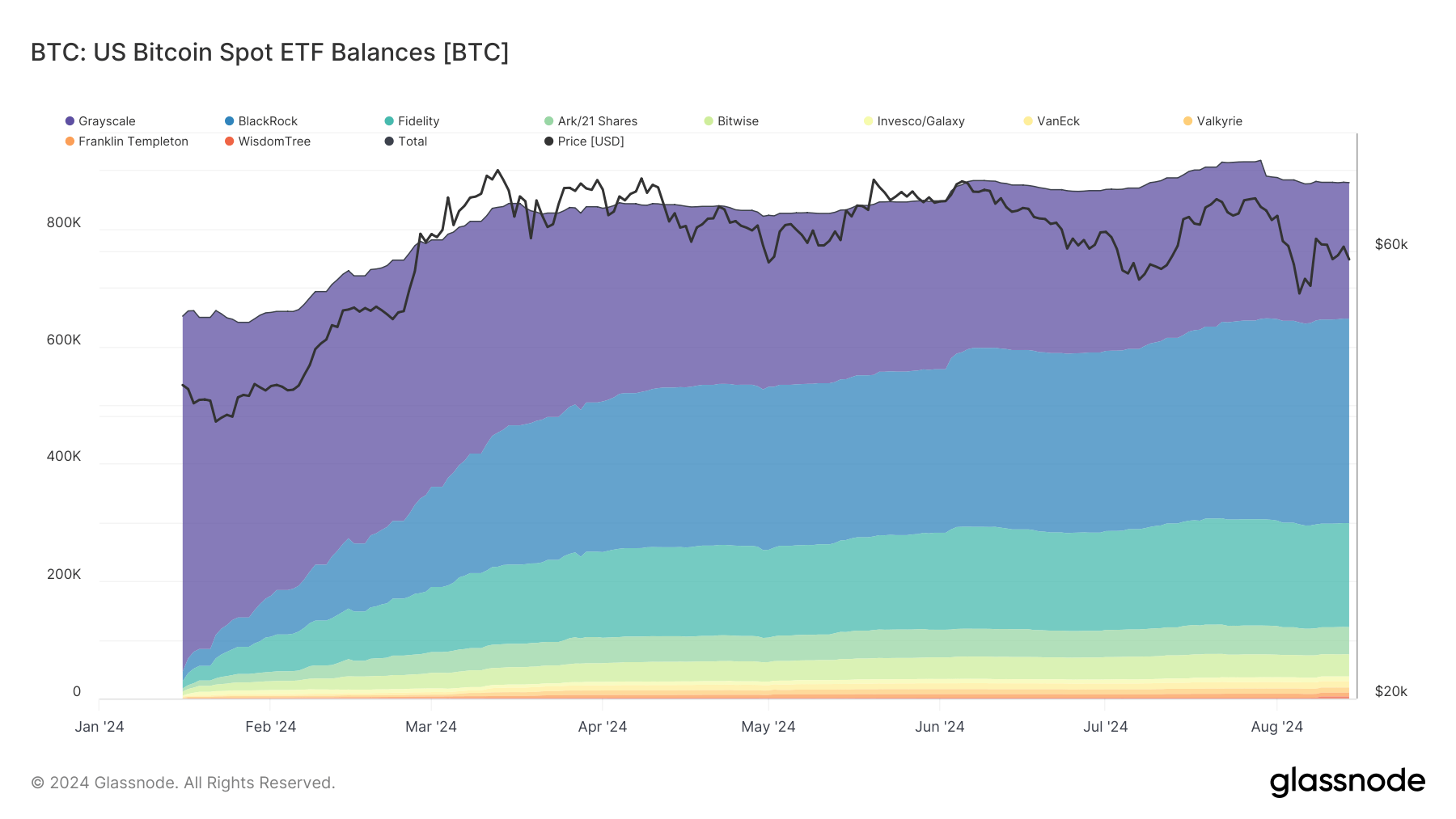

One reason behind this rise in LTH supply could be the maturation of BTC held by spot ETFs. The methodology for calculating LTH supply considers Bitcoin that has not moved for 155 days or more as part of the long-term holder supply. Given that US Bitcoin spot ETF balances have increased from 651,641 BTC on Jan.16 to 879,799 BTC on Aug. 14, a significant portion of these holdings would now have crossed the 155-day threshold, contributing to the increase in LTH supply.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…