On Dec. 14, Bitcoin (BTC) broke above $18,000 for the first time in 34 days, marking a 16.5% gain from the $15,500 low on Nov. 21. The move followed a 3% gain in the S&P 500 futures in 3 days, which reclaimed the critical 4,000 points support.

While BTC price started the day in favor of bulls, investors anxiously awaited the U.S. Federal Reserve Committee’s decision on interest rates, along with Fed chair Jerome Powell’s remarks. The subsequent 0.50% hike and Powell’s explanation of why the Fed would stay the course of its current policy gave investors good reason to doubt that BTC price will hold its current gains leading into the $370 million options expiry on Dec. 16.

Analysts and traders expect some form of softening in the macroeconomic tightening movement. For those unfamiliar, the Federal Reserve has previously increased its balance sheet from $4.16 trillion in February 2020 to a staggering $8.9 trillion in February 2022.

Since that peak, the monetary authority has been trying to unload debt instruments and exchange-traded funds (ETFs), a process known as tapering. However, the previous five months resulted in less than $360 billion of assets decline.

Until there’s a clearer guide on the economic policies of the world’s largest economy, Bitcoin traders are likely to remain skeptical of a sustained price movement, regardless of the direction.

Bears placed most of their bets below $16,500

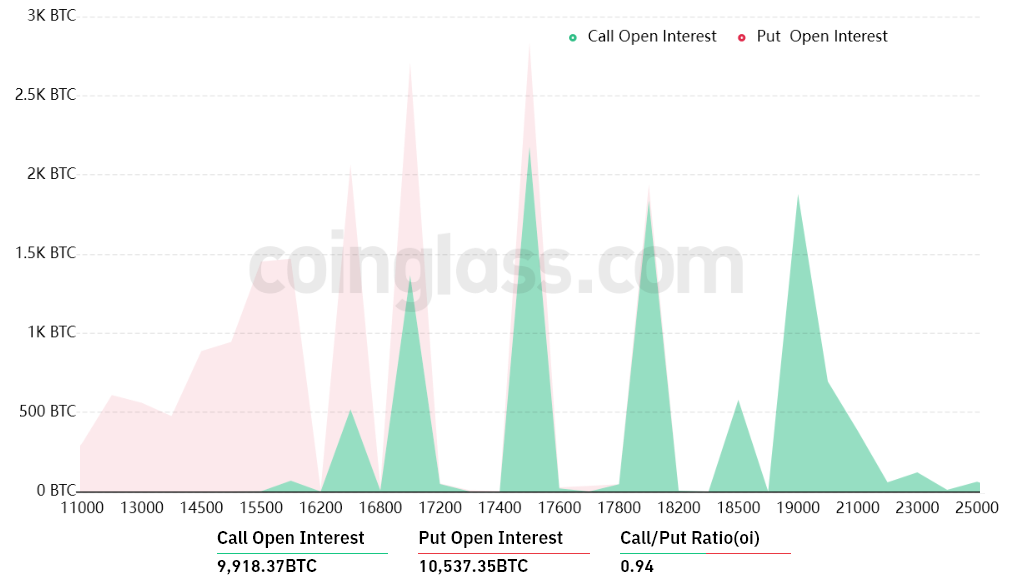

The open interest for the Dec. 16 options expiry is $370 million, but the actual figure will be lower since bears were caught off-guard after the move to $18,000 on Dec. 14. These traders completely missed the mark by placing bearish bets between $11,000 and $16,500, which seems unlikely given the market conditions.

The 0.94 call-to-put ratio shows a balance between the $180 million call (buy) open interest against the $190 million put (sell) options. Nevertheless, as Bitcoin stands near $18,000, most bearish bets will likely become worthless.

If Bitcoin remains above $18,000 at 8:00 am UTC on Dec. 16, virtually none of these put (sell) options will be available. This difference happens because a right to sell Bitcoin at $17,000 or $18,000 is worthless if BTC trades above that level on expiry.

Bulls can profit up to $155 million

Below are the four most likely scenarios based on the current price action. The number of

Click Here to Read the Full Original Article at Cointelegraph.com News…