Bitcoin (BTC) is due to finish 2023 as it started, on-chain analytics firm Glassnode says as October gains near 30%.

In the latest edition of its weekly newsletter, “The Week On-Chain,” released Oct. 24, researchers argued that the past week “sets the foundation” for a BTC price uptrend.

BTC price “convincingly” beats out resistance levels

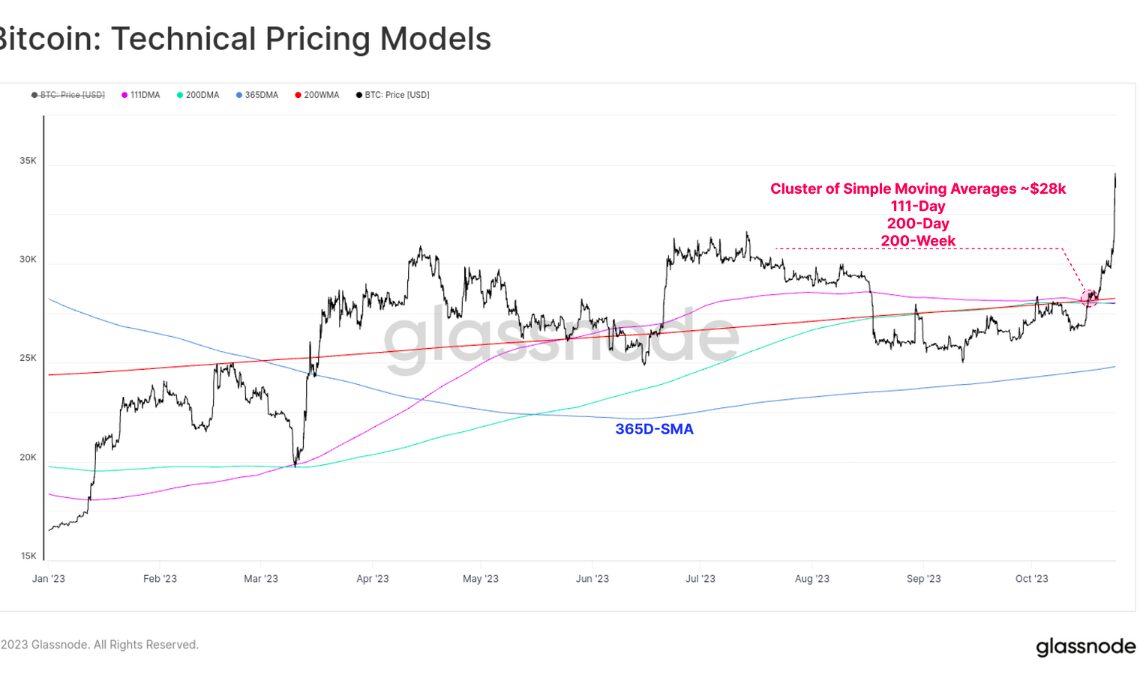

As it hit $35,200 this week, Bitcoin eclipsed various key trendlines, which had previously acted as support for months.

These included various moving averages (MA), among them the 200-week simple MA at $28,400 — the classic “bear market” support line.

“A cluster of long-term simple moving averages of price are located around $28k, and have provided market resistance through September and October,” Glassnode noted.

“After a month of the market grinding higher, the bulls found sufficient strength this week to convincingly break through the 111-day, 200-day, and 200-week averages.”

In so doing, the profitability of various investor cohorts improved considerably. The so-called cost basis of speculators and market newcomers also lies near $28,000.

“The Short-Term Holder (STH) cost basis is also now in the rear view mirror at $28k, putting the average recent investor into an average profit of +20%,” “The Week On-Chain” continued.

Researchers uploaded a chart of the short-term holder market value to realized value (STH-MVRV) ratio, which tracks profitability of STH coins. They noted that even prior to the October upside, no major capitulatory behavior was visible.

“We can see instances in 2021-22 where STH-MVRV reached relatively deep corrections of -20% or more,” they explained.

“Whilst the August sell-off did reach a low of -10%, it is noteworthy how shallow this MVRV decline is by comparison, suggesting the recent correction found noteworthy support, being a precursor to this weeks rally.”

Bitcoin “sets the foundation” for green year

As Cointelegraph reported, the presence of STH entities versus their seasoned counterparts, the long-term holders (LTHs) is now historically low.

Related: Bitcoin price model expects $45K ‘phase’ to hit in November

Despite facing profitability issues of their own, LTHs now own more than three-quarters of the available BTC supply for the first time.

Their cost basis is lower, further toward $20,000 — and while some…

Click Here to Read the Full Original Article at Cointelegraph.com News…