The Hash Ribbon, an indicator for determining miner capitulation based on when the market reaches a bottom, ended on Aug. 18 after 2 months of dwindling miner participation. The end of the period marked the third-longest capitulation in history, according to data analyzed by CryptoSlate.

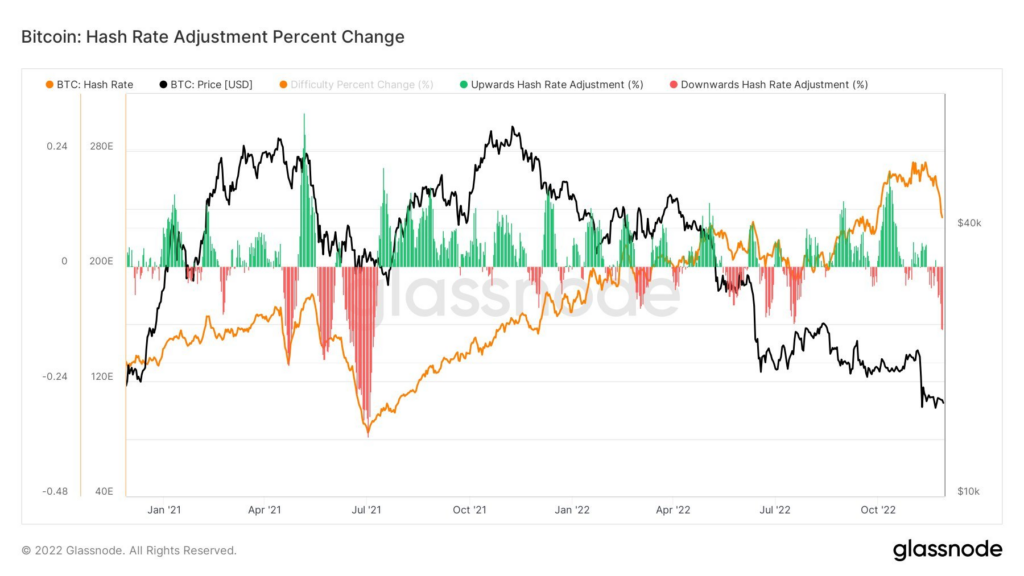

However, the crypto industry’s recent meltdown seems to have taken a toll on the price of Bitcoin with on-chain data recently revealing the highest negative hash rate adjustment in 2022.

The Hash Ribbon is not yet off to mark another bull run as the case with 2020’s market. Unfortunately, the indicator is warning investors to anticipate yet another period of price unsustainability.

Hash Ribbons use both the 30 and 60-day simple moving averages to deduce the participation of miners across the BTC network. The 30-day SMA falling below the 60-day SMA denotes miner capitulation, while the end of capitulation begins when the 30-day SMA breaks above the 60-day SMA.

The latest Hash Ribbon shows both MAs are nearing a crossover, with the 30-day SMA almost falling below the blue line, which therefore indicates the capitulatory phase. Furthermore, the current setup is similar to the June 20220 hash ribbon metric when BTC dropped from $31,150 to $20,000.

The financial cost of mining bitcoins, compared to the current price of the coin has proved strenuous for miners. Therefore sending a majority of them out of the network, which explains why the last two months of hash rate have been wiped out.

In case the capitulation phase picks up in November/December, there is a high chance of marking its longest phase in the history of BTC.

As shown on the Glassnode chart below, Bitcoin’s hash rate is declining towards record levels as a sign of miners shutting down operations. The hash rate is down to a yearly low that was last witnessed in July 2021.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…