Bitcoin and crypto markets experienced a robust recovery Tuesday, with Bitcoin surging past the $56,000 mark and Ethereum breaking above $2,500, bouncing back from the “Block Monday.” Yesterday, Bitcoin plummeted over 15%, touching lows near $49,000, while Ethereum dropped by more than 20% to a low of $2,115. The recovery in Bitcoin and crypto paralleled a broader resurgence in global financial markets, driven by several key factors.

#1 Nikkei Rebounds, Bitcoin Follows

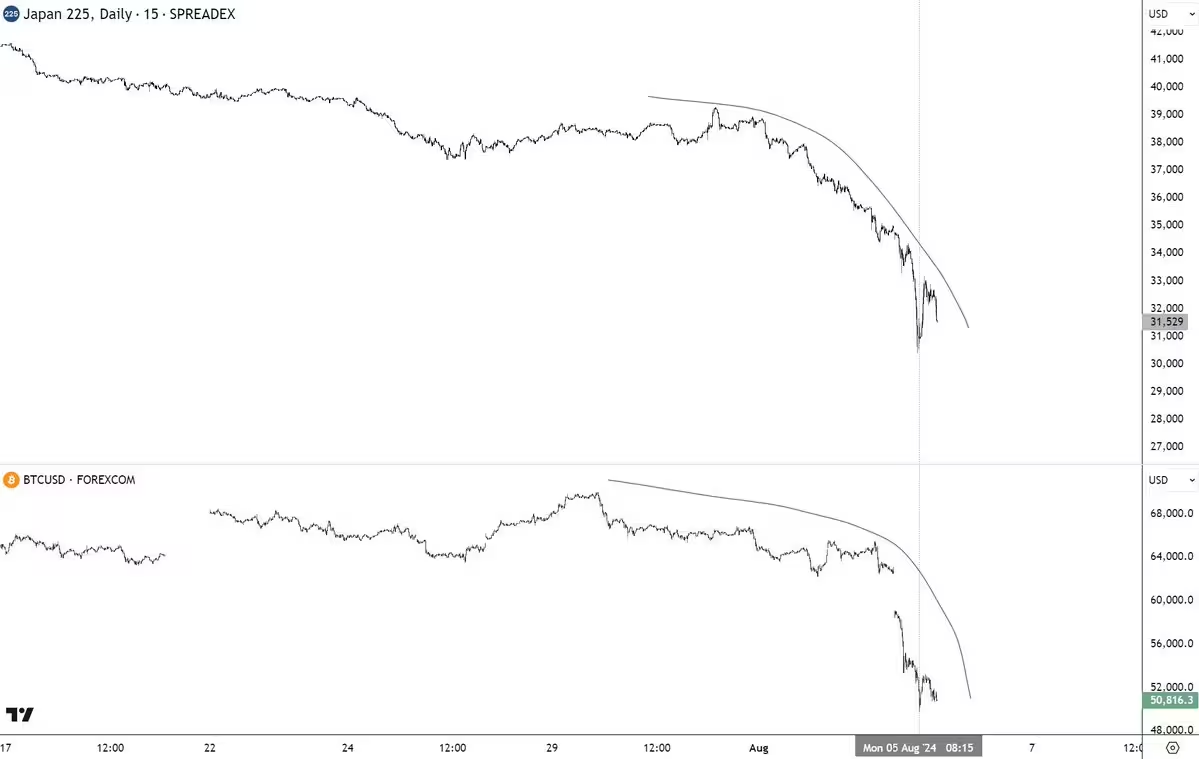

Japan’s primary stock index, the Nikkei 225, experienced a record-breaking recovery following its most significant drop since the 1987 Black Monday crash. The index surged by 10.23%, closing at 34.675,46 points. This rebound came after a sharp 12.4% decline on Monday, spurred by global market instability and looming recession fears in the US, alongside complications arising from the unwinding of the Yen ‘carry trade.’

Related Reading

Popular crypto analyst JACKIS (@i_am_jackis) remarked via X: “I think that crypto right now is reacting to macro conditions but nothing specific IMO is happening to crypto itself. Here is BTC & Nikkei in comparison. When macro conditions settle Bitcoin / crypto should rebound stronger but until then be careful.”

#2 ISM Services Data Is Bullish

The US Institute for Supply Management reported on Monday that its non-manufacturing PMI rose to 51.4 in July from June’s 48.8, which was the lowest since May 2020. This index measures the health of the services sector, which constitutes over two-thirds of the US economy. A PMI above 50 suggests expansion, and the latest data indicates a rebound in service sector activity, easing some concerns over an impending recession.

Eric Wallerstein of Yardeni Research expressed relief and cautious optimism about the data: “Woah, maybe the US economy is not crashing? ISM services employment up 5 points to 51.1. Entire PMI in expansion,” he stated via X.

Andreas Steno Larsen of Steno Research also commented, highlighting the precariousness of market sentiment: “ISM Services away from the recession zone again. Not sure it is strong enough to convince Markets. We are not trading macro currently. We are trading leveraged stops.”

Related Reading

Ram Ahluwalia, CEO of Lumida Wealth, added: “ISM Services are *up* reversing the signal from the ISM Manufacturing data last Friday. No recession folks. This is a technical / positioning driven…

Click Here to Read the Full Original Article at NewsBTC…