Bitcoin (BTC) climbed back above $43,000 during Asian trading hours following news that BlackRock amended its spot exchange-traded fund (ETF) application to comply with the U.S. Securities and Exchange Commission (SEC).

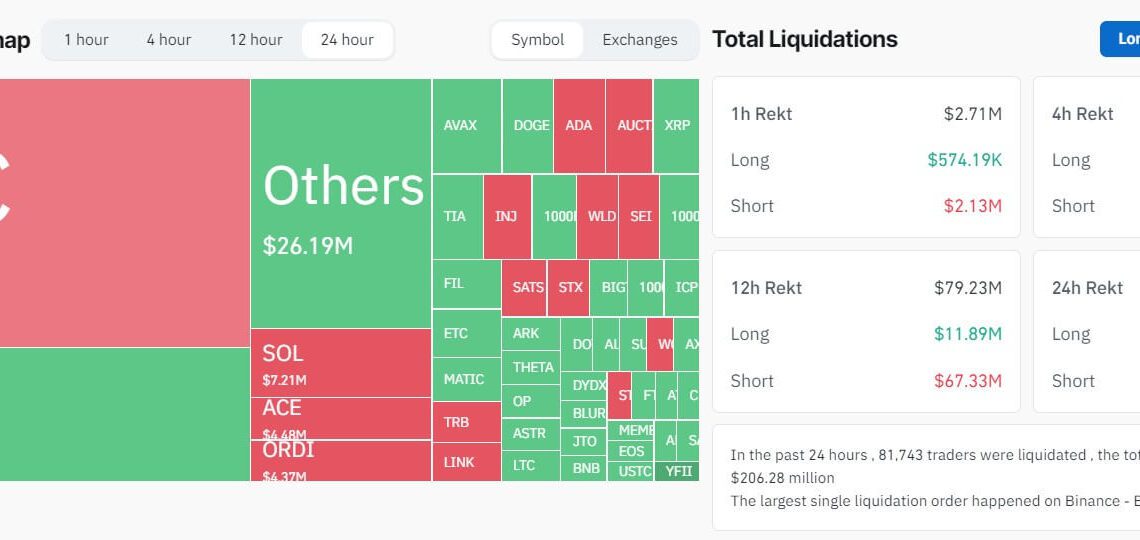

Coinglass data shows that the price movement liquidated $206 million across all assets from more than 81,000 crypto traders during the past day. Long traders lost $107.82 million, while short traders were liquidated $98 million during the reporting period.

Across assets, speculators on BTC price accounted for roughly $68 million, or 32%, of the total losses incurred—$42 million were liquidated from traders betting against further BTC price increases. In comparison, about $26 million was liquidated from long-position holders.

Notably, Bitcoin has further reduced its low Liquidation Sensitivity Index (LSI) score of just $11.72 million USD/%, the lowest level recorded by CryptoSlate. This change suggests markets are further maturing with less leverage in the market betting against Bitcoin, with only $67.9 million liquidated from a 6% price swing.

Ethereum experienced liquidations across long and short positions, with $18.38 million and $16.6 million respectively.

Large-cap cryptocurrencies like Solana, XRP, and Dogecoin also witnessed notable liquidations totaling $7.66 million, $3.2 million, and $3.5 million, respectively.

Meanwhile, crypto traders using the embattled Binance platform accounted for more than 50% of the total losses suffered in the market. The exchange users lost $102.85 million during the past day, with the most significant single liquidation order being an $8.82 million long position BTC.

Market rebounds

The current price performance represents a reversal of fortune for the top cryptocurrency that had begun the week meekly, falling to around $41,000 on Dec. 18 amid a broader market drawdown.

However, its price picked up following news that BlackRock, the world’s largest asset manager and one of the applicants for a spot ETF, revised its applications with the SEC.

BlackRock’s new amendment revealed an IBIT market ticker and that the relevant transactions will occur in exchange for cash.

In a recent note to investors, Markus Thielen, the head of research at Matrixport, asserted that BTC is the superior asset for this year, adding that more investors are pondering whether to allocate more capital next year.

Meanwhile, other top 10 cryptocurrencies, including XRP, Ethereum, Solana, and…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…