Bitcoin has faced its first major correction since early November, dropping 13% from its all-time high of $108,364. This sudden pullback has sent shockwaves across the crypto market, shifting sentiment from extreme bullishness to uncertainty and even fear. The sell-off has been particularly brutal for altcoins, many of which are bleeding hard as Bitcoin struggles to regain momentum.

Related Reading

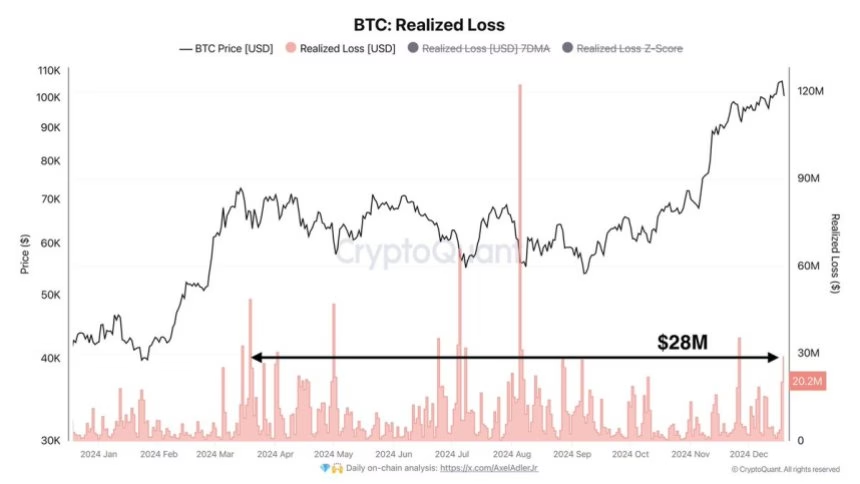

Key metrics from CryptoQuant highlight the gravity of the situation, with realized losses totaling $28.9 million—an alarming 3.2 times higher than the weekly average. This spike in realized losses suggests that some investors exit positions as the market recalibrates after weeks of aggressive upward movement.

The big question now is whether this is simply a healthy correction in an otherwise bullish trend or the start of a larger downtrend. Traders are closely watching Bitcoin’s ability to hold critical support levels and the behavior of altcoins, which often amplify Bitcoin’s price movements.

For now, the market remains at a crossroads, with the coming days likely to reveal whether Bitcoin can recover and resume its uptrend—or if this correction signals a more prolonged period of weakness.

Bitcoin Facing Selling Pressure

Bitcoin is under significant selling pressure after two days of aggressive bearish activity, marking a pivotal moment for the market. The sudden sentiment shift has caused many analysts and investors to turn cautious, with some flipping bearish as Bitcoin’s recent trend begins to lose momentum. This correction has left the market questioning whether the current price movement is a natural pause or a precursor to deeper losses.

Top analyst Axel Adler recently shared insights on X, supported by compelling on-chain data, highlighting that realized losses have surged to $28.9 million. This figure is 3.2 times higher than the weekly average, indicating heightened selling activity. Adler’s analysis underscores that while the sell-off might seem alarming, it’s consistent with a healthy market correction, especially following Bitcoin’s remarkable rally to $108,300.

Adler notes that the current dip should not trigger panic but instead serve as a moment of patience for long-term holders. He emphasized that now is a time to HODL unless additional bearish signals emerge to suggest…

Click Here to Read the Full Original Article at NewsBTC…