A quant has explained how a rally could be possible for Bitcoin in this third quarter of 2024 as miner selling pressure has disappeared.

Bitcoin Miners Appear To Have Stopped Their Selling

In a CryptoQuant Quicktake post, an analyst has talked about how the selling pressure concerns from miners have resolved recently. There are two on-chain indicators of focus here.

Related Reading

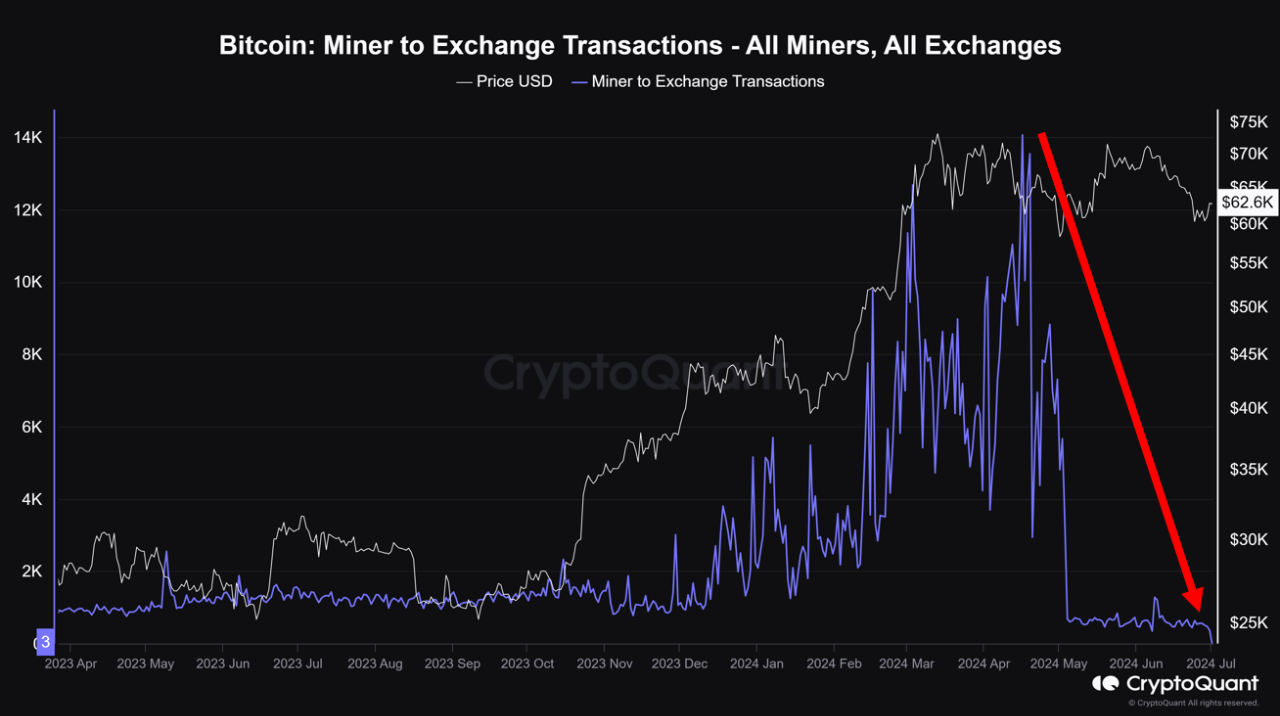

The first of these is the “Miner to Exchange Transactions,” which, as its name suggests, keeps track of the total number of transactions that are going from miner-related wallets to exchange-affiliated ones.

When the value of this metric is high, it means the miners are making a high number of deposits to exchanges. Generally, the main reason why these chain validators may transfer their coins to these centralized entities is for selling-related purposes.

As such, this kind of trend can have potential bearish consequences for the market. Low values of the indicator, on the other hand, could either be neutral or bullish for the asset, as they imply miners are possibly not participating in any selling through these platforms.

Now, here is a chart that shows the trend in the Bitcoin Miner to Exchange Transactions over the past year or so:

As is visible in the above graph, the Bitcoin Miner to Exchange Transactions had been rising between late 2023 and end of April of this year. This uptrend in the metric had taken place as the price of the cryptocurrency itself had been going through a rally.

It would appear that the miners saw the rally as an exit opportunity, as they gradually upped their selling pressure as the price went towards a new all-time high (ATH).

It’s also apparent, however, that since the peak in April, the indicator’s value has observed a very rapid decline. Thus, it’s possible that miners’ appetite for selling has cooled off.

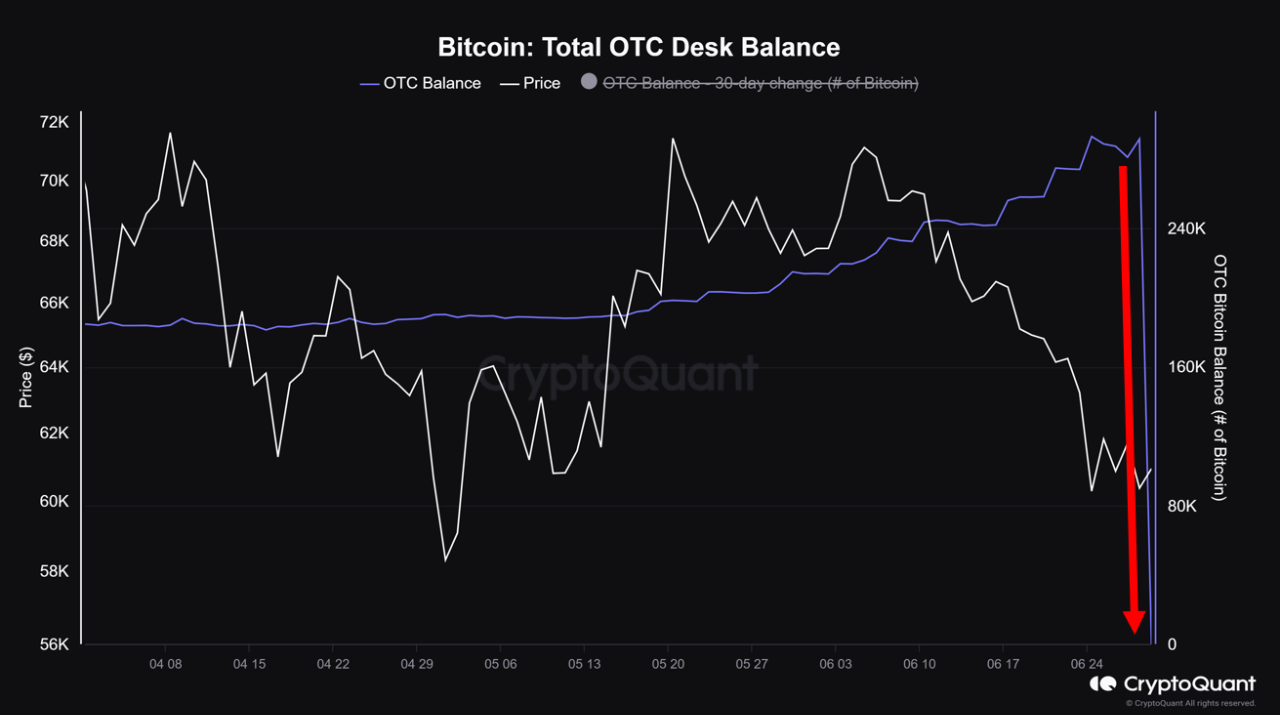

Exchanges aren’t the only way miners sell, however, as over-the-counter (OTC) desks are also a popular option among these chain validators. Below is a chart that shows the trend in the Total OTC Desk Balance, which is an indicator that keeps track of the non-exchange and non-miner wallets that miners send to when they want to sell.

From the graph, it’s visible that the Total OTC Desk Balance had been at relatively high…

Click Here to Read the Full Original Article at NewsBTC…