Since August 2010, there have been only 677 days in which you could have bought Bitcoin and currently be at a loss, with 86% of days where ‘holding Bitcoin has been profitable relative to today’s price,’ as per Coinglass data.

Data from Coinglass shows that entities who purchased Bitcoin on any one of the other 4,081 days are in profit as of press time. The chart below shows the days in red, which days Bitcoin purchased would have led to a loss by today’s price, and green for purchases now in profit.

As a percentage, there are only 14% of the total days since 2010, where purchasers are now at a loss.

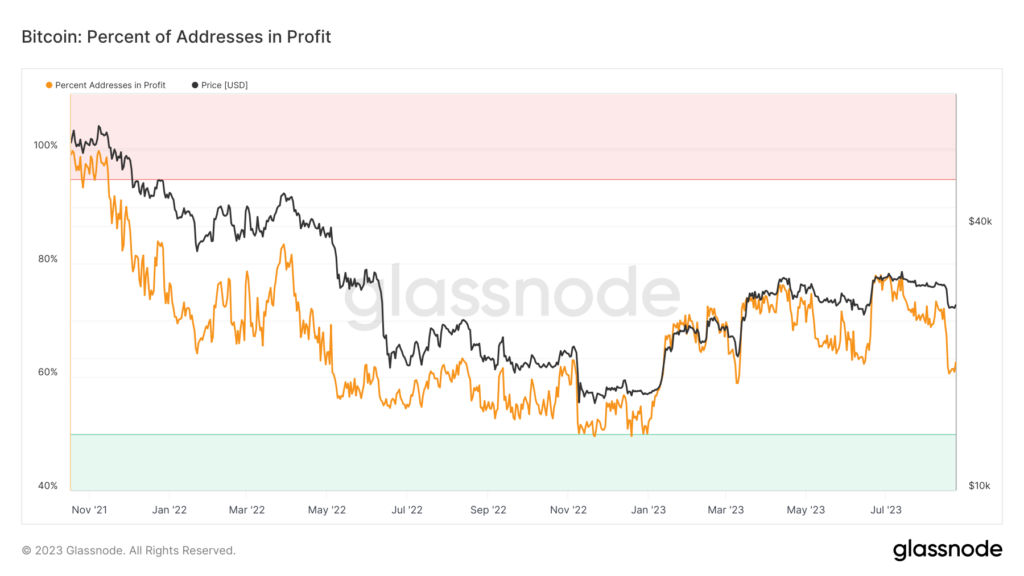

However, with Bitcoin down over 60% from its all-time high, currently, only 61% of addresses are actually in profit. Therefore, 39% of entities added to their positions on one of the identified 677 unprofitable days.

The highest number of addresses in profit this year came on July 13, the day of the XRP ruling, at 79%, with the year starting at just 52%.

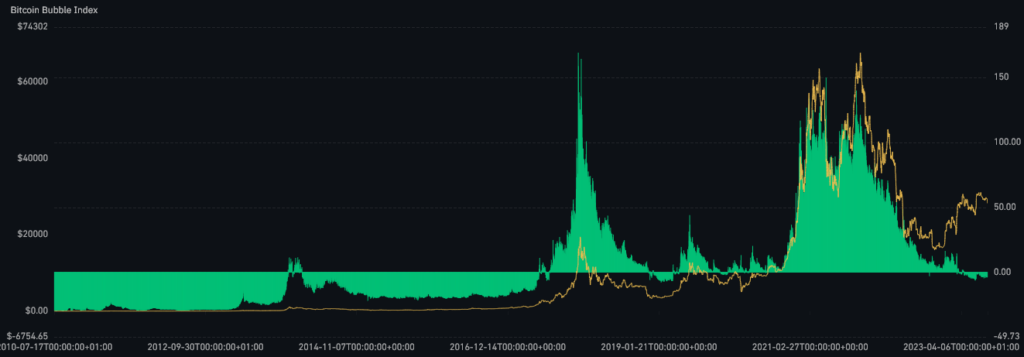

Coinglass’s ‘Bitcoin Bubble Index’ indicates the likelihood that the top cryptocurrency is in a bubble based on health metrics such as Google trends, Bitcoin difficulty, and transactions.

At present, with over 60% of holders in profit, the chart shows a negative possibility of a bubble, indicating a healthy network with upside potential.

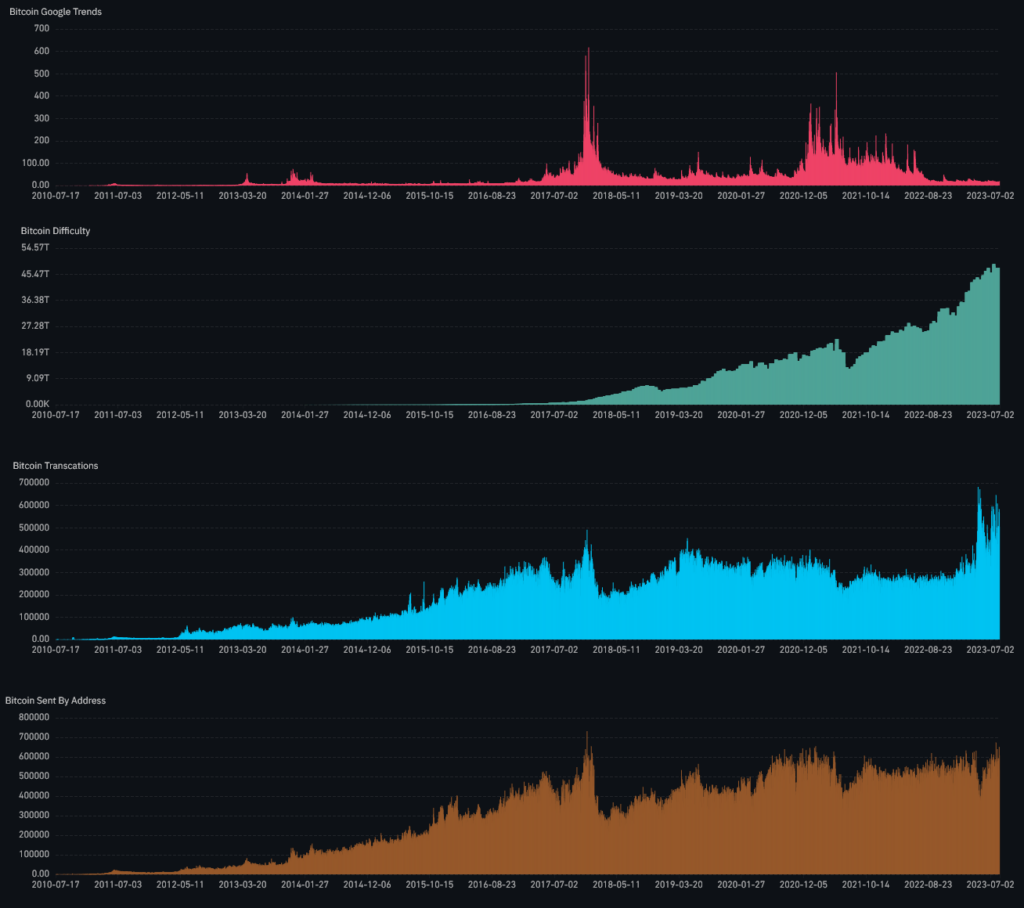

The sub-metrics of the index show a declining search volume on Google while Bitcoin difficulty, number of transactions, and transaction value are all close to all-time highs and trending upward.

Therefore, while there are entities currently holding at a loss, the majority are in profit, with only Google interest trending down.

Notably, the major spikes around Google search volume for Bitcoin surround halvings. The next halving will occur in less than six months, and, one could say, the network has never been healthier.

The post Bitcoin profitable on 86% of days, yet just 61% of holders are in profit appeared first on CryptoSlate.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…