A popular crypto analyst is updating his outlook on Bitcoin (BTC) as a key event approaches.

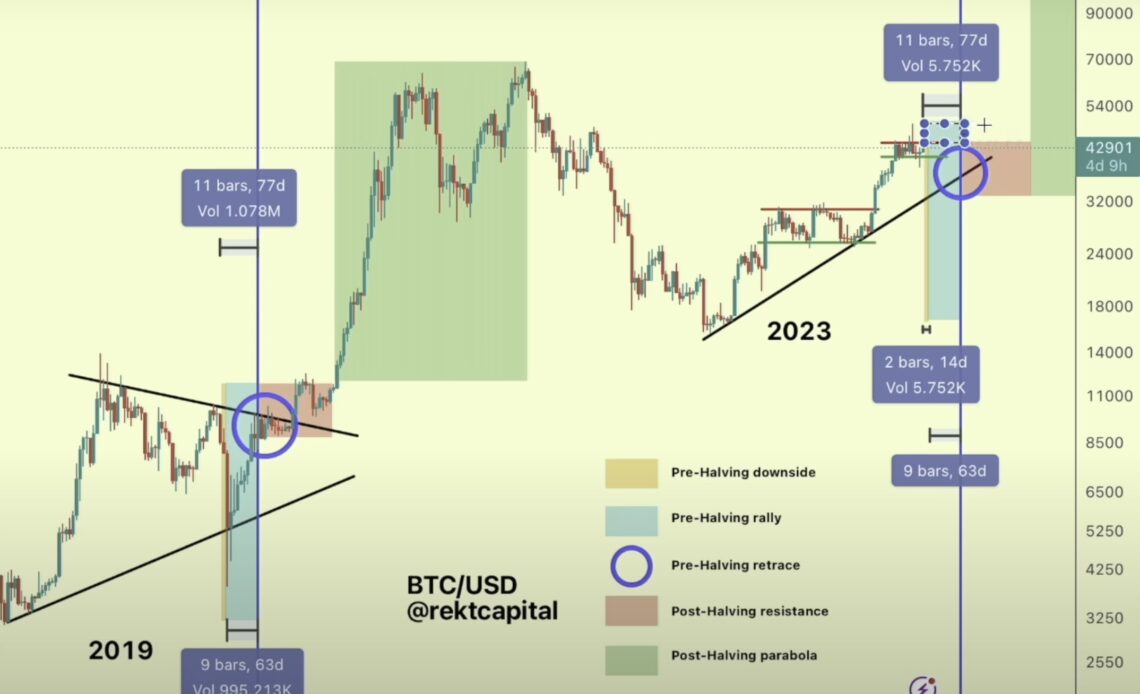

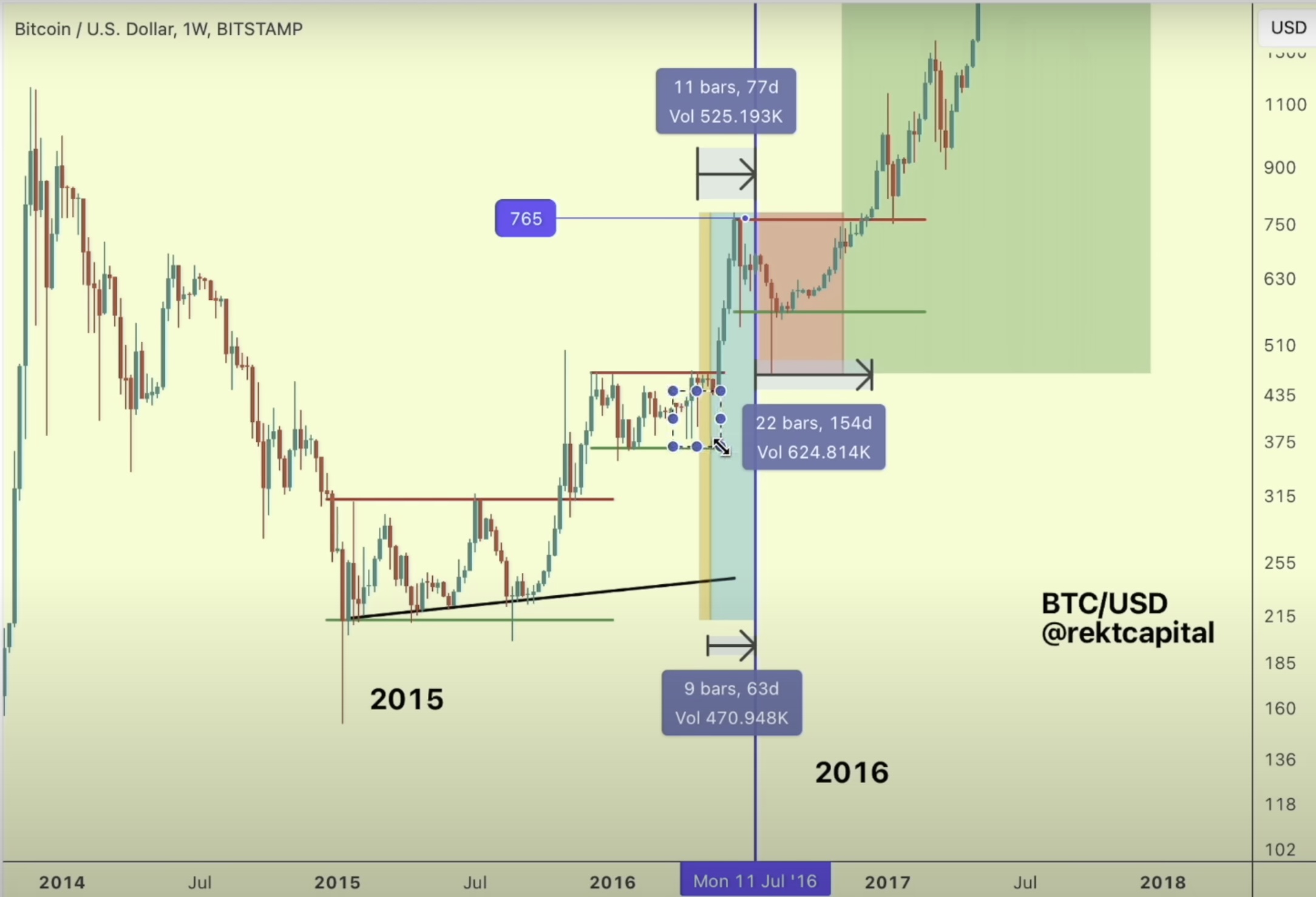

Pseudonymous crypto trader Rekt Capital tells his 53,700 YouTube subscribers that Bitcoin is likely going to repeat a 2016 pattern and rally heading into the mid-April BTC halving, when miners’ rewards are cut in half.

However, the trader warns Bitcoin could nosedive in the near term as the crypto king remains in a re-accumulation range.

“So you can see that we’re here in the re-accumulation range once again, very similar to 2016. And in 2016 we saw downside deviation wicking within the re-accumulation range.

What we’re seeing in this cycle is also downside wicking, but below the re-accumulation range, not within it, but just below it. Still, nonetheless, though, pulling back in retracement within this overall re-accumulation range and holding that re-accumulation range as we approach the halving event.

So if history were to repeat based on 2016 we should see some sort of upside going into the pre-halving rally.”

Looking at his chart, the trader suggests Bitcoin may rally to around the $50,000 level heading into the halving.

The trader also believes that in the next two weeks, Bitcoin could dip and revisit the $38,000 level.

“But the next two weeks are going to be quite interesting because they are opening up for potential still downside wicking below this re-accumulation range like we saw in 2016. In 2016, you can see [in chart below] that there were multiple weeks of downside wicking within the re-accumulation range.

So if this is any indication, what if we get some persistent downside wicking still even in this cycle within the re-accumulation range, maybe still downside deviating below that re-accumulation range.”

The trader also thinks there remains a small chance that the re-accumulation range will break down, sending Bitcoin below $38,000.

“Any downside deviation below this range in this current cycle is a possibility…

There are very specific conditions that Bitcoin would need to simply meet to break below $38,000…

But as long as that re-accumulation range holds, then we’re only going to finish on a 21% retrace from the highs and history is suggesting to us that we’re probably going to see this re-accumulation range continue to hold going into the halving.”

The trader suggests a “worst case scenario” for a Bitcoin dip this…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…