Bitcoin (BTC) hodlers enjoyed another day of zero volatility on Dec. 26 as hopeful forecasts sought signs of a trend change.

Opinions diverge further over BTC price bottom

Data from Cointelegraph Markets Pro and TradingView confirmed more sideways action near $16,800 for BTC/USD on Boxing Day.

The pair took the holiday period in its stride, with reduced volumes having no impact on an already deflated market experiencing its lowest volatility on record.

With few trading opportunities in the last week of “Do Nothing December,” analysts attempted to ready the ship for potential headwinds to come.

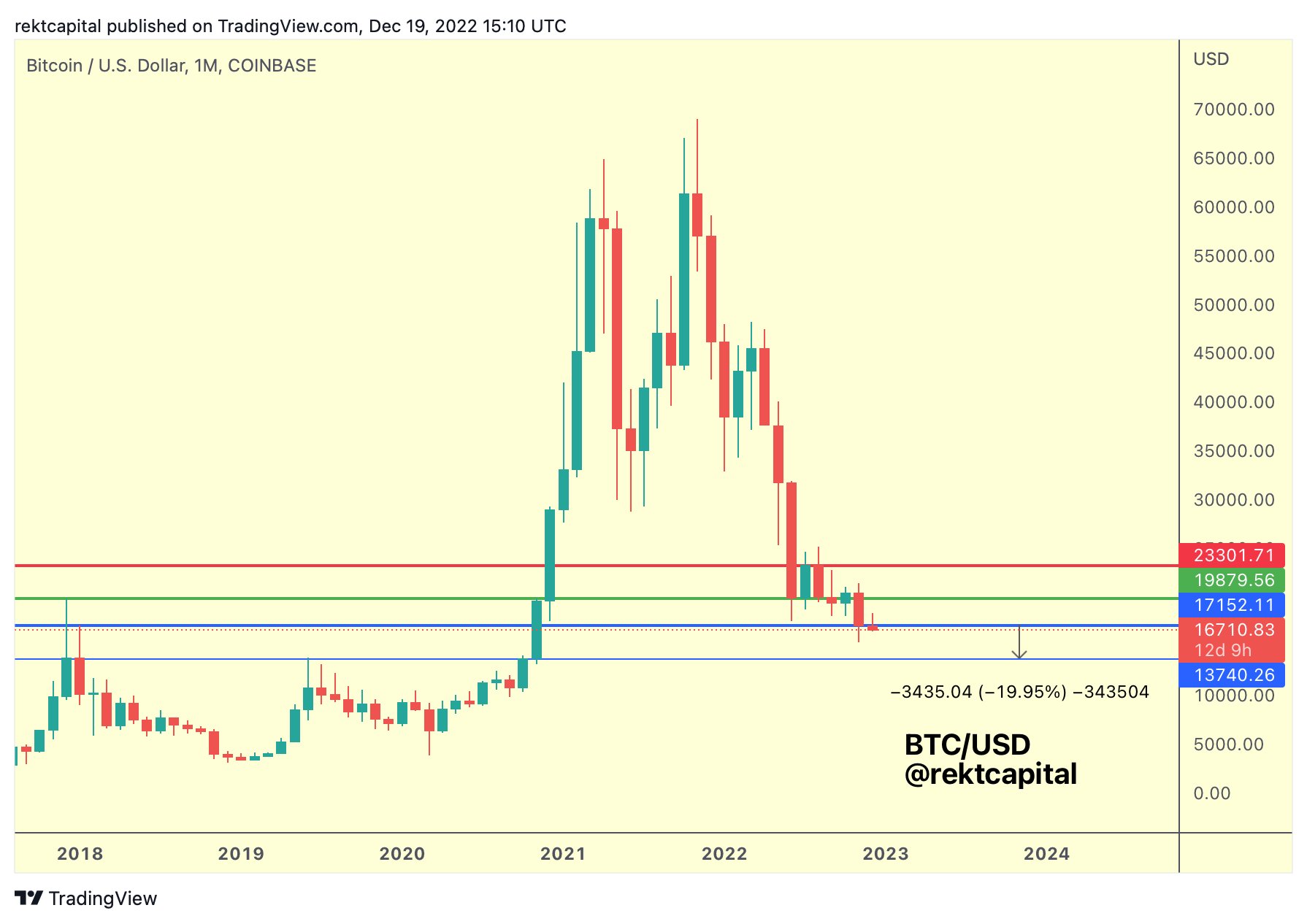

“If BTC fails to reclaims ~$17,150 as support before the end of the year… Then $BTC will establish the $13900-$17150 range as its new playground,” Rekt Capital tweeted in a fresh update on the day.

“Therefore at worst, BTC could drop to the Range Low of $13900, Which translates to a -20% drop from current prices.”

Rekt Capital was referring to a previous theory involving support levels on the one-month BTC/USD chart.

Fresh downside remained a popular bet among commentators, with Il Capo of Crypto as insistent as ever about a new macro low being yet to come.

“I think most bears are expecting 10k, ignoring all the support before that level. 11k-13k is a very strong support that should hold,” he reasoned.

Responding, however, another popular trading account, Profit Blue, stuck to its warnings that $10,000 would mark the Bitcoin bear market bottom.

Analyst counts down to volatility return

In terms of breaking the agonizing low-volatility status quo, meanwhile, trader Elizy had a potential silver lining for market participants.

Related: Bitcoin accumulation addresses near record 800K despite whale selling

“BTC the movement is approaching …. I think in the next 48h,” part of a tweet stated on the day.

Elizy added a one-week BTC/USD chart with significant support in place at just above $13,000.

Many, however, were more than content to wait until the BTC price “chopfest” naturally came to an end.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Click Here to Read the Full Original Article at Cointelegraph.com News…