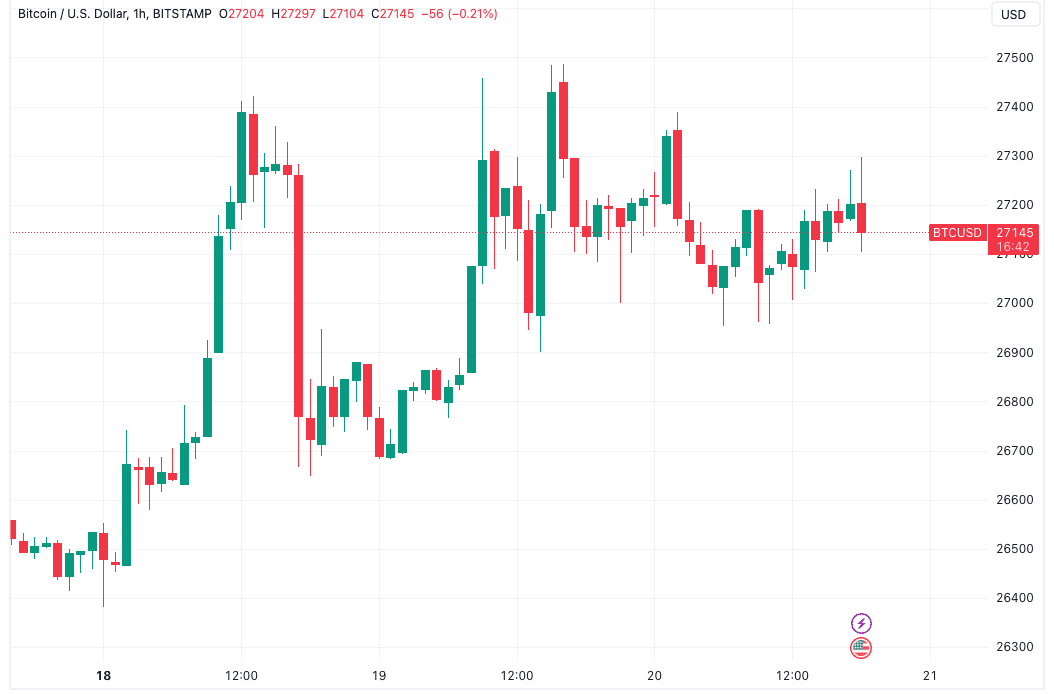

Bitcoin (BTC) saw snap volatility on Sep. 20 as the United States Federal Reserve maintained interest rates at twenty-year highs.

BTC price digests Fed rate pause

Data from Cointelegraph Markets Pro and TradingView followed BTC price action as it reacted to the rate decision and accompanying commentary from Fed Chair Jerome Powell.

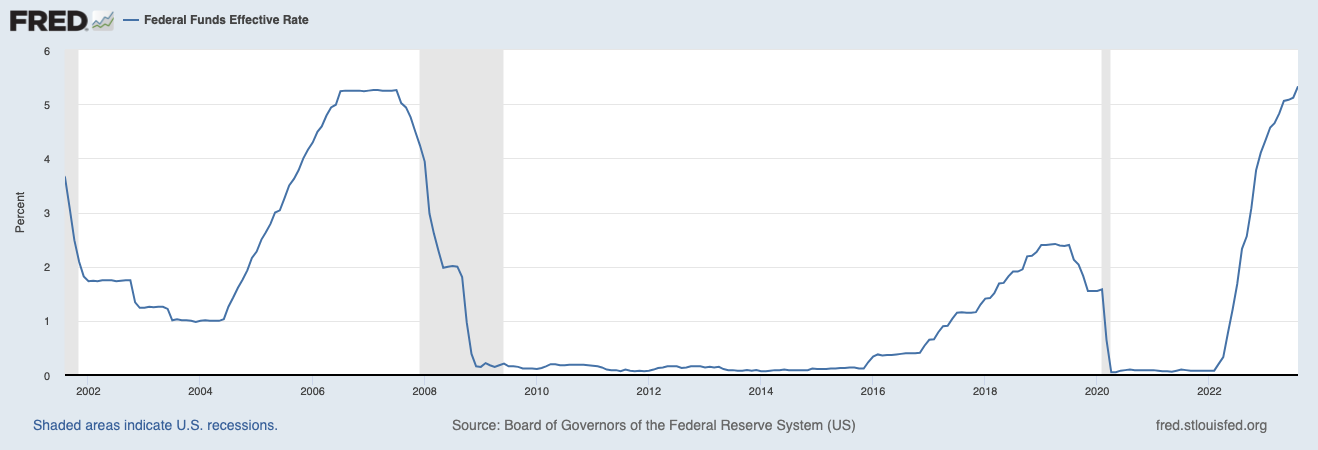

The Federal Open Market Committee (FOMC) opted to keep rates at their previous levels set in July this year.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run,” a press release stated.

“In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.”

The move was overwhelmingly expected ahead of time by markets, with a 99% probability of a rate hike pause already in place, per data from CME Group’s FedWatch Tool.

The Fed’s language remained cautious over the future of inflation, however, with no guarantee that conditions would become more lax.

“In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals,” the release continued.

SUMMARY OF FED DECISION (9/20/23):

1. Fed PAUSES rate hikes leaving rates unchanged

2. 12 Fed officials see 1 more rate hike

3. 7 Fed officials see no more rate hikes

4. Fed sees rates higher for longer

5. Fed sees inflation at 2.6% in 2024

Is the Fed pause finally here?

— The Kobeissi Letter (@KobeissiLetter) September 20, 2023

Reacting, Michaël van de Poppe, founder and CEO of trading firm Eight, suggested that no more rate hikes would come in future. Bitcoin, he predicted, would benefit.

“No rate hike from the FED. My best guess: we’re done with the hiking policy,” part of an X post read.

“Bitcoin is likely to start trending up from here (yes, a fakeout usually happens at the news).”

Powell hints that another rate hike could come in 2023

BTC price action saw jitters as the decision came, with Powell still to complete his speech at the subsequent press conference at the time of writing.

Related: Bitcoin price all-time high will precede 2024 halving — New prediction

The road to getting inflation down to the Fed’s 2% target, he said, had “a long way to go.”

“If the…

Click Here to Read the Full Original Article at Cointelegraph.com News…