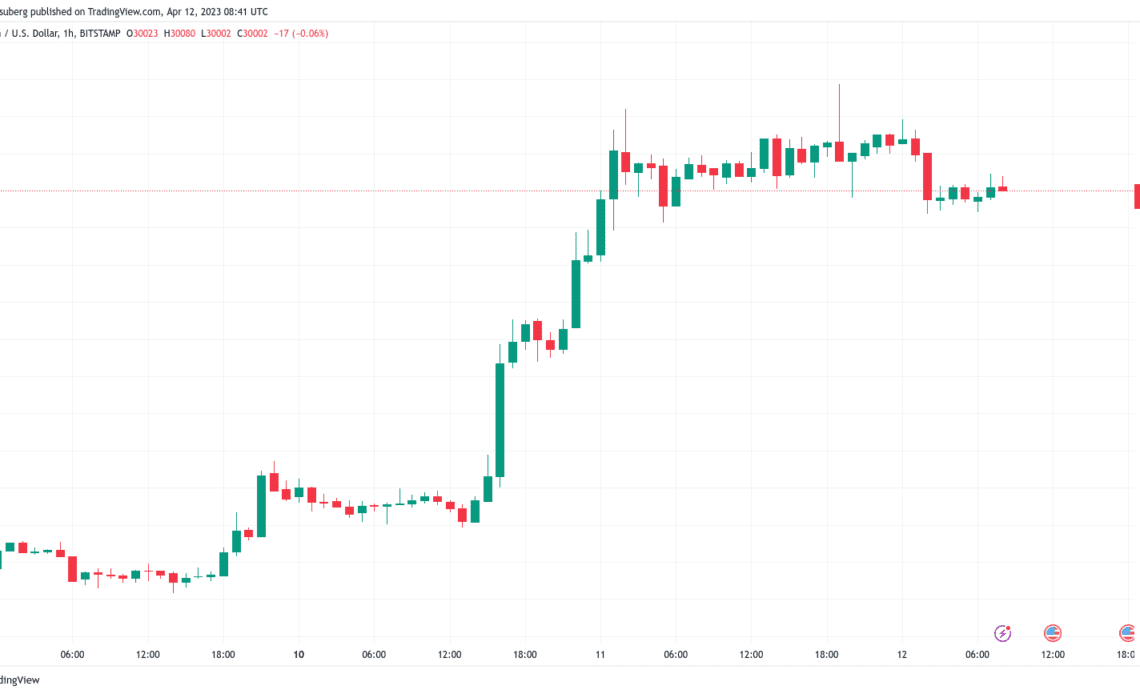

Bitcoin (BTC) traced $30,000 on April 12 as looming United States macroeconomic data heightened nerves.

Analyst warns markets “discounting significance” of CPI

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering near the significant psychological level after overnight lows of $29,875 on Bitstamp.

Consumer Price Index (CPI) for March are due at 2.30pm Eastern time, followed by minutes from last month’s meeting of the Federal Reserve Federal Open Market Committee (FOMC), at which policymakers confirmed a 0.25% interest rate hike.

“Today is US CPI day, and for the first time in a long while, it feels like the market is discounting the significance of this event…,” analytics account Tedtalksmacro wrote in part of Twitter commentary.

“Trader positioning leading into today is nowhere near as conservative/risk-off as we typically would observe.”

Forecast at 5.2% year-on-year versus 6% a month ago, CPI presents a mixed bag — Fed policy remains hawkwish, while pressure from the recent banking crisis has markets unsure as to what further policy tightening is feasible.

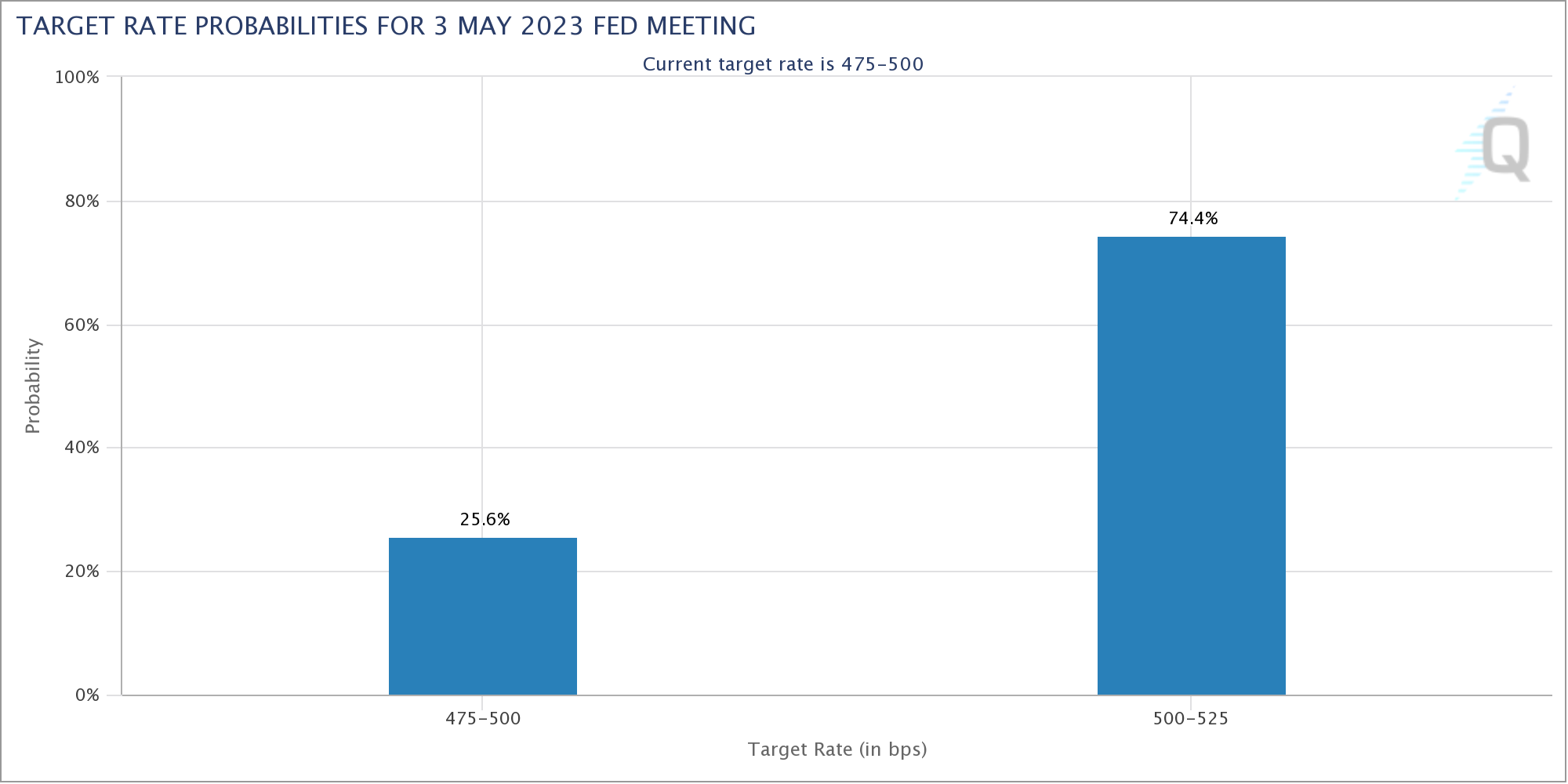

Data from CME Group’s FedWatch Tool shows expectations of rate hikes continuing in May, but potentially pausing thereafter.

“We are keeping in mind that the Fed is still largely data dependent and has warned against taking its foot off the pedal early,” trading firm QCP Capital wrote in a market update released on the day.

“Markets are 75% priced for a 25bps hike in May. Therefore this number carries great importance either way. A lower than expected print will likely take off the hike and lead to a risk asset rally.”

Related: Crypto audits and bug bounties are broken: Here’s how to fix them

QCP continued that the release of the FOMC minutes may have an equally influential impact on cryptoassets thanks to the divergence of the Fed’s position versus market sentiment.

“Investors will closely scrutinize the reasons for the Fed’s downshifting and what they will keep an eye on in terms of the banking sector, liquidity, and overall market performance. While data dependency on inflation will be a critical factor, comments about bank stability will carry weight, in particular how many rate hikes the Fed see the current credit tightening as being equivalent to,” the update stated.

“Lately, crypto as an asset class has not been a good reflection of…

Click Here to Read the Full Original Article at Cointelegraph.com News…