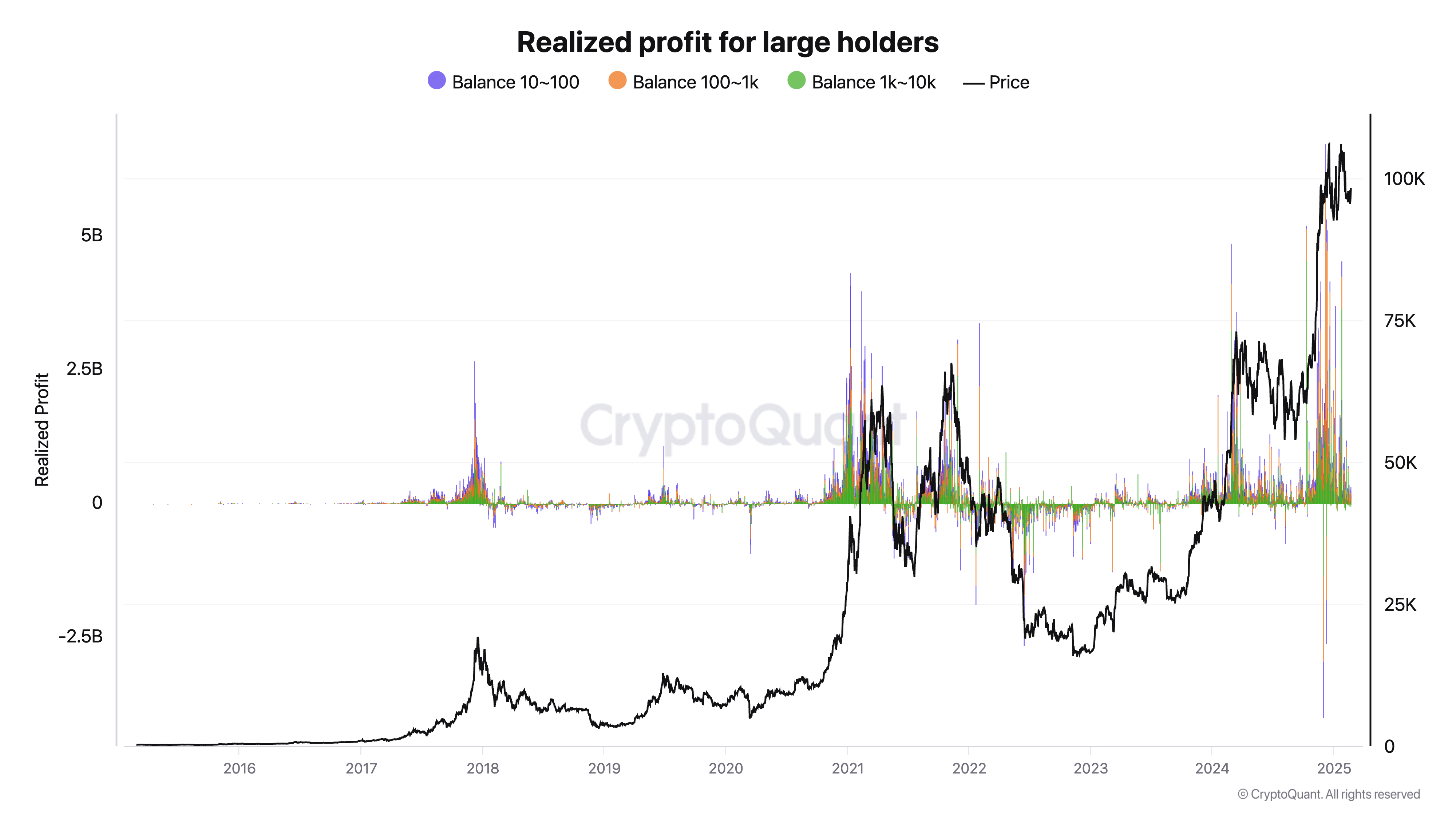

Bitcoin’s realized profits for large holders—addresses holding 10-100 BTC, 100-1K BTC, and 1 K—10 K BTC—declined steadily in February 2025.

Data from CryptoQuant showed a significant spike in the second half of January, which saw up to $3 billion in realized profits. However, since January, these holders have progressively realized fewer profits, with February showing a flattening or diminishing profit realization compared to earlier peaks.

This decline shows large holders are selling in much smaller volumes, contributing to the market’s sideways movement in the past few weeks. The absence of negative realized profits indicates these cohorts have not incurred losses, maintaining profitability as Bitcoin’s price stabilized above $90,000.

Large holders exert significant influence on Bitcoin’s price due to their control over a substantial portion of the circulating supply. With Bitcoin’s fixed supply of 21 million coins, addresses holding 10+ BTC represent a disproportionate share, with 1K+ BTC holders controlling approximately 40% of the supply, according to some estimates.

Their reduced profit-taking in February, as opposed to the aggressive selling seen earlier this year, impacts both liquidity and market sentiment, potentially supporting price stability at current levels. When these holders realize profits, it can flood the market with sell orders, reducing upward momentum.

These cohorts of large holders include a wide variety of investors, including early adopters, funds, exchanges, governments, companies, ETFs, etc. Their collective behavior could be partly responsible for the subdued price action we’ve seen in the past few weeks.

LTHs, defined as addresses holding Bitcoin for more than 155 days, peaked in profitability at 71 in mid-December 2024 and stood at 67.2 on Feb. 20, 2025, indicating that these holders are realizing fewer gains but remain highly profitable. Bitcoin’s price not dropping below $90,000 this year supports this, as LTHs and large holders adjust their strategies in response to market conditions.

The intersection between large holders and LTHs is likely substantial, particularly among the 1K-10K BTC cohort. Many large holders are early adopters, institutional investors, or crypto funds that accumulated Bitcoin six…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…