The Bitcoin price rose to $38.475 yesterday, marking a marginally higher high for the year. Nevertheless, the price did not manage to close the day above the important $38,000 mark. Shortly before the end of the day, the bears managed to push the price down again.

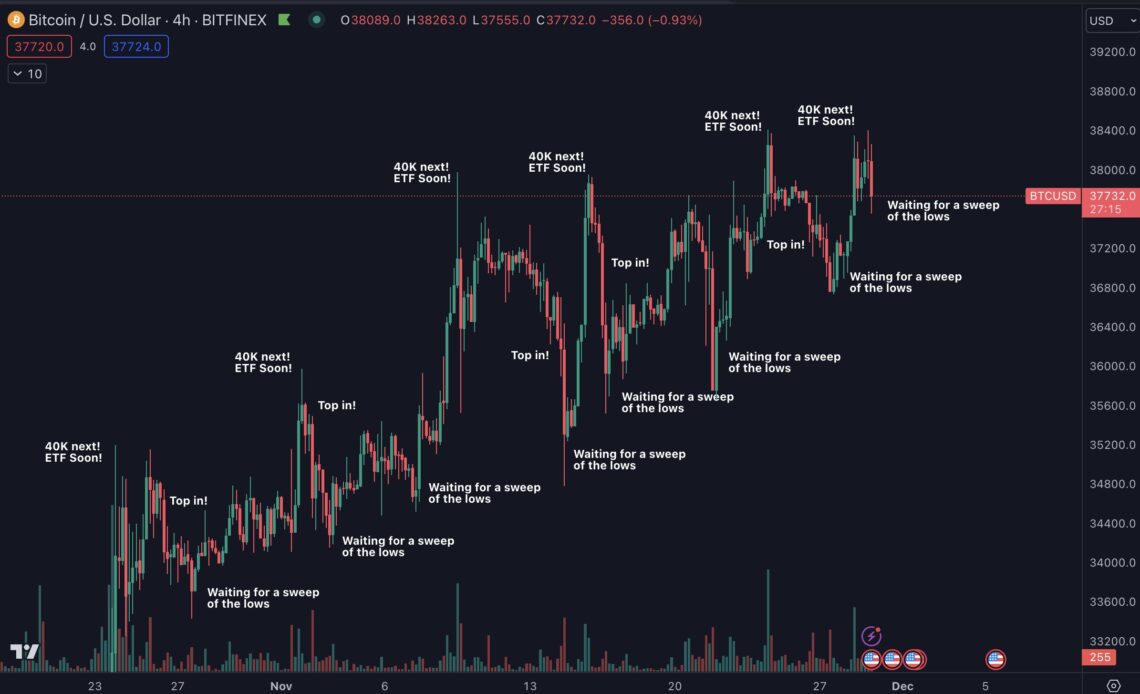

As crypto analyst Daan Crypto Trades remarked, “Market does its best to shake out everyone trying to pre-position for a possible Bitcoin ETF approval. It’s just free liquidity for the MMs/Whales. Sweep highs, trap longs, squeeze out longs, bait shorts, front run lows and repeat the whole process.”

BlackRock Argues With SEC Over Details Of Spot Bitcoin ETF

In a notable development, BlackRock, the world’s largest asset manager, has been again actively engaged in discussions with the US Securities and Exchange Commission (SEC) concerning the structure of its spot ETF yesterday.

Eric Balchunas, senior ETF analyst at Bloomberg, revealed, “BlackRock met with the SEC’s Trading & Markets division again yesterday and presented them with a ‘revised’ in-kind model design based on Staff’s comments at their 11/20 meeting.” This revised model includes a notable change in the process, specifically at ‘Step 4’, which is the offshore entity market maker acquiring Bitcoin from Coinbase and then pre-paying in cash to the US registered broker dealer who is not allowed to touch BTC.

James Seyffart, another Bloomberg analyst, highlighted the ongoing negotiations, adding, “More confirmation that Issuers are still meeting with the SEC. BlackRock/Nasdaq still pushing for In-Kind creation & redemption. Seems like SEC hasn’t budged on cash creates demands if this was the primary focus of the meeting. At least not before yesterday, Interesting days ahead!”

The original “In-Kind Redemption” flow had Market Maker’s Broker/Dealer entity (MM-BD) placing an order for redemption through the Authorized Participant (AP), who approves the order, allowing MM-crypto to borrow Bitcoin (or cash) to sell short. This redemption flow had potential balance sheet impacts and risks that the SEC was concerned about.

BlackRock has now proposed a “Revised In-Kind (‘Prepay Model’)” Redemption flow. This new model involves MM-crypto delivering cash to MM-BD instead of Bitcoin, and MM-BD then delivers ETF shares to the Transfer Agent via API. The Bitcoin custodian is instructed by the issuer to transfer Bitcoin to MM-crypto, who then…

Click Here to Read the Full Original Article at NewsBTC…